UK/US/EU (Specify Region) Tightens Buy Now, Pay Later Rules To Shield Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

UK Tightens Buy Now, Pay Later Rules to Shield Consumers

Buy now, pay later (BNPL) services are facing stricter regulation in the UK as the Financial Conduct Authority (FCA) cracks down on irresponsible lending practices. The surge in popularity of BNPL, offering consumers the ability to defer payments on purchases, has led to concerns about rising debt levels and a lack of consumer protection. This move aims to ensure that consumers understand the financial implications before committing to these payment plans and to protect vulnerable individuals from spiraling debt.

The FCA's new rules, which came into effect in July 2023, represent a significant shift in how BNPL providers operate within the UK. For years, these services existed in a regulatory grey area, escaping the stringent rules applied to traditional credit products. This loophole is now closed.

Key Changes Introduced by the FCA:

-

Affordability Assessments: BNPL providers are now legally obligated to conduct thorough affordability checks before approving applications. This involves assessing a customer's income, expenses, and existing debt to determine their ability to repay the loan. This is a major step towards responsible lending and aims to prevent consumers from taking on more debt than they can manage.

-

Increased Transparency: Greater transparency is demanded regarding the costs associated with BNPL. Providers must clearly state all fees and interest charges, removing any ambiguity that previously existed. This includes upfront disclosure of potential late payment fees, which can be substantial.

-

Debt Collection Practices: The FCA has imposed stricter guidelines on debt collection practices employed by BNPL companies. Aggressive or unfair collection methods are now prohibited, protecting consumers from harassment and distress.

-

Credit Reference Agency Reporting: A landmark change is the mandatory reporting of missed payments to credit reference agencies. This means that late or missed BNPL payments will now impact a consumer's credit score, similar to credit card defaults. This increased accountability aims to encourage responsible usage of BNPL services.

Impact on Consumers and the BNPL Industry:

The new regulations are expected to significantly impact both consumers and the BNPL industry. Consumers will find it harder to secure BNPL loans if their financial situation is deemed precarious, encouraging more responsible borrowing habits. The industry itself faces increased compliance costs and potentially reduced profitability due to stricter lending criteria. Several BNPL providers have already adjusted their lending practices to comply with the new rules. Some have even exited the UK market entirely due to the increased regulatory burden.

What This Means for You:

If you use or are considering using BNPL, it's crucial to:

- Understand the terms and conditions: Read the fine print carefully before agreeing to a BNPL plan. Pay close attention to interest rates, fees, and repayment schedules.

- Only borrow what you can afford: Don't use BNPL for purchases you can't realistically afford to repay.

- Budget carefully: Factor BNPL repayments into your monthly budget to avoid falling behind on payments.

- Consider alternatives: Explore alternative payment methods if BNPL seems financially risky.

The FCA's intervention highlights a growing global trend of increased scrutiny towards the BNPL sector. Similar regulatory changes are being considered or implemented in other countries, reflecting a widespread concern about the potential for consumer harm. The UK’s proactive approach sets a precedent for other nations grappling with regulating this rapidly evolving financial technology. The long-term success of these regulations will depend on effective enforcement and ongoing monitoring by the FCA. Consumers should remain vigilant and responsible when using BNPL services.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on UK/US/EU (Specify Region) Tightens Buy Now, Pay Later Rules To Shield Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

International Assistance Urged Ensuring Safety And Responsible Tourism In Bali

May 20, 2025

International Assistance Urged Ensuring Safety And Responsible Tourism In Bali

May 20, 2025 -

Australias Interest Rate Cut A Response To Cooling Inflation

May 20, 2025

Australias Interest Rate Cut A Response To Cooling Inflation

May 20, 2025 -

Putins Power Play Demonstrating Independence From Trump

May 20, 2025

Putins Power Play Demonstrating Independence From Trump

May 20, 2025 -

Dutertes Local Election Triumph International Legal Hurdles Remain

May 20, 2025

Dutertes Local Election Triumph International Legal Hurdles Remain

May 20, 2025 -

Urgent Security Alert Private And Criminal Records Stolen In Legal Aid Hack

May 20, 2025

Urgent Security Alert Private And Criminal Records Stolen In Legal Aid Hack

May 20, 2025

Latest Posts

-

Emotional Resonance Over Action The Last Of Us Enduring Appeal

May 20, 2025

Emotional Resonance Over Action The Last Of Us Enduring Appeal

May 20, 2025 -

Jamie Lee Curtis Talks Lindsay Lohan A Post Freaky Friday Friendship Update

May 20, 2025

Jamie Lee Curtis Talks Lindsay Lohan A Post Freaky Friday Friendship Update

May 20, 2025 -

Former Olympic Champion Speaks Out Against Coachs Abusive Methods

May 20, 2025

Former Olympic Champion Speaks Out Against Coachs Abusive Methods

May 20, 2025 -

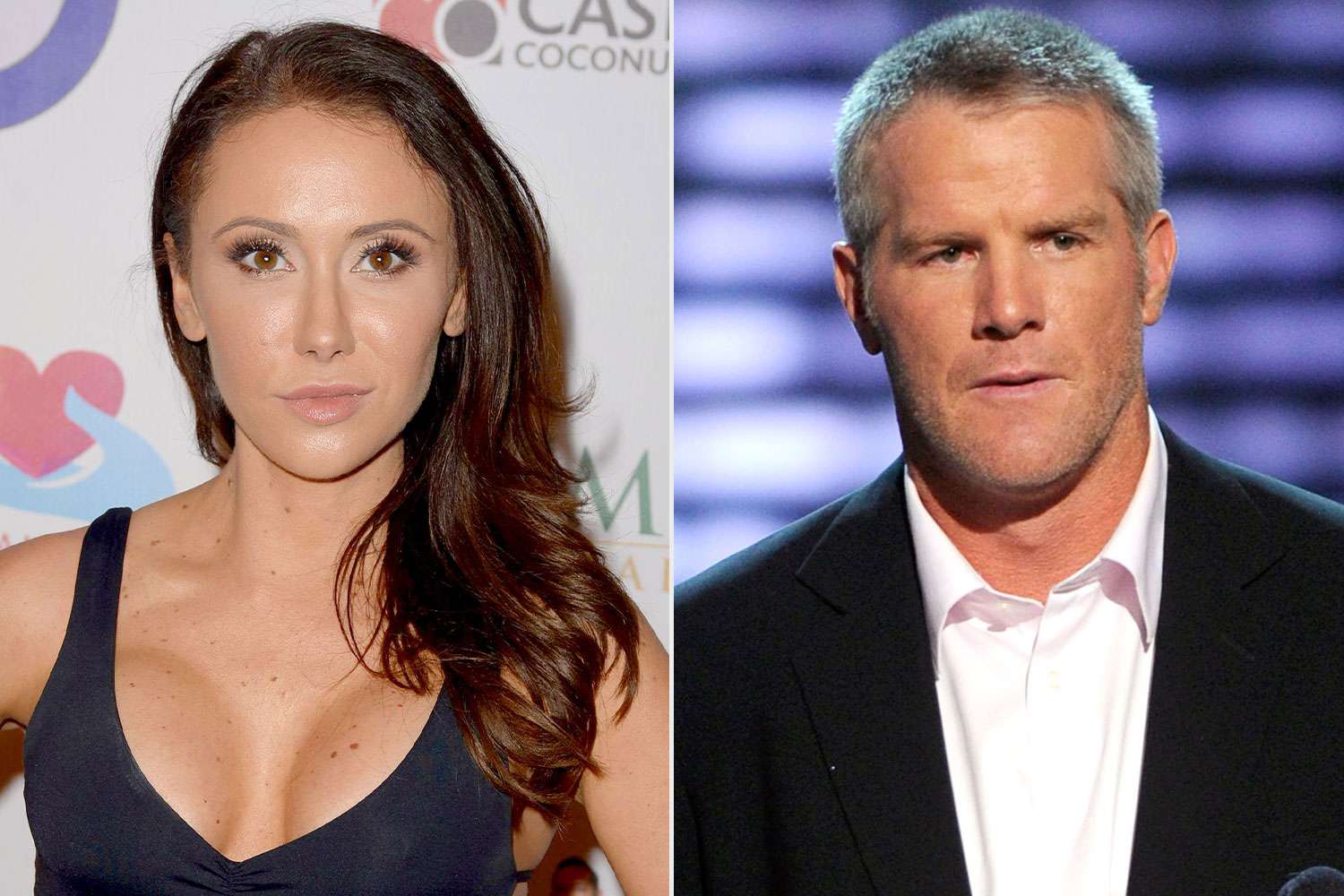

The Brett Favre Scandal Jenn Stergers Account Of Dehumanization

May 20, 2025

The Brett Favre Scandal Jenn Stergers Account Of Dehumanization

May 20, 2025 -

Jon Jones Calls For Aspinall Stripping Fans React To Latest Comments

May 20, 2025

Jon Jones Calls For Aspinall Stripping Fans React To Latest Comments

May 20, 2025