UK Interest Rate Cut: Implications For Borrowers And Savers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rate Cut: Implications for Borrowers and Savers

The Bank of England's (BoE) surprise decision to cut interest rates has sent ripples through the UK economy, leaving many wondering about the implications for their personal finances. This move, intended to stimulate economic growth amidst growing concerns about inflation and a potential recession, will significantly impact both borrowers and savers in different, often opposing, ways. Understanding these implications is crucial for navigating the current economic climate.

Understanding the Interest Rate Cut

The BoE's Monetary Policy Committee (MPC) voted to lower the base interest rate, a key benchmark influencing borrowing costs across the country. This reduction aims to encourage borrowing and spending, boosting economic activity. However, the decision wasn't unanimous, highlighting the complexities and uncertainties facing the UK economy. The move follows months of fluctuating inflation figures and growing anxieties about a potential economic downturn. This is a significant shift from the previous period of rate hikes designed to curb inflation.

Implications for Borrowers: A Silver Lining?

For borrowers, particularly those with variable-rate mortgages or loans, the interest rate cut translates into lower monthly payments. This can offer considerable relief to households struggling with the rising cost of living. Existing mortgage holders will likely see a reduction in their monthly repayments, freeing up extra cash for other expenses. New borrowers can also expect more favorable loan terms, making large purchases like houses and cars more accessible.

- Reduced Mortgage Payments: Lower interest rates directly translate to lower monthly mortgage payments.

- Cheaper Loans: Personal loans and other forms of credit will also become cheaper to obtain.

- Increased Borrowing Power: Individuals may find it easier to qualify for larger loans.

Implications for Savers: A Challenging Landscape

The picture for savers is less rosy. A lower interest rate generally means lower returns on savings accounts and other interest-bearing investments. This reduction in returns can erode the purchasing power of savings, particularly if inflation remains high. Savers may need to explore alternative investment strategies to maintain or improve their returns in this environment. This could involve looking into higher-yield savings accounts (though these are becoming increasingly rare), or exploring potentially higher-risk investments – a decision that should be made cautiously after careful consideration and potentially with professional financial advice.

- Lower Savings Interest Rates: Expect to see a decrease in the interest earned on savings accounts and ISAs.

- Eroded Savings: The reduced interest might not keep pace with inflation, leading to a decrease in the real value of savings.

- Need for Diversification: Savers may need to diversify their portfolios to protect against the impact of low interest rates.

Looking Ahead: Uncertainty and Adaptation

The long-term effects of this interest rate cut remain uncertain. The BoE's decision is a response to current economic conditions, and its effectiveness will depend on various factors, including consumer confidence and global economic trends. Both borrowers and savers need to carefully monitor the economic landscape and adapt their financial strategies accordingly. Seeking advice from a financial advisor can provide valuable guidance during this period of economic uncertainty.

Call to Action: Stay informed about economic developments and consult with a financial advisor to ensure your financial plan aligns with the changing interest rate environment. Understanding the nuances of this rate cut is critical to managing your finances effectively in the coming months. For further information on personal finance and economic trends, explore resources from reputable financial institutions and government websites. [Link to a relevant government website, e.g., the Bank of England].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rate Cut: Implications For Borrowers And Savers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Cheers To Chaos The Owl Bar Shootings Aftermath

Aug 08, 2025

From Cheers To Chaos The Owl Bar Shootings Aftermath

Aug 08, 2025 -

Final Fantasy Xv Inspired Lost Soul Aside Officially Goes Gold For Ps 5 Pc Launch

Aug 08, 2025

Final Fantasy Xv Inspired Lost Soul Aside Officially Goes Gold For Ps 5 Pc Launch

Aug 08, 2025 -

Welsh Guests Rejected Airbnb Hosts Actions Spark Outrage

Aug 08, 2025

Welsh Guests Rejected Airbnb Hosts Actions Spark Outrage

Aug 08, 2025 -

Gas Station Supplement Addiction Consumers Report Severe Withdrawal Symptoms

Aug 08, 2025

Gas Station Supplement Addiction Consumers Report Severe Withdrawal Symptoms

Aug 08, 2025 -

Feel Free Drink Is The Popular Beverage Harming Young Consumers

Aug 08, 2025

Feel Free Drink Is The Popular Beverage Harming Young Consumers

Aug 08, 2025

Latest Posts

-

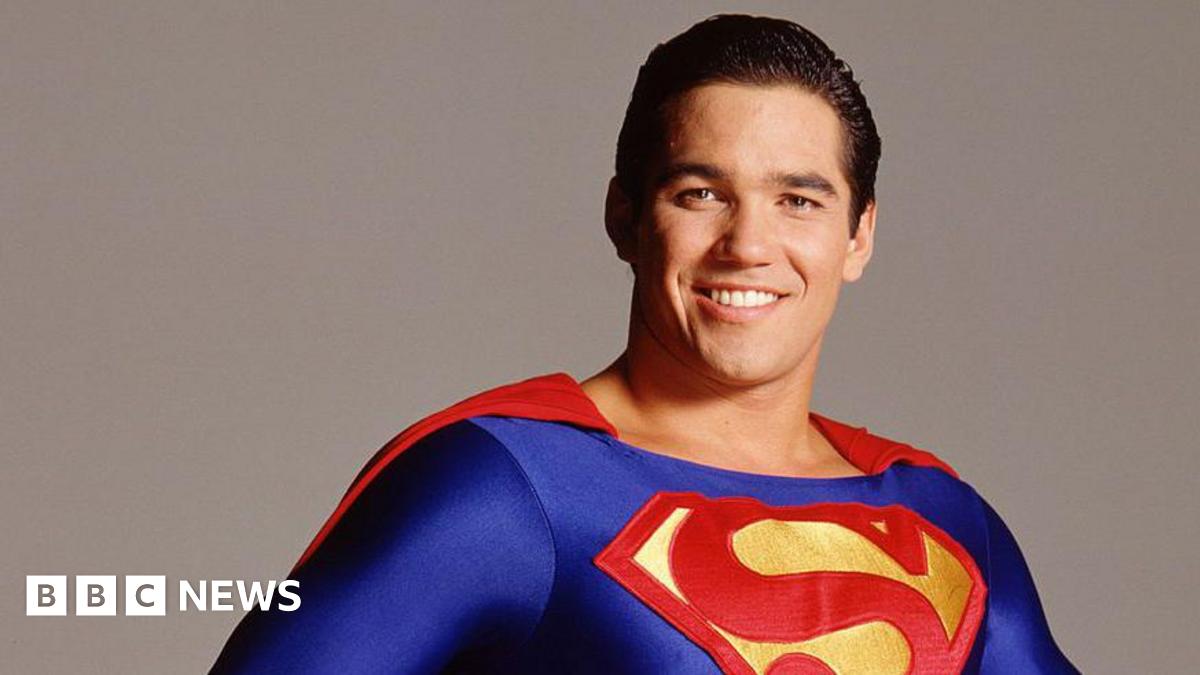

Dean Cains New Role Ex Superman Star Joins Ice

Aug 09, 2025

Dean Cains New Role Ex Superman Star Joins Ice

Aug 09, 2025 -

Nick Balls Cross Fit Success How The British Champion Stays At The Top

Aug 09, 2025

Nick Balls Cross Fit Success How The British Champion Stays At The Top

Aug 09, 2025 -

Is Trumps Threat To Deploy The Military On Us Soil Becoming A Reality

Aug 09, 2025

Is Trumps Threat To Deploy The Military On Us Soil Becoming A Reality

Aug 09, 2025 -

Increasing Reality Trumps Talk Of Using Military Force Within Us Borders

Aug 09, 2025

Increasing Reality Trumps Talk Of Using Military Force Within Us Borders

Aug 09, 2025 -

Political Fallout Trump Administrations Impact On Fbi Leadership Revealed

Aug 09, 2025

Political Fallout Trump Administrations Impact On Fbi Leadership Revealed

Aug 09, 2025