UK University Tuition Fees 2024: Return On Investment And Cost Breakdown

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK University Tuition Fees 2024: Return on Investment and Cost Breakdown

Is university still worth it? With UK university tuition fees continuing to rise, prospective students and their families are grappling with a crucial question: is the investment in higher education still worthwhile? This article breaks down the cost of university in 2024, explores potential returns on investment (ROI), and helps you make an informed decision.

Tuition Fees: The Current Landscape

For the 2024 academic year, tuition fees for undergraduate courses in England remain capped at £9,250 per year for most subjects. However, this figure can be misleading. Several factors significantly impact the overall cost:

- Subject Matter: Certain subjects, particularly those involving laboratory work or specialist equipment (like medicine, dentistry, and engineering), often command higher fees. These can exceed the standard cap significantly.

- University Prestige: More prestigious universities, consistently ranked highly in national and international league tables, may charge closer to the maximum allowed.

- International Students: International students typically face substantially higher tuition fees than their UK counterparts. These fees can vary greatly depending on the university and course.

Beyond Tuition: The Hidden Costs

Tuition fees are just the tip of the iceberg. Students should factor in several additional expenses:

- Living Costs: Accommodation, food, transportation, and everyday expenses vary dramatically depending on location. London, for example, is considerably more expensive than smaller university towns. Expect to budget significantly for this aspect.

- Books and Materials: Textbooks, stationery, and other course materials can add up quickly.

- Travel: Travel costs for visiting family, attending conferences, or participating in extracurricular activities should be considered.

- Personal Expenses: Entertainment, social events, and personal care products also contribute to the overall cost.

Calculating Your Return on Investment (ROI)

Assessing the ROI of a university education requires a long-term perspective. While immediate financial gains are unlikely, a degree can significantly improve your long-term earning potential. Factors to consider include:

- Projected Earnings: Research average salaries for graduates in your chosen field. Websites like the Office for National Statistics (ONS) provide valuable data.

- Career Progression: Consider the potential for career advancement and salary increases throughout your working life.

- Non-Monetary Benefits: Account for intangible benefits like personal development, increased job satisfaction, and expanded career options.

Making the Decision: Weighing the Costs and Benefits

Choosing a university is a significant financial and personal commitment. To make an informed decision:

- Research thoroughly: Explore different universities and courses that align with your career aspirations.

- Budget realistically: Create a detailed budget encompassing all anticipated expenses.

- Explore funding options: Investigate student loans, grants, scholarships, and part-time work opportunities. The Student Loan Company website is an excellent resource.

- Consider alternatives: Explore apprenticeships or vocational training as alternative pathways.

Conclusion:

While UK university tuition fees are substantial, the long-term benefits of a degree can outweigh the initial costs for many. However, thorough planning, realistic budgeting, and a clear understanding of your career goals are essential for maximizing your return on investment. Don't hesitate to seek guidance from university advisors and financial professionals to ensure you make the best decision for your future.

Keywords: UK university tuition fees 2024, university fees, cost of university, return on investment, ROI university, student finance, student loans, university cost breakdown, higher education costs, UK student finance, university fees England.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK University Tuition Fees 2024: Return On Investment And Cost Breakdown. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

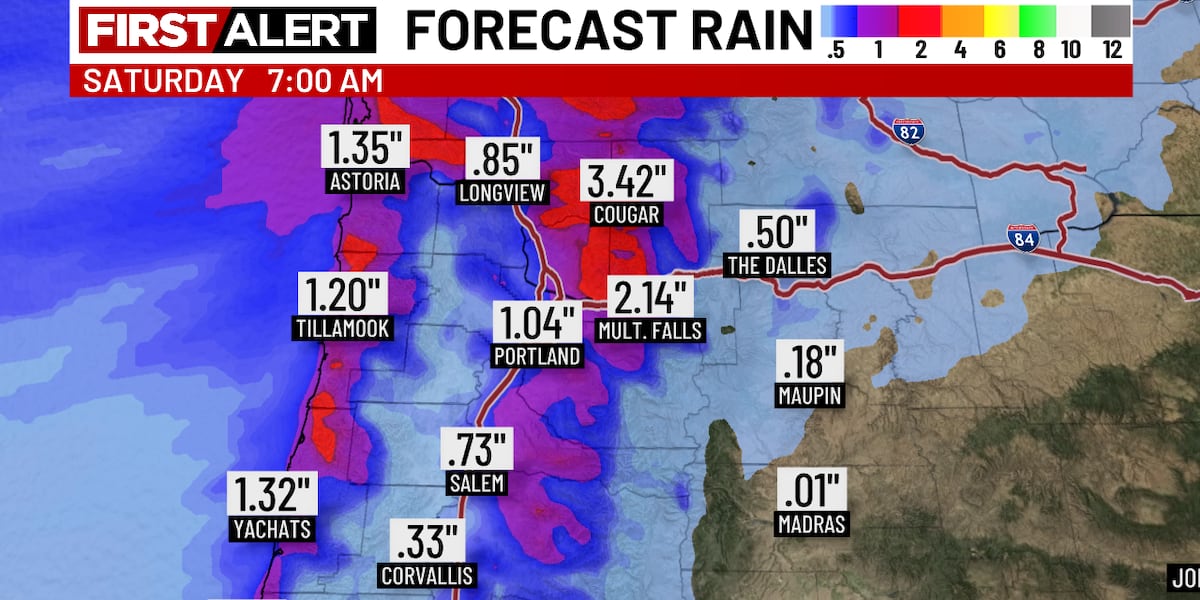

Soaking Rain Gives Way To Dry Weekend In August

Aug 15, 2025

Soaking Rain Gives Way To Dry Weekend In August

Aug 15, 2025 -

Economic Headwinds Dampen Monterey Classic Car Auction Results

Aug 15, 2025

Economic Headwinds Dampen Monterey Classic Car Auction Results

Aug 15, 2025 -

Future Of Palestine Action Uncertain Following Widespread Arrests

Aug 15, 2025

Future Of Palestine Action Uncertain Following Widespread Arrests

Aug 15, 2025 -

Premier League Returns Live Manager Press Conferences And Season Preview

Aug 15, 2025

Premier League Returns Live Manager Press Conferences And Season Preview

Aug 15, 2025 -

How Much Does University Cost In The Uk Return On Investment Explained

Aug 15, 2025

How Much Does University Cost In The Uk Return On Investment Explained

Aug 15, 2025

Latest Posts

-

Council Condemns Mass Dumping Of Library Books In Croydon

Aug 15, 2025

Council Condemns Mass Dumping Of Library Books In Croydon

Aug 15, 2025 -

Taylor Swifts Evolving Soundscape Analyzing Her New Album And Public Relationship

Aug 15, 2025

Taylor Swifts Evolving Soundscape Analyzing Her New Album And Public Relationship

Aug 15, 2025 -

Cowboys Owner Jerry Jones Reveals Stage 4 Cancer Diagnosis

Aug 15, 2025

Cowboys Owner Jerry Jones Reveals Stage 4 Cancer Diagnosis

Aug 15, 2025 -

Summertime Celebrating Love And Friendship With Kates Tips

Aug 15, 2025

Summertime Celebrating Love And Friendship With Kates Tips

Aug 15, 2025 -

Makeup Brands Apology Addressing Controversy Surrounding Comedian In Advertisement

Aug 15, 2025

Makeup Brands Apology Addressing Controversy Surrounding Comedian In Advertisement

Aug 15, 2025