UK Interest Rate Cut: Analysis And Implications For Borrowers And Savers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rate Cut: Analysis and Implications for Borrowers and Savers

The Bank of England's (BoE) surprise decision to cut interest rates has sent ripples through the UK economy, leaving borrowers and savers alike wondering about the implications. This unexpected move, driven by concerns over slowing economic growth and the potential impact of the ongoing global uncertainty, marks a significant shift in monetary policy. But what does it all mean for you? Let's delve into the details.

Why the Interest Rate Cut?

The BoE's Monetary Policy Committee (MPC) cited weakening economic indicators as the primary reason for the reduction. Concerns about Brexit's lingering effects, global trade tensions, and a slowdown in manufacturing are all contributing factors. The hope is that lower interest rates will stimulate borrowing and spending, boosting economic activity. This strategy aims to prevent a deeper economic downturn, echoing similar actions taken by central banks globally in response to economic headwinds. [Link to BoE press release]

Implications for Borrowers:

For those with mortgages, loans, or other forms of debt, the interest rate cut translates into potential savings. Lower interest rates mean lower monthly payments, freeing up disposable income. This is particularly beneficial for those with variable-rate mortgages, who will see an immediate reduction in their repayments. However, it's crucial to check with your lender to understand the specific impact on your individual circumstances. Some lenders may not pass on the full reduction immediately.

- Positive: Reduced monthly payments, increased disposable income.

- Neutral: Fixed-rate mortgage holders will see no immediate change.

- Negative: Potential for future rate hikes if economic conditions don't improve.

Implications for Savers:

Unfortunately, the picture is less rosy for savers. Lower interest rates typically mean lower returns on savings accounts and investments. This could erode the purchasing power of savings, especially for those relying on interest income as a significant portion of their retirement funds. Savers may need to explore alternative investment options to maintain their returns, such as higher-risk investments or switching to accounts offering better rates, although these often come with caveats.

- Negative: Lower returns on savings accounts and investments.

- Neutral: Impact varies depending on the type of savings account and investment portfolio.

- Positive: Potential for increased spending due to improved affordability.

Looking Ahead: What to Expect

The long-term effects of this interest rate cut remain uncertain. While it aims to stimulate the economy, it also carries risks. Inflation could be affected, and the impact on the housing market is another key area to watch. The BoE will continue to monitor economic indicators closely and may adjust its policy further depending on the evolving economic landscape. Experts suggest staying informed about economic news and consulting financial advisors for personalized advice.

Need further assistance?

Consider seeking advice from a qualified financial advisor to discuss your personal financial situation and explore strategies to mitigate the impact of the interest rate cut. [Link to reputable financial advice website]

Keywords: UK interest rates, Bank of England, interest rate cut, borrowers, savers, mortgage rates, economic slowdown, monetary policy, inflation, savings accounts, investments, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rate Cut: Analysis And Implications For Borrowers And Savers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Western And Southern Open Analyzing The Collins Townsend Matchup

Aug 09, 2025

2025 Western And Southern Open Analyzing The Collins Townsend Matchup

Aug 09, 2025 -

Chinese Owners Of British Steel Demand Millions From Uk Government

Aug 09, 2025

Chinese Owners Of British Steel Demand Millions From Uk Government

Aug 09, 2025 -

Uncovering The Brands Behind Tommy Fleetwood A Look At His Sponsorship Landscape

Aug 09, 2025

Uncovering The Brands Behind Tommy Fleetwood A Look At His Sponsorship Landscape

Aug 09, 2025 -

Lions Ennis Rakestraw Apologizes For Nasty Dms Seeks End To Harassment

Aug 09, 2025

Lions Ennis Rakestraw Apologizes For Nasty Dms Seeks End To Harassment

Aug 09, 2025 -

Western And Southern Open 2025 In Depth Preview Of Collins Vs Townsend

Aug 09, 2025

Western And Southern Open 2025 In Depth Preview Of Collins Vs Townsend

Aug 09, 2025

Latest Posts

-

Trumps Domestic Military Deployment A Looming Reality

Aug 09, 2025

Trumps Domestic Military Deployment A Looming Reality

Aug 09, 2025 -

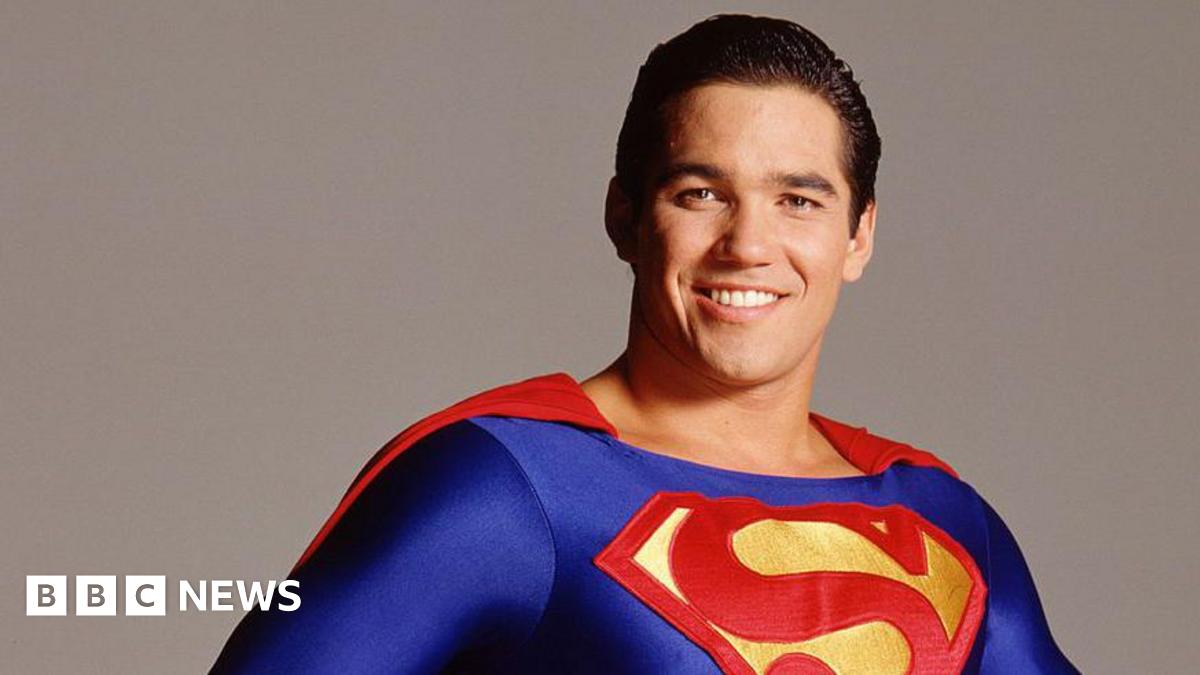

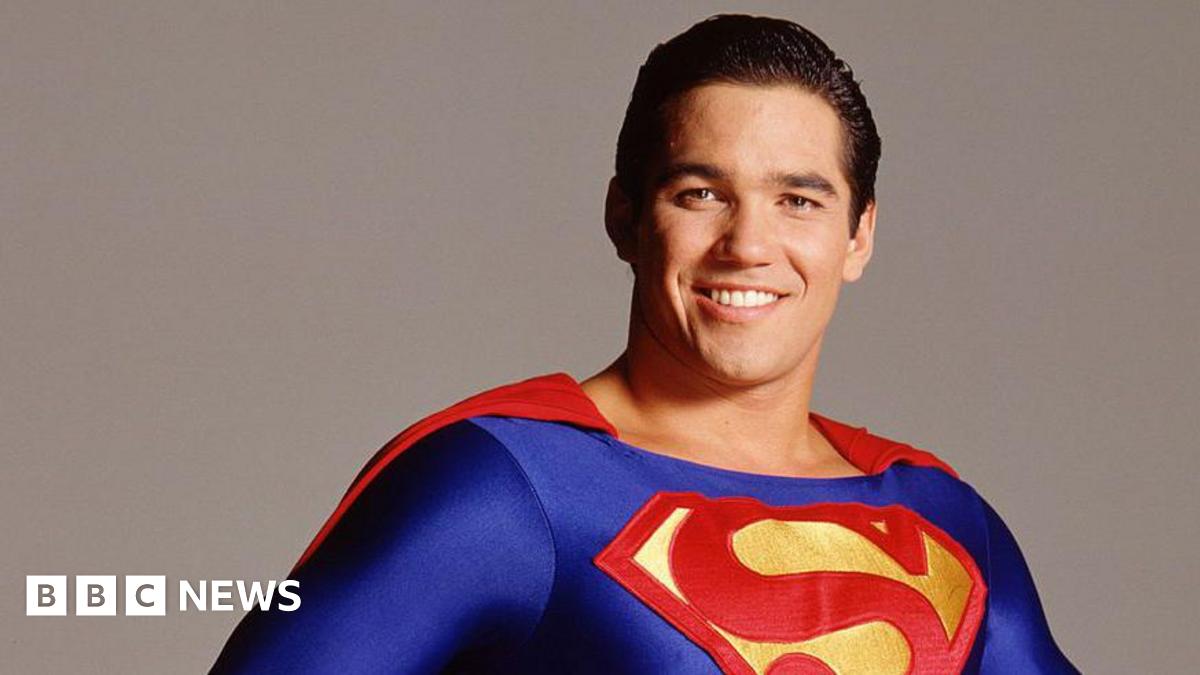

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025

Dean Cains Unexpected Career Change Joining Ice

Aug 09, 2025 -

Actor Dean Cain Announces Transition To Ice Agent Role

Aug 09, 2025

Actor Dean Cain Announces Transition To Ice Agent Role

Aug 09, 2025 -

Rakestraw Injury Fallout Reshaping The Detroit Lions Secondary

Aug 09, 2025

Rakestraw Injury Fallout Reshaping The Detroit Lions Secondary

Aug 09, 2025 -

Complete Guide Monaco Vs Inter Milan History Form And Betting Odds

Aug 09, 2025

Complete Guide Monaco Vs Inter Milan History Form And Betting Odds

Aug 09, 2025