UK Tax Authorities Ban Rob Cross, Ex-World Darts Champion, From Company Directorships

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Tax Authorities Ban Rob Cross, Ex-World Darts Champion, from Company Directorships

Former World Darts Champion Rob Cross faces a significant setback in his business career after being banned from acting as a company director by the UK tax authorities. The Insolvency Service announced the disqualification order, highlighting serious breaches of his duties as a director. This news sends shockwaves through the world of darts and corporate governance, raising questions about the responsibilities of high-profile individuals in managing their businesses.

The disqualification, effective immediately, prevents Cross from managing or taking part in the formation of a company for a period of 11 years. This substantial penalty underscores the severity of the misconduct found by the Insolvency Service's investigation. While the exact details of the breaches remain undisclosed, the ban itself speaks volumes about the seriousness of the situation. Such bans are not uncommon, but the high profile of the individual involved adds a considerable layer of public interest.

Understanding the Implications of the Ban

The Insolvency Service's actions highlight the importance of robust corporate governance and compliance with UK tax regulations. The ban on Cross serves as a stark reminder that even high-profile individuals are subject to the same legal consequences for failing to meet their directorial duties. This includes adhering to strict financial regulations and accurately reporting company activities to relevant authorities. Failure to do so can result in significant penalties, impacting both personal and professional reputations.

This case also underscores the potential consequences of poor financial management within a company. While the specifics of Cross's case are yet to be fully revealed, the disqualification suggests significant failings in his oversight and responsibility as a director. This serves as a cautionary tale for aspiring entrepreneurs and established business leaders alike.

The Impact on Cross's Career and Reputation

The disqualification undoubtedly casts a shadow over Cross's career, extending beyond his achievements in the darts world. His reputation, built on years of sporting success, now faces a challenge. While his darting career remains unaffected by this business-related setback, the negative publicity surrounding the ban could affect sponsorships and endorsements.

For those interested in similar cases of director disqualification, the Insolvency Service website provides further details and resources: [Link to Insolvency Service Website]. Understanding the legal implications of company directorship is crucial for anyone involved in running a business in the UK.

Looking Ahead: Lessons Learned

This situation provides a valuable lesson for all business leaders. Maintaining meticulous financial records, complying with all relevant tax regulations, and ensuring responsible corporate governance are paramount for success and avoiding potential legal repercussions. The consequences of neglecting these responsibilities can be severe, as highlighted by the case of Rob Cross.

Key takeaways:

- Compliance is crucial: Adhering to tax laws and regulations is non-negotiable for company directors.

- Transparency is essential: Maintaining accurate and transparent financial records is vital.

- Professional advice is recommended: Seeking expert advice from accountants and legal professionals is highly advisable.

This incident serves as a reminder that success in one field doesn’t guarantee success in another. The implications of this ban on Rob Cross's future business ventures remain to be seen, but it serves as a compelling case study in the importance of responsible business practices and compliance within the UK legal framework.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK Tax Authorities Ban Rob Cross, Ex-World Darts Champion, From Company Directorships. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Madeleine Mc Cann Case Hope Fades After 18 Years Of Investigation

Jun 06, 2025

Madeleine Mc Cann Case Hope Fades After 18 Years Of Investigation

Jun 06, 2025 -

Unpaid Taxes Cost Rob Cross Directorship Former World Darts Champion Banned

Jun 06, 2025

Unpaid Taxes Cost Rob Cross Directorship Former World Darts Champion Banned

Jun 06, 2025 -

Israeli American Hostages Remains Recovered In Gaza Joint Military Operation

Jun 06, 2025

Israeli American Hostages Remains Recovered In Gaza Joint Military Operation

Jun 06, 2025 -

Pete De Boer Fired Dallas Stars Clean House After Conference Finals Exit

Jun 06, 2025

Pete De Boer Fired Dallas Stars Clean House After Conference Finals Exit

Jun 06, 2025 -

Milwaukee Jury Concludes Deliberations In Anderson Case

Jun 06, 2025

Milwaukee Jury Concludes Deliberations In Anderson Case

Jun 06, 2025

Latest Posts

-

Karine Jean Pierre Leaves Democratic Party A New Political Chapter

Jun 07, 2025

Karine Jean Pierre Leaves Democratic Party A New Political Chapter

Jun 07, 2025 -

Preventing Hospitalization Understanding The Influence Of Early Life Microbiome Development

Jun 07, 2025

Preventing Hospitalization Understanding The Influence Of Early Life Microbiome Development

Jun 07, 2025 -

Jury Reaches Verdict In Milwaukees Maxwell Anderson Case

Jun 07, 2025

Jury Reaches Verdict In Milwaukees Maxwell Anderson Case

Jun 07, 2025 -

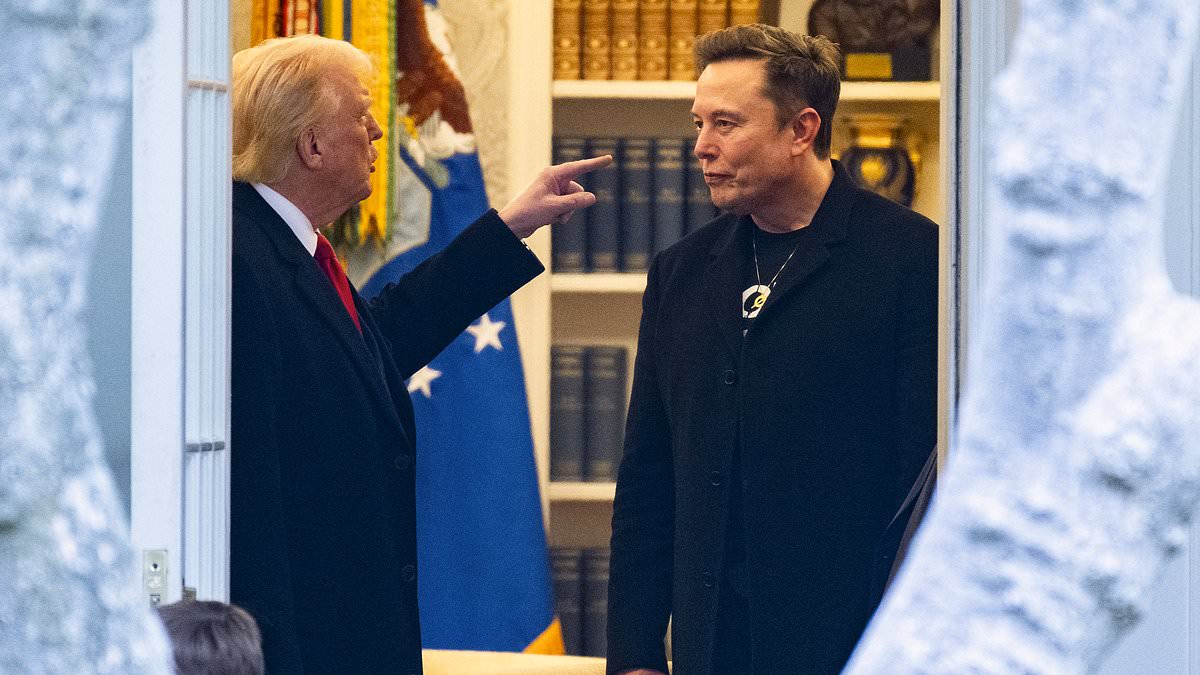

Behind The Trump Musk Fallout The Untold Story Of A Powerful Insider

Jun 07, 2025

Behind The Trump Musk Fallout The Untold Story Of A Powerful Insider

Jun 07, 2025 -

Karine Jean Pierres Political Shift No Longer A Democrat

Jun 07, 2025

Karine Jean Pierres Political Shift No Longer A Democrat

Jun 07, 2025