Unconventional Trading Strategies Dominate Wall Street: The Why And How

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unconventional Trading Strategies Dominate Wall Street: The Why and How

Wall Street, long the bastion of traditional investment strategies, is undergoing a seismic shift. Unconventional trading methods are no longer niche strategies; they're dominating the market, forcing established players to adapt or be left behind. This dramatic change is driven by a confluence of factors, from technological advancements to evolving market dynamics, and understanding these trends is crucial for navigating the modern financial landscape.

The Rise of Algorithmic Trading and High-Frequency Trading (HFT):

One of the most significant drivers of this shift is the proliferation of algorithmic and high-frequency trading. These strategies, reliant on sophisticated computer programs and incredibly fast execution speeds, allow traders to exploit even the smallest market inefficiencies. HFT firms, in particular, are known for their lightning-fast trades, often executed in milliseconds, making them incredibly difficult to compete with using traditional methods. This dominance has led to increased market volatility and a need for investors to understand the implications of these powerful, automated systems.

- Algorithmic Trading: Uses complex algorithms to analyze market data and execute trades automatically.

- High-Frequency Trading (HFT): Employs ultra-fast computer programs to execute a large number of trades in milliseconds, often profiting from tiny price discrepancies.

The Impact of Big Data and Artificial Intelligence (AI):

The explosion of big data and the advancements in artificial intelligence are further fueling the adoption of unconventional trading strategies. AI-powered systems can process vast quantities of data – including news sentiment, social media trends, and even weather patterns – to identify potential trading opportunities that would be impossible for human analysts to detect. This data-driven approach allows for more precise predictions and more efficient risk management, giving AI-powered strategies a significant edge. .

The Growing Popularity of Sentiment Analysis and Social Media Trading:

Traditionally, fundamental and technical analysis dominated investment decisions. Now, sentiment analysis – gauging market mood from news articles, social media posts, and online forums – is gaining traction. This allows traders to anticipate market shifts based on public opinion, even before traditional indicators reflect the change. Platforms that facilitate social trading, where users can copy the trades of successful investors, are also contributing to this trend. However, it’s crucial to remember that social media sentiment can be highly volatile and prone to manipulation.

How to Adapt to the New Landscape:

For both individual investors and institutional players, adapting to this new reality is crucial. This requires:

- Embracing Technology: Investing in sophisticated trading tools and learning about algorithmic and AI-powered strategies is essential.

- Diversification: Spreading investments across a variety of asset classes and strategies mitigates risk in this rapidly changing market.

- Continuous Learning: Staying abreast of the latest trends and technological advancements is critical for success.

- Risk Management: Understanding and managing the increased volatility associated with these unconventional strategies is paramount.

Conclusion:

The dominance of unconventional trading strategies on Wall Street is a testament to the power of technology and data-driven decision-making. While these strategies present challenges, they also offer exciting opportunities for those who can adapt and embrace the changing landscape. By understanding the underlying forces driving this transformation, investors can better position themselves for success in the increasingly complex world of modern finance. The future of trading is here, and it's driven by algorithms, AI, and an unprecedented access to information. Are you ready?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unconventional Trading Strategies Dominate Wall Street: The Why And How. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adobe Stock And Ai Navigating The Future Of Stock Photography Nasdaq Adbe

Jun 13, 2025

Adobe Stock And Ai Navigating The Future Of Stock Photography Nasdaq Adbe

Jun 13, 2025 -

Wildfire Prompts Emergency Sr 87 Closure South Of Payson Arizona

Jun 13, 2025

Wildfire Prompts Emergency Sr 87 Closure South Of Payson Arizona

Jun 13, 2025 -

Premier League Thomas Frank Takes The Helm At Tottenham

Jun 13, 2025

Premier League Thomas Frank Takes The Helm At Tottenham

Jun 13, 2025 -

Budget Squeeze Reeves Outlines Increased Spending On Nhs And Housing

Jun 13, 2025

Budget Squeeze Reeves Outlines Increased Spending On Nhs And Housing

Jun 13, 2025 -

Oregon Wildfire Evacuations And Highway Closures Amid High Winds

Jun 13, 2025

Oregon Wildfire Evacuations And Highway Closures Amid High Winds

Jun 13, 2025

Latest Posts

-

Offshore Tournament Boat Fire Leaves Five Rescued

Jun 14, 2025

Offshore Tournament Boat Fire Leaves Five Rescued

Jun 14, 2025 -

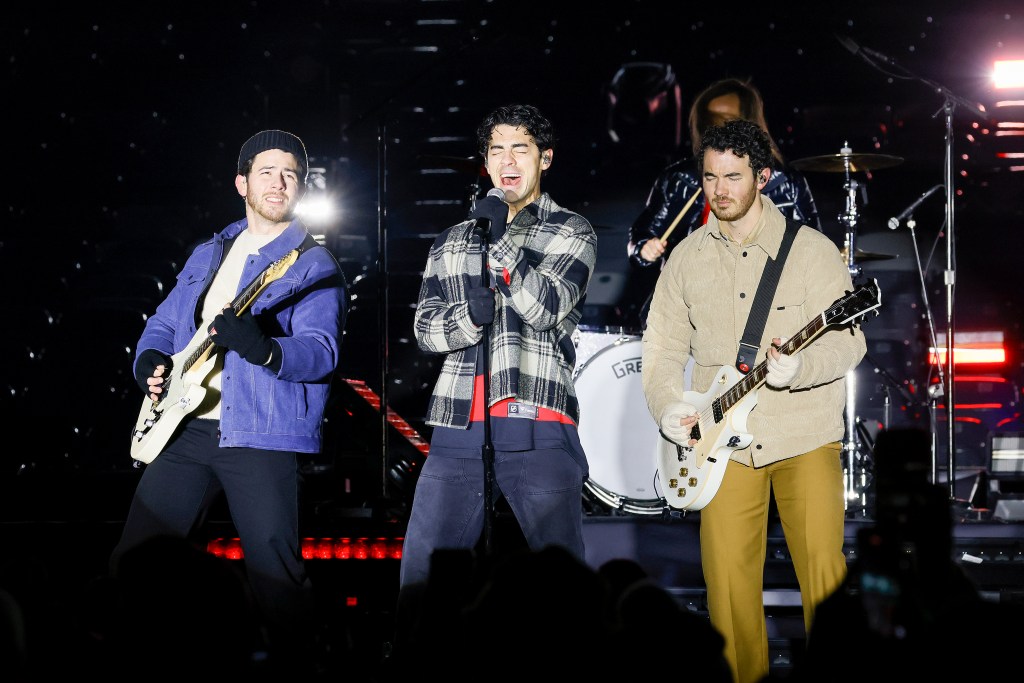

Confirmed Jonas Brothers Cancel Shows Affecting Wrigley Field

Jun 14, 2025

Confirmed Jonas Brothers Cancel Shows Affecting Wrigley Field

Jun 14, 2025 -

Teslas Future Unveiled Elon Musk On His Most Important Product Ever

Jun 14, 2025

Teslas Future Unveiled Elon Musk On His Most Important Product Ever

Jun 14, 2025 -

Carlsbad Brush Fire Under Control Evacuation Orders Lifted

Jun 14, 2025

Carlsbad Brush Fire Under Control Evacuation Orders Lifted

Jun 14, 2025 -

Bbc Responds To David Walliams Nazi Salute On Would I Lie To You Controversy Erupts

Jun 14, 2025

Bbc Responds To David Walliams Nazi Salute On Would I Lie To You Controversy Erupts

Jun 14, 2025