Unconventional Trades On Wall Street: A Closer Look At Recent Market Behavior

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unconventional Trades on Wall Street: A Closer Look at Recent Market Behavior

Wall Street, the epicenter of global finance, has witnessed a surge in unconventional trading strategies in recent months. This shift, fueled by factors ranging from persistently high inflation and fluctuating interest rates to the rise of meme stocks and the increasing influence of social media, is reshaping the market landscape and prompting experts to reassess traditional investment models. This article delves into the specifics of these unconventional trades and analyzes their impact on market behavior.

The Rise of Meme Stocks and Retail Investor Influence:

One of the most significant trends driving unconventional trades is the continued influence of retail investors, often mobilized through social media platforms like Reddit's WallStreetBets. The phenomenon, which propelled stocks like GameStop and AMC Entertainment to astronomical heights, demonstrates the power of coordinated retail trading activity in defying traditional market forces. While the initial meme stock craze has subsided somewhat, its impact remains significant, highlighting the vulnerability of traditional market analysis to collective, emotion-driven trading decisions. This shift necessitates a reassessment of risk management strategies for institutional investors.

The Impact of Algorithmic Trading and High-Frequency Trading (HFT):

Algorithmic and high-frequency trading (HFT) continue to play a dominant role in shaping market behavior. These automated trading systems execute millions of trades per second, often exploiting minute price discrepancies for profit. While enhancing market liquidity, HFT can also contribute to increased market volatility and flash crashes, making it challenging to predict market trends accurately. Understanding the intricacies of algorithmic trading is crucial for navigating the complexities of the modern financial market. [Link to a reputable article on algorithmic trading].

Options Trading and the Increased Volatility:

The increased market volatility has also led to a rise in options trading activity. Options contracts offer investors the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. This flexibility makes options trading attractive in volatile markets, enabling investors to hedge against risk or speculate on significant price movements. However, the complexity of options trading necessitates a thorough understanding of the underlying mechanics before engaging. Incorrect strategies can lead to substantial losses. [Link to a reputable resource on options trading].

The Role of Inflation and Interest Rate Hikes:

Macroeconomic factors such as persistently high inflation and subsequent interest rate hikes by central banks are significantly influencing investor behavior. These factors create uncertainty in the market, pushing investors towards more unconventional strategies as they seek to protect their portfolios from inflation and rising interest rates. This uncertainty is reflected in the increased volatility and the shifting preferences for different asset classes.

Navigating the Unconventional Market:

The current market landscape demands a nuanced understanding of the forces at play. Investors need to be particularly aware of:

- Increased Market Volatility: Be prepared for significant price swings and unexpected market movements.

- The Influence of Social Media: Remain cautious of information disseminated through social media and avoid impulsive decisions based solely on online sentiment.

- The Complexity of Algorithmic Trading: Understand the limitations of traditional market analysis in the face of high-frequency trading.

- Risk Management: Implement robust risk management strategies to mitigate potential losses.

Conclusion:

The prevalence of unconventional trades on Wall Street reflects a rapidly evolving market landscape. By understanding the factors driving these trends and adapting their investment strategies accordingly, investors can better navigate the complexities of the modern financial market and potentially capitalize on emerging opportunities. However, caution and thorough research remain paramount. Remember to consult with a qualified financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unconventional Trades On Wall Street: A Closer Look At Recent Market Behavior. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Payson Brush Fire Update Beeline Highway Area Evacuations

Jun 14, 2025

Payson Brush Fire Update Beeline Highway Area Evacuations

Jun 14, 2025 -

Air India Ahmedabad London Crash Latest Updates And Investigation Details

Jun 14, 2025

Air India Ahmedabad London Crash Latest Updates And Investigation Details

Jun 14, 2025 -

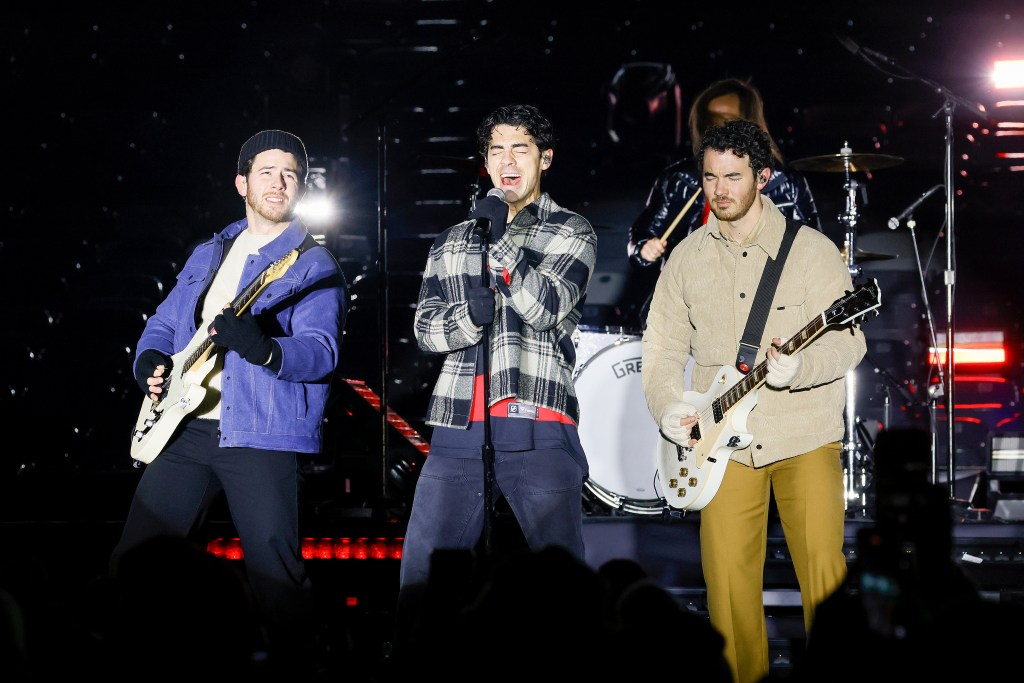

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025 -

Illini Mens Golf The 2025 Professional Golf Landscape For Former Players

Jun 14, 2025

Illini Mens Golf The 2025 Professional Golf Landscape For Former Players

Jun 14, 2025 -

New Jonas Brothers Album Live From The O2 London Includes When You Know

Jun 14, 2025

New Jonas Brothers Album Live From The O2 London Includes When You Know

Jun 14, 2025

Latest Posts

-

2025 Us Open Analyzing The Potential Cut Line And At Risk Golfers

Jun 15, 2025

2025 Us Open Analyzing The Potential Cut Line And At Risk Golfers

Jun 15, 2025 -

Iran Attack New Video Evidence Released By Israel Cnn

Jun 15, 2025

Iran Attack New Video Evidence Released By Israel Cnn

Jun 15, 2025 -

Watch Lsu Baseball Play Arkansas In Omaha College World Series Game Details

Jun 15, 2025

Watch Lsu Baseball Play Arkansas In Omaha College World Series Game Details

Jun 15, 2025 -

Black Box Data Expected To Clarify Air India Flight Incident

Jun 15, 2025

Black Box Data Expected To Clarify Air India Flight Incident

Jun 15, 2025 -

Israels Iran Attack Leaked Video Reveals Operational Details

Jun 15, 2025

Israels Iran Attack Leaked Video Reveals Operational Details

Jun 15, 2025