UK Interest Rate Cut: A Deep Dive Into The Implications For Borrowers And Savers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rate Cut: A Deep Dive into the Implications for Borrowers and Savers

The Bank of England's (BoE) recent decision to cut interest rates has sent ripples throughout the UK economy, sparking a flurry of discussion amongst borrowers and savers alike. This move, a significant shift in monetary policy, aims to stimulate economic growth amidst growing concerns about inflation and a potential recession. But what does this actually mean for your wallet? Let's delve into the implications for both borrowers and savers.

Why Did the Bank of England Cut Interest Rates?

The BoE's decision wasn't made lightly. The UK economy is facing a complex set of challenges. High inflation, fueled by rising energy prices and supply chain disruptions, is eroding consumer spending power. Simultaneously, fears of a looming recession are casting a long shadow over business investment and confidence. By lowering interest rates, the BoE hopes to:

- Boost borrowing and spending: Lower interest rates make borrowing cheaper for businesses and consumers, encouraging investment and spending, thereby stimulating economic activity.

- Reduce the cost of mortgages: A rate cut directly translates to lower mortgage payments for homeowners, freeing up disposable income.

- Weaken the pound: A weaker pound can boost exports by making UK goods cheaper for overseas buyers.

However, this isn't a simple solution, and the BoE is carefully weighing the potential downsides.

The Impact on Borrowers:

For borrowers, the news is largely positive. Lower interest rates mean:

- Reduced mortgage payments: Homeowners with variable-rate mortgages will immediately see a decrease in their monthly payments. Those with fixed-rate mortgages will benefit when they refinance.

- Cheaper loans: Personal loans, car loans, and business loans will become more affordable, potentially boosting consumer spending and business investment.

- Increased borrowing capacity: With lower interest rates, borrowers can potentially qualify for larger loans.

However, borrowers should be aware that:

- The reduction may be small: The extent of the relief will depend on the size of the rate cut and the individual's loan terms.

- Not all lenders will pass on the savings immediately: Some lenders may be slower to adjust their rates.

The Impact on Savers:

For savers, the picture is less rosy. Lower interest rates typically translate to:

- Lower returns on savings accounts: The interest earned on savings accounts, ISAs, and other savings products will likely decrease, reducing the return on savings.

- Reduced incentive to save: With lower returns, savers may be less inclined to save money, potentially impacting long-term financial goals.

What Should You Do?

The interest rate cut presents both opportunities and challenges. Borrowers should consider refinancing their mortgages or loans to take advantage of lower rates. Savers, on the other hand, might need to explore alternative investment options to maintain their returns. It's crucial to:

- Review your existing loan and savings accounts: Contact your bank or lender to understand the implications of the rate cut on your finances.

- Consider diversifying your investments: Don't put all your eggs in one basket. Explore different investment options to mitigate risk.

- Seek professional financial advice: A financial advisor can provide personalized guidance tailored to your individual circumstances.

The UK interest rate cut is a complex issue with far-reaching consequences. Staying informed and proactive is key to navigating these changes and making informed financial decisions. Keep an eye on the Bank of England's announcements and consult with financial experts for the latest updates and personalized advice. This is a dynamic situation, and continuous monitoring is recommended. [Link to Bank of England website]

Keywords: UK interest rate, interest rate cut, Bank of England, borrowers, savers, mortgage rates, loans, savings accounts, inflation, recession, economic growth, monetary policy, financial advice, investment, ISA.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rate Cut: A Deep Dive Into The Implications For Borrowers And Savers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Danielle Collins Vs Taylor Townsend Where To Watch And Match Analysis

Aug 09, 2025

Danielle Collins Vs Taylor Townsend Where To Watch And Match Analysis

Aug 09, 2025 -

Analyzing The Lions Defense The Ennis Rakestraw Injury Fallout

Aug 09, 2025

Analyzing The Lions Defense The Ennis Rakestraw Injury Fallout

Aug 09, 2025 -

Exclusive Cnn Meets With A Top Gang Commander In Ecuadors War Zone

Aug 09, 2025

Exclusive Cnn Meets With A Top Gang Commander In Ecuadors War Zone

Aug 09, 2025 -

Long Term Study Connects Vitamin B12 Levels To Increased Dementia Risk

Aug 09, 2025

Long Term Study Connects Vitamin B12 Levels To Increased Dementia Risk

Aug 09, 2025 -

Upcoming 401 K Regulations A Guide To Understanding The Impact

Aug 09, 2025

Upcoming 401 K Regulations A Guide To Understanding The Impact

Aug 09, 2025

Latest Posts

-

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025

Rondale Moore Injury Update Vikings Wide Receiver Hurt In Preseason Game

Aug 10, 2025 -

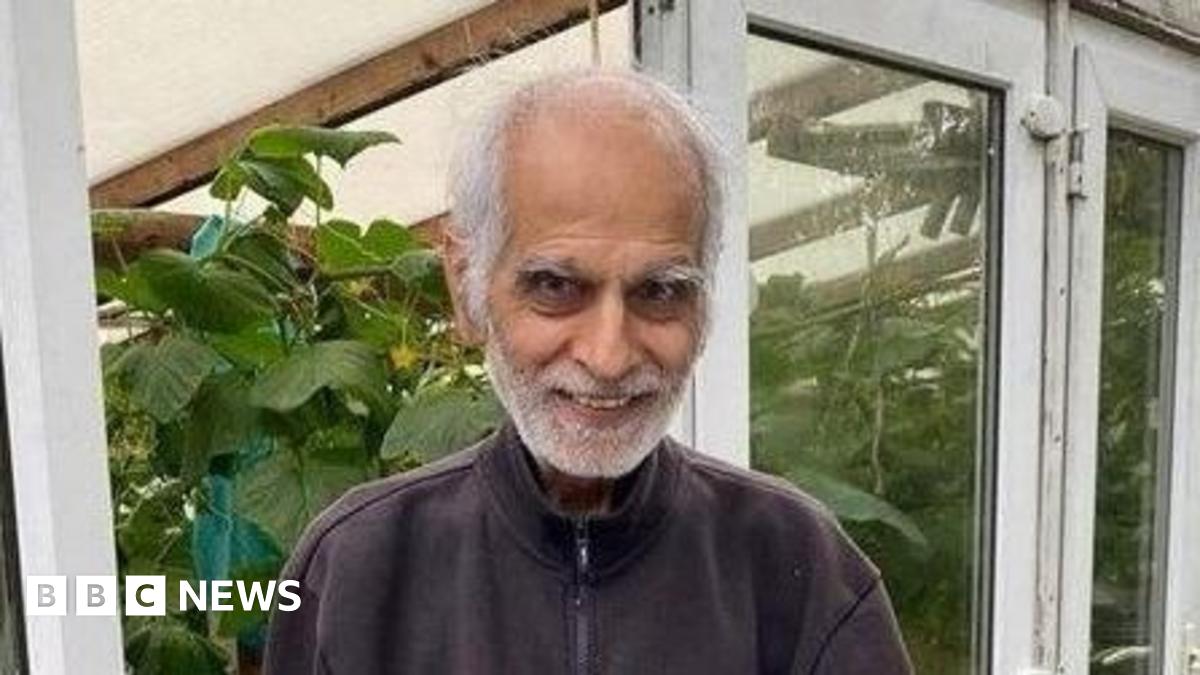

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025

Bhim Kohli Death Investigation Launched Into Police Handling Of Information

Aug 10, 2025 -

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025

Four Dead In Montana Bar Shooting Suspect Arrested

Aug 10, 2025 -

Allegations Of Indecent Assault Against Hardeep Singh Kohli At Bbc Studio

Aug 10, 2025

Allegations Of Indecent Assault Against Hardeep Singh Kohli At Bbc Studio

Aug 10, 2025 -

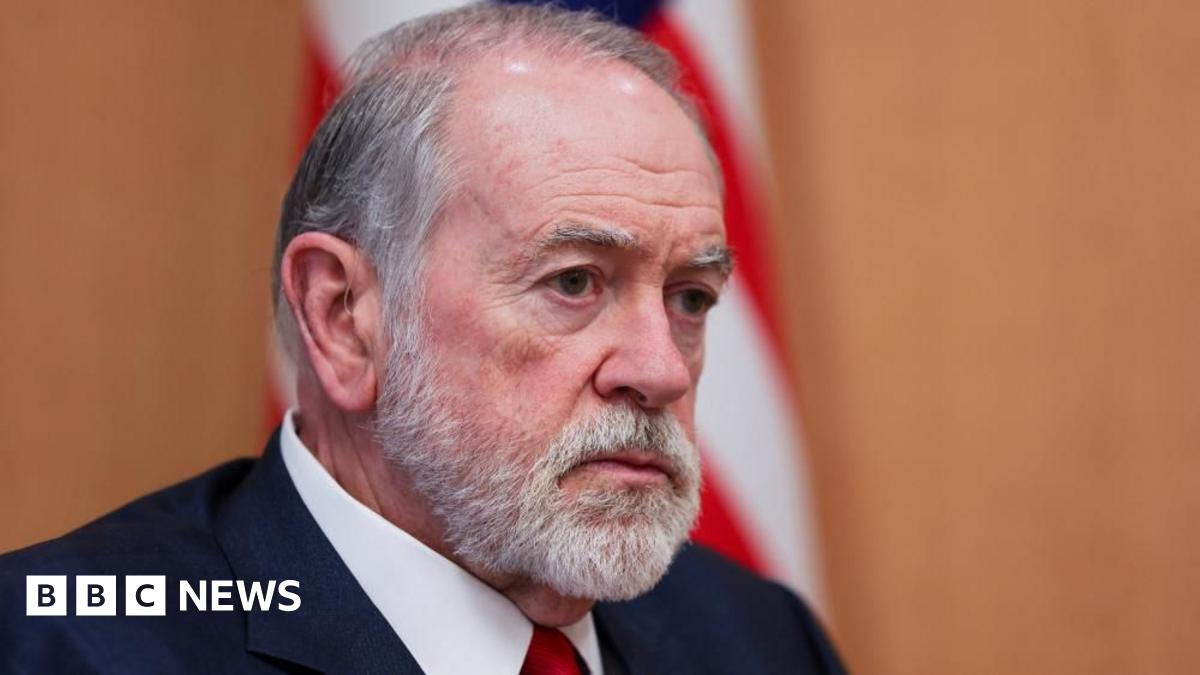

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025

Wwii Hypothetical Us Ambassador To Israel Criticizes Keir Starmers Leadership

Aug 10, 2025