UK Savings Crisis: One In Ten Britons Have No Savings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

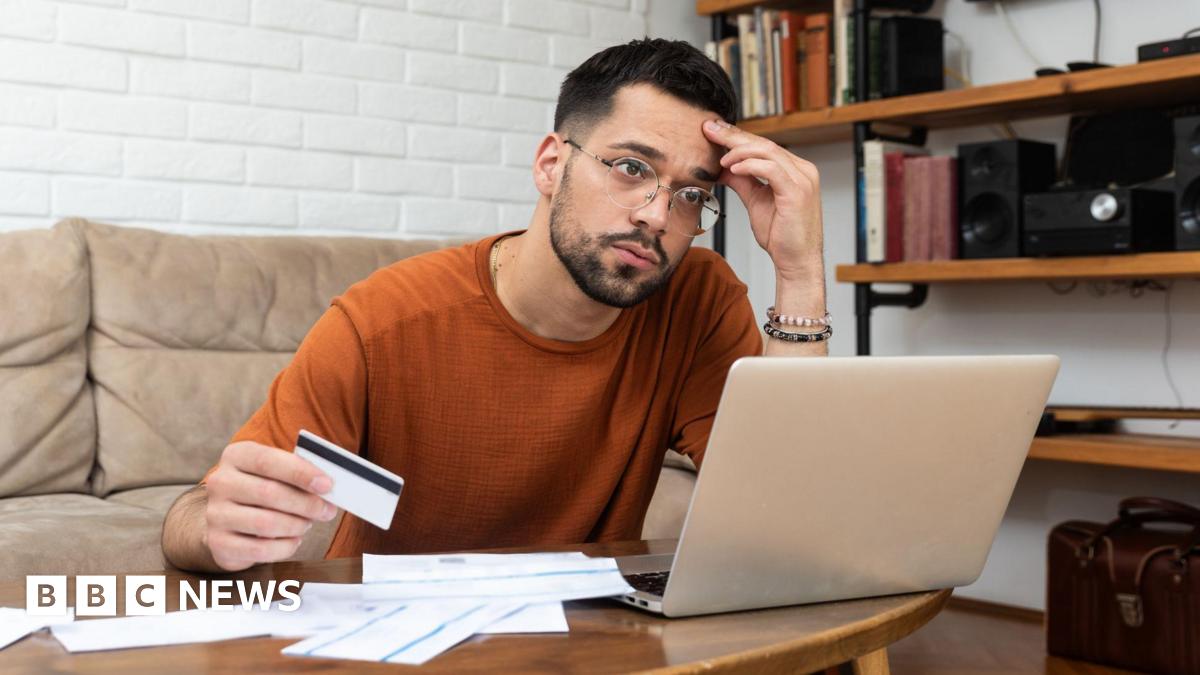

UK Savings Crisis: One in Ten Britons Have No Savings – A Nation on the Brink?

The UK is facing a worrying savings crisis, with a recent study revealing that a staggering one in ten Britons have absolutely no savings whatsoever. This alarming statistic highlights a precarious financial situation for many, leaving them vulnerable to unexpected life events and fueling concerns about the nation's economic resilience. The implications are far-reaching, impacting everything from individual financial security to the overall health of the UK economy.

A Nation Living Paycheck to Paycheck:

The findings, released by [Insert Source Here – e.g., the Office for National Statistics, a reputable financial institution], paint a stark picture of financial insecurity. The report indicates that millions are living paycheck to paycheck, with no financial buffer to absorb unexpected expenses like car repairs, medical bills, or job loss. This lack of savings leaves individuals exposed to significant financial hardship and potential debt spirals.

Factors Contributing to the Crisis:

Several factors contribute to this growing crisis:

- The Cost of Living Crisis: Soaring inflation, rising energy prices, and increased food costs have significantly squeezed household budgets, leaving little room for saving. Many are simply struggling to meet their essential needs, let alone put money aside.

- Stagnant Wages: Wage growth has failed to keep pace with inflation for many years, leaving real incomes stagnant or even declining. This makes saving incredibly difficult, even for those with stable employment.

- Increased Debt: Many households are burdened by high levels of debt, from mortgages and credit cards to personal loans. This debt servicing consumes a significant portion of their income, leaving little left for savings.

- Lack of Financial Literacy: A lack of understanding about personal finance and effective savings strategies also plays a role. Many individuals lack the knowledge and resources to make informed decisions about their money.

The Consequences of Insufficient Savings:

The consequences of this savings crisis are far-reaching:

- Increased Vulnerability to Shocks: Individuals with no savings are highly vulnerable to unexpected events, potentially leading to homelessness, debt, and even mental health problems.

- Reduced Consumer Spending: Lack of savings can restrict consumer spending, potentially impacting economic growth.

- Increased Reliance on Social Security: The lack of personal savings could place an increased burden on the already strained social security system.

What Can Be Done?

Addressing this crisis requires a multi-pronged approach:

- Government Intervention: The government could implement policies to boost wages, control inflation, and improve access to affordable housing and childcare. Increased financial literacy programs in schools and communities are also crucial.

- Financial Institutions: Banks and other financial institutions should offer more accessible and affordable savings products tailored to low-income individuals.

- Individual Responsibility: Individuals need to prioritize budgeting, develop realistic savings plans, and seek financial advice when needed. Even small, regular savings can make a significant difference over time. Consider utilizing tools like budgeting apps and online savings calculators to help manage finances effectively.

Looking Ahead:

The UK's savings crisis is a serious issue that demands immediate attention. Without significant action from the government, financial institutions, and individuals, the situation is likely to worsen, leading to increased financial insecurity and economic instability. It's time for a national conversation about financial resilience and the steps needed to ensure a more secure future for all Britons. Learn more about budgeting and saving strategies by visiting [Link to a relevant government website or financial literacy resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Savings Crisis: One In Ten Britons Have No Savings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Britons Savings Woes One In Ten Report Having No Savings At All

May 18, 2025

Britons Savings Woes One In Ten Report Having No Savings At All

May 18, 2025 -

Assisted Dying Mps To Debate Revised Bill In England And Wales

May 18, 2025

Assisted Dying Mps To Debate Revised Bill In England And Wales

May 18, 2025 -

Shocking Findings High Levels Of Arsenic And Cadmium In Rice Cnn Reports

May 18, 2025

Shocking Findings High Levels Of Arsenic And Cadmium In Rice Cnn Reports

May 18, 2025 -

Mlb 2024 Ten Troubling Numbers From The Seasons Start

May 18, 2025

Mlb 2024 Ten Troubling Numbers From The Seasons Start

May 18, 2025 -

Jansen Surrenders Walk Off Blast Analyzing The Crucial Play

May 18, 2025

Jansen Surrenders Walk Off Blast Analyzing The Crucial Play

May 18, 2025

Latest Posts

-

Cassie Venturas Testimony Ends Dawn Richards Begins In Diddy Trial

May 18, 2025

Cassie Venturas Testimony Ends Dawn Richards Begins In Diddy Trial

May 18, 2025 -

Secret Service Interviews James Comey Over Trump Seashell Post

May 18, 2025

Secret Service Interviews James Comey Over Trump Seashell Post

May 18, 2025 -

Diddys Legal Battle Why Aubrey O Day Wont Testify

May 18, 2025

Diddys Legal Battle Why Aubrey O Day Wont Testify

May 18, 2025 -

Slowing Ocean Currents Accelerating Us Sea Level Rise

May 18, 2025

Slowing Ocean Currents Accelerating Us Sea Level Rise

May 18, 2025 -

Crucial Ocean Current System Slowdown Implications For Us Coastlines

May 18, 2025

Crucial Ocean Current System Slowdown Implications For Us Coastlines

May 18, 2025