UK Spending Review: Priorities Of £10,000-£96,000 Earners Revealed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

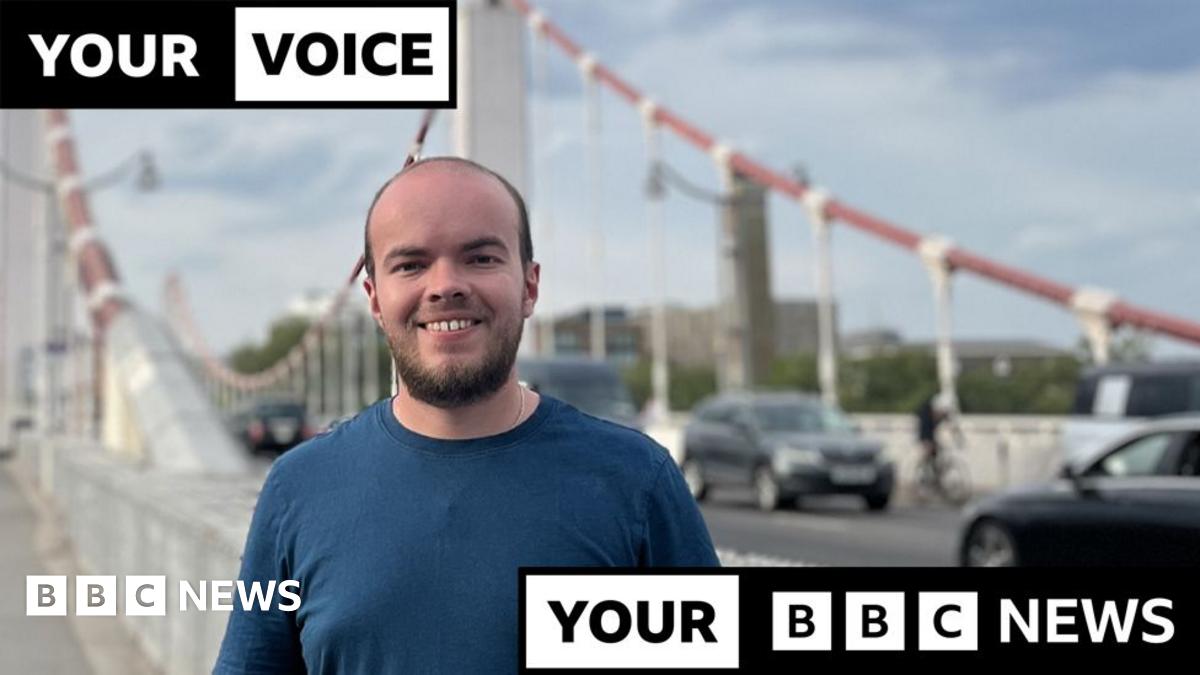

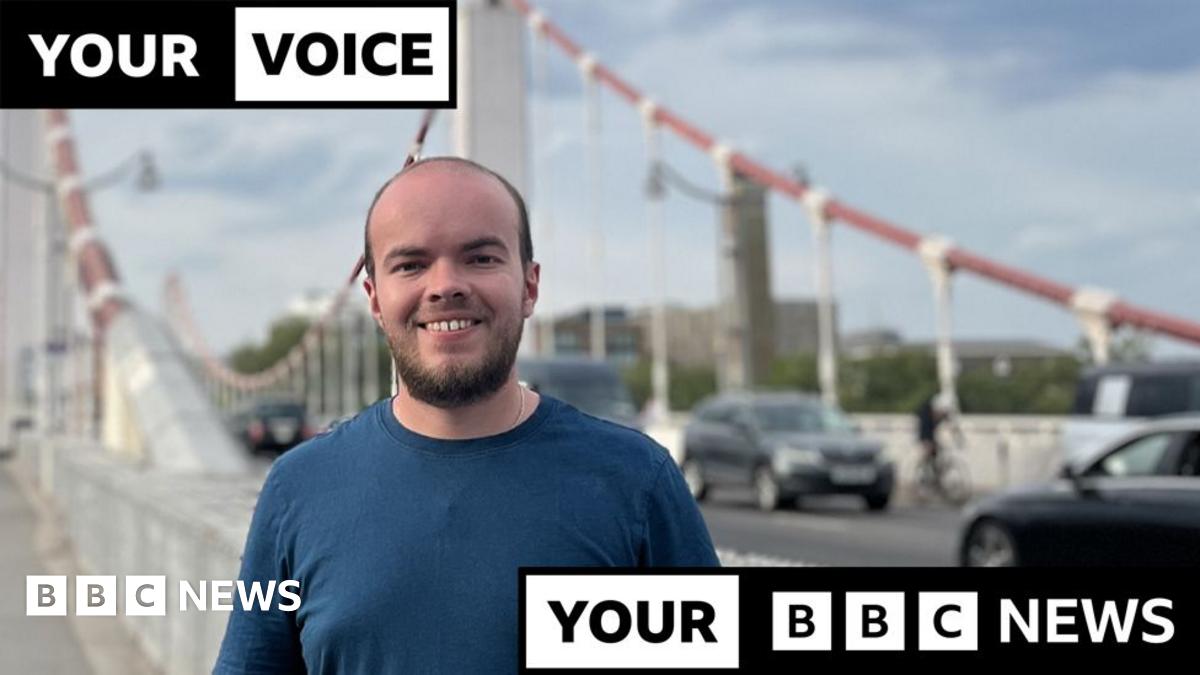

UK Spending Review: Priorities of £10,000-£96,000 Earners Revealed

The UK government's recent Spending Review has sparked intense debate, with the allocation of public funds scrutinized from all angles. But what about the spending priorities of the earners themselves – the backbone of the UK economy? New data reveals fascinating insights into how individuals earning between £10,000 and £96,000 annually allocate their disposable income, offering a compelling counterpoint to the official review.

This analysis, compiled from [Source of data - cite reputable source here, e.g., a financial institution, research firm], examines spending habits across various income brackets within this range. The findings offer a nuanced perspective on consumer confidence, economic trends, and the impact of the Spending Review on individual financial decisions.

Key Findings: A Breakdown by Income Bracket

The data reveals distinct spending patterns across different income levels:

-

£10,000 - £25,000: This group, often facing significant financial pressures, prioritizes essential spending on housing, food, and transportation. Data suggests a high proportion of disposable income is allocated to debt repayment, indicating financial vulnerability. The Spending Review's impact on this group is likely significant, particularly concerning any changes to benefits or support programs.

-

£25,000 - £40,000: This bracket shows a shift towards discretionary spending, with increased allocation to entertainment, leisure activities, and personal care. However, savings remain a priority, reflecting a cautious approach to financial management. Tax changes within the Spending Review could directly affect this group's disposable income and subsequent spending habits.

-

£40,000 - £60,000: This income bracket demonstrates a balanced approach, allocating resources to both essential and discretionary spending. There's a noticeable increase in investment in home improvements and larger purchases, suggesting growing financial security. Changes to tax relief or investment incentives within the Spending Review could significantly influence decisions in this bracket.

-

£60,000 - £96,000: This higher-income group shows a strong focus on long-term financial planning. Investment in pensions, property, and education feature prominently, alongside significant discretionary spending on travel, luxury goods, and experiences. The Spending Review's impact on capital gains tax or other investment-related policies will be keenly felt by this segment.

The Spending Review's Impact: A Shifting Landscape

The Spending Review's focus on [mention key areas of the Spending Review, e.g., infrastructure, healthcare, education] directly influences the financial landscape for these earners. For example, increased investment in public transportation could benefit lower-income earners, while tax breaks for certain investments could disproportionately affect higher-income individuals.

Looking Ahead: Understanding Consumer Behaviour

Understanding the spending priorities of these key demographics is crucial for businesses, policymakers, and economists alike. This data provides valuable insights into consumer sentiment, economic resilience, and the potential effects of future government policies. Further research is needed to fully analyze the long-term implications of the Spending Review and its impact on individual financial well-being.

Call to Action: Stay informed about upcoming economic developments and their potential impact on your personal finances. Consider seeking professional financial advice to optimize your spending and investment strategies. [Link to a relevant resource, e.g., a financial planning website or government resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Spending Review: Priorities Of £10,000-£96,000 Earners Revealed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live Webcast Korn Ferry Reports Q2 2025 Financial Results On June 18

Jun 12, 2025

Live Webcast Korn Ferry Reports Q2 2025 Financial Results On June 18

Jun 12, 2025 -

Heat Legend Dwyane Wade Shares Encouraging Message

Jun 12, 2025

Heat Legend Dwyane Wade Shares Encouraging Message

Jun 12, 2025 -

Younger Women In England Revised Cervical Screening Invitation Process

Jun 12, 2025

Younger Women In England Revised Cervical Screening Invitation Process

Jun 12, 2025 -

Box Office Buzz Superman Early Access On Amazon Prime Shatters Fandango Pre Sale Records

Jun 12, 2025

Box Office Buzz Superman Early Access On Amazon Prime Shatters Fandango Pre Sale Records

Jun 12, 2025 -

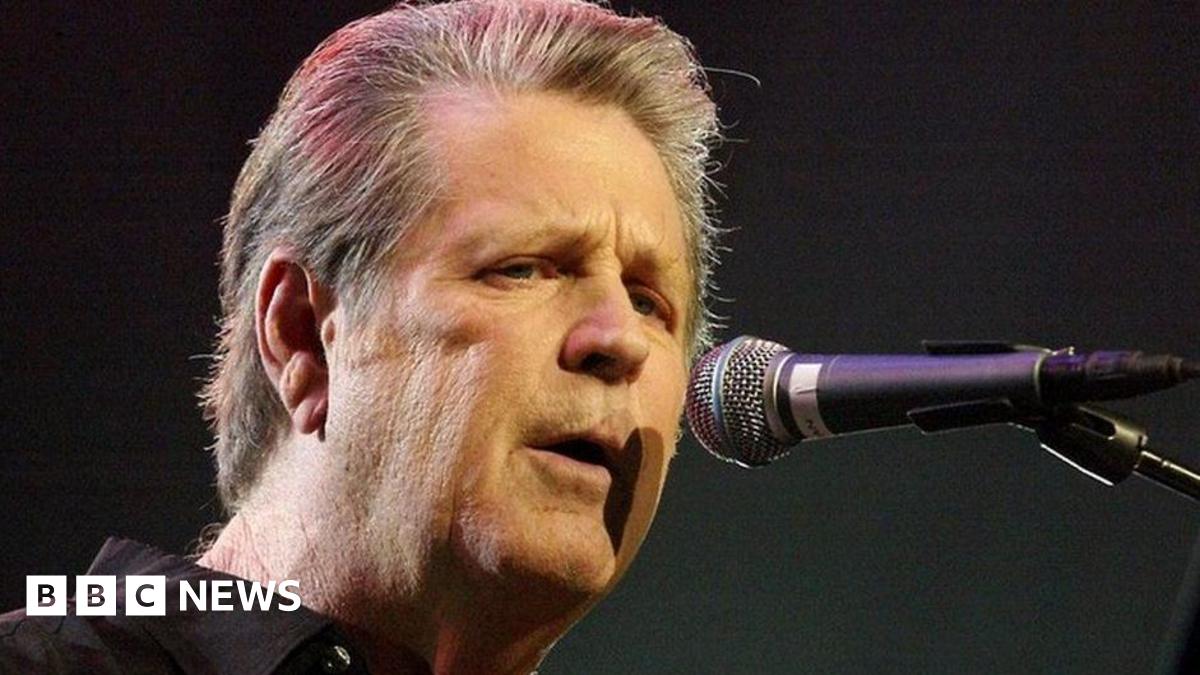

Music Legend Brian Wilson Celebrating His Enduring Impact On Popular Music

Jun 12, 2025

Music Legend Brian Wilson Celebrating His Enduring Impact On Popular Music

Jun 12, 2025

Latest Posts

-

Lawler Defends Infrastructure Vote At Putnam County Town Hall Meeting

Jun 13, 2025

Lawler Defends Infrastructure Vote At Putnam County Town Hall Meeting

Jun 13, 2025 -

Police Discover Bomb Making Materials At Home Of Austria School Shooting Suspect

Jun 13, 2025

Police Discover Bomb Making Materials At Home Of Austria School Shooting Suspect

Jun 13, 2025 -

Tik Tok Star Khaby Lame Released Departs United States

Jun 13, 2025

Tik Tok Star Khaby Lame Released Departs United States

Jun 13, 2025 -

Frank Confirmed Tottenham Hotspur Appoints New Manager To Replace Postecoglou

Jun 13, 2025

Frank Confirmed Tottenham Hotspur Appoints New Manager To Replace Postecoglou

Jun 13, 2025 -

Nfls Brian Rolapp A Top Contender In Pga Tour Ceo Search

Jun 13, 2025

Nfls Brian Rolapp A Top Contender In Pga Tour Ceo Search

Jun 13, 2025