UK Interest Rates Plunge: Two-Year Low Sends Shockwaves Through Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rates Plunge: Two-Year Low Sends Shockwaves Through Economy

The Bank of England's unexpected decision to slash interest rates to a two-year low has sent shockwaves through the UK economy, leaving economists scrambling to understand the implications. This dramatic move, announced earlier today, sees the base rate fall to 4.25%, a significant drop from the previously anticipated 4.5%. The decision has sparked immediate reactions across various sectors, from homeowners to businesses.

What Triggered the Sudden Drop?

The official statement cited a combination of factors contributing to this unprecedented interest rate plunge. While inflation remains stubbornly high – currently sitting at 8.7% – recent data suggests a potential softening of the market. Specifically, weaker-than-expected GDP growth figures and a cooling in the housing market appear to have swayed the Monetary Policy Committee (MPC) towards a more dovish approach. The Bank acknowledged the ongoing challenges but emphasized the need to avoid a sharp economic contraction.

Impact on Homeowners and Borrowers:

This rate cut will offer immediate relief to millions of homeowners with variable-rate mortgages. Lower interest rates translate to lower monthly payments, potentially freeing up disposable income for many families. However, the long-term implications remain uncertain. While some may celebrate reduced borrowing costs, others worry about the potential for future inflation spikes. This situation highlights the complexities of navigating fluctuating interest rates, emphasizing the importance of financial planning and seeking professional advice when necessary. For more information on managing your mortgage in times of economic uncertainty, check out this helpful guide from the Money Advice Service: [Insert link to a relevant resource here].

Businesses Brace for Uncertainty:

The impact on businesses is equally complex. While lower borrowing costs could stimulate investment and growth, the uncertainty surrounding the overall economic outlook is causing apprehension. Many businesses are already grappling with rising energy prices and supply chain disruptions. The sudden rate cut introduces another layer of uncertainty, making it difficult to plan for the future. This could lead to a cautious approach to expansion and hiring, potentially hindering economic recovery.

Expert Opinions Diverge:

Economists are divided on the wisdom of this drastic move. Some applaud the Bank's proactive approach to preventing a deeper recession, highlighting the potential benefits of stimulating the economy. Others express concern that this could fuel further inflation in the long run, potentially undoing any short-term gains. The debate continues, and the coming months will be crucial in determining the true impact of this decision. This uncertainty underscores the need for ongoing monitoring of economic indicators and policy adjustments as needed.

Looking Ahead: What to Expect

The coming months will be critical in assessing the success of this bold strategy. The Bank of England will be closely monitoring inflation figures, economic growth, and other key metrics to inform future policy decisions. While the immediate impact is a welcome relief for many, the long-term consequences remain to be seen. It’s a time of significant economic volatility, requiring both individuals and businesses to remain informed and adapt to the shifting landscape. Stay tuned for further updates as the situation unfolds.

Keywords: UK interest rates, Bank of England, interest rate cut, two-year low, inflation, economic impact, mortgage rates, borrowing costs, economic uncertainty, monetary policy, GDP growth, recession.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rates Plunge: Two-Year Low Sends Shockwaves Through Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

23 Year Age Gap Tommy Fleetwoods Marriage And Wealth

Aug 09, 2025

23 Year Age Gap Tommy Fleetwoods Marriage And Wealth

Aug 09, 2025 -

Monaco Vs Inter Head To Head Stats Key Players And Match Analysis

Aug 09, 2025

Monaco Vs Inter Head To Head Stats Key Players And Match Analysis

Aug 09, 2025 -

First Migrants Returned To France Under New Uk Deportation Policy

Aug 09, 2025

First Migrants Returned To France Under New Uk Deportation Policy

Aug 09, 2025 -

World Champion Nick Ball A Deep Dive Into His Cross Fit Training And Lifestyle

Aug 09, 2025

World Champion Nick Ball A Deep Dive Into His Cross Fit Training And Lifestyle

Aug 09, 2025 -

Political Discussions David Lammy Hosts Us Vice President Jd Vance

Aug 09, 2025

Political Discussions David Lammy Hosts Us Vice President Jd Vance

Aug 09, 2025

Latest Posts

-

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

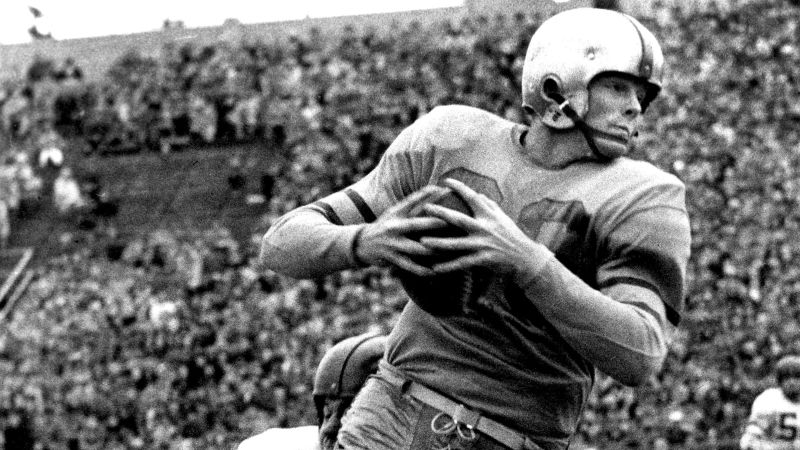

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025 -

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025 -

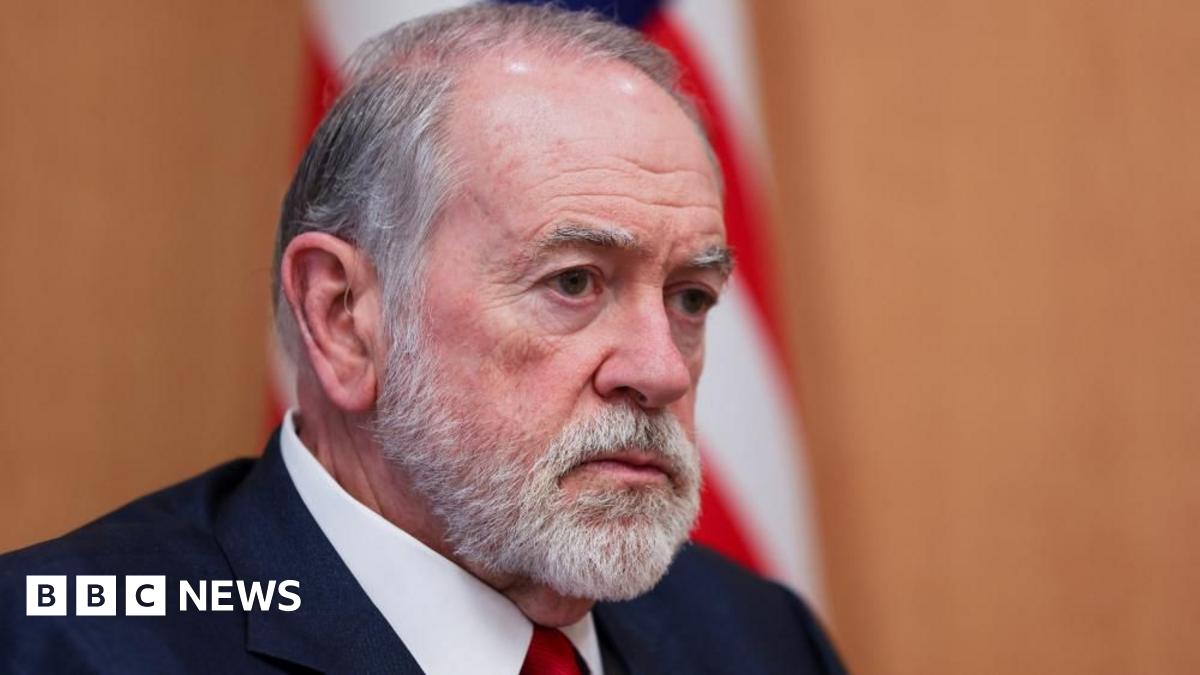

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025