UK Interest Rates Plunge: Two-Year Low Sparks Economic Debate

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Interest Rates Plunge: Two-Year Low Sparks Economic Debate

The Bank of England's surprise decision to slash interest rates to a two-year low has sent shockwaves through the UK economy, sparking a heated debate among economists and analysts. The move, announced earlier this week, sees the base rate fall to 4.25%, a significant drop that many believe is a desperate attempt to combat the looming threat of recession. But is it the right move? And what are the potential consequences for consumers and businesses?

A Bold Move in Uncertain Times

The cut, the most significant single reduction in several years, comes amidst growing concerns about inflation and slowing economic growth. While inflation remains stubbornly high, recent data suggests a potential softening in the pace of price increases. The Bank of England argues that this, coupled with weakening economic indicators, justifies the aggressive rate reduction. This decision marks a significant shift from the Bank's previous hawkish stance, prioritizing inflation control above all else.

This sharp downturn in interest rates contrasts sharply with the global trend. Many other central banks are maintaining or even increasing interest rates to combat inflation, highlighting the unique challenges facing the UK economy. The divergence in monetary policy strategies underscores the complex and interconnected nature of the global financial system.

Arguments For and Against the Rate Cut

Proponents of the rate cut argue that it is crucial to prevent a deeper economic downturn. Lower borrowing costs should stimulate lending, encourage investment, and boost consumer spending, helping to avoid a recession. The hope is that this will provide a much-needed injection of confidence into the market.

However, critics warn that the rate cut could exacerbate inflationary pressures. By making borrowing cheaper, it could fuel further demand, leading to higher prices and potentially undermining the Bank of England's inflation target. There are also concerns about the potential for a weakening pound, which could further increase import costs and add to inflation.

What Does This Mean for Consumers and Businesses?

The impact of the rate cut will vary depending on individual circumstances. For homeowners with variable-rate mortgages, the reduction could translate into lower monthly payments, offering some welcome relief. However, the benefits may be limited, as many lenders are slow to pass on rate cuts to customers. For savers, the lower rates could mean lower returns on their deposits.

Businesses may benefit from cheaper borrowing costs, potentially leading to increased investment and job creation. However, the uncertainty surrounding the economic outlook could still dampen business confidence, limiting the overall impact.

The Road Ahead: Uncertainty and Ongoing Debate

The impact of this significant interest rate cut will unfold over time. The Bank of England's decision is a high-stakes gamble, and its effectiveness will depend on a variety of factors, including consumer and business confidence, global economic conditions, and the future trajectory of inflation. The ensuing debate about the best course of action for the UK economy will undoubtedly continue for months to come.

The coming weeks and months will be crucial in determining the success or failure of this bold monetary policy maneuver. Experts will closely monitor economic data to assess the impact of the rate cut and guide future policy decisions. The UK economy stands at a critical juncture, and the consequences of this interest rate plunge remain to be seen.

Further Reading:

- – Official source for monetary policy announcements.

- – For further analysis and perspectives.

Keywords: UK interest rates, Bank of England, interest rate cut, economic debate, inflation, recession, monetary policy, economic growth, borrowing costs, mortgage rates, savings rates, UK economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Interest Rates Plunge: Two-Year Low Sparks Economic Debate. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Historic Low Uk Interest Rates Fall To Lowest Point Since Date

Aug 09, 2025

Historic Low Uk Interest Rates Fall To Lowest Point Since Date

Aug 09, 2025 -

12 Weight Loss Achieved With Daily Pill A New Approach To Weight Management

Aug 09, 2025

12 Weight Loss Achieved With Daily Pill A New Approach To Weight Management

Aug 09, 2025 -

The Fbi Trump Administration Feud Impact Of Senior Official Dismissals

Aug 09, 2025

The Fbi Trump Administration Feud Impact Of Senior Official Dismissals

Aug 09, 2025 -

Ten Year Study Highlights The Connection Between Vitamin B12 And Dementia

Aug 09, 2025

Ten Year Study Highlights The Connection Between Vitamin B12 And Dementia

Aug 09, 2025 -

The Ai Race Heats Up Analyzing The Impact Of The New Chat Gpt

Aug 09, 2025

The Ai Race Heats Up Analyzing The Impact Of The New Chat Gpt

Aug 09, 2025

Latest Posts

-

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025

Jaxson Darts Preseason Debut Best Plays And Highlights From Week 1

Aug 10, 2025 -

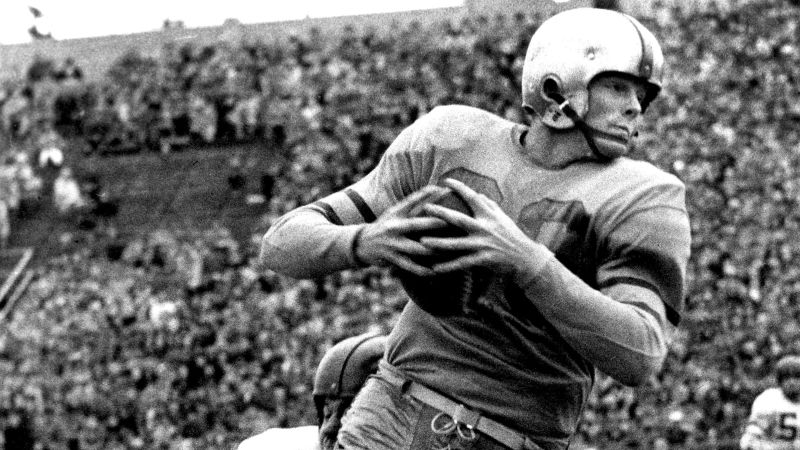

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025

Hall Of Fame Candidate Billy Howton Packers Star And Nflpa Founder Dead At 95

Aug 10, 2025 -

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025

Apollo 13s Jim Lovell A Life In Space And A Nations Tribute

Aug 10, 2025 -

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025

Nicola Sturgeons Memoir Arrest Detailed As Worst Day Of My Life

Aug 10, 2025 -

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025

Mike Huckabee Weighs In Starmers Leadership And Wwii Hypothetical

Aug 10, 2025