Understanding Amazon (AMZN) Stock: The Drivers Of Its Momentum

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding Amazon (AMZN) Stock: The Drivers of its Momentum

Amazon (AMZN) stock has consistently been a major player in the tech sector, captivating investors with its impressive growth and market dominance. But what exactly fuels this momentum? Understanding the key drivers behind AMZN's performance is crucial for any investor considering adding it to their portfolio. This article delves into the factors contributing to Amazon's stock price fluctuations and long-term growth potential.

The Powerhouse of E-commerce:

Amazon's dominance in online retail remains a cornerstone of its success. Its vast selection, convenient delivery options (including same-day and Prime delivery), and personalized recommendations keep customers returning. The continuous expansion into new markets and the ever-growing adoption of e-commerce globally fuel significant revenue growth. This core business provides a stable foundation for AMZN's overall valuation. However, increasing competition from established players and new entrants necessitates constant innovation and strategic adaptation.

Amazon Web Services (AWS): The Cloud Colossus:

AWS, Amazon's cloud computing arm, is a major profit driver and a key factor in AMZN's stock performance. Its market-leading position in Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) provides a recurring revenue stream with high margins. The growing demand for cloud computing across industries ensures sustained growth for AWS, even in economic downturns. Understanding AWS's performance is crucial to predicting AMZN's overall financial health. [Link to AWS website]

Advertising Revenue: A Growing Force:

Amazon's advertising business is quietly becoming a significant revenue generator. With billions of users browsing its platform daily, targeted advertising opportunities are immense. This segment’s growth is closely tied to the overall growth of e-commerce and digital advertising, making it a reliable source of future revenue.

Beyond Retail and Cloud: Diversification and Innovation:

Amazon's success isn't limited to e-commerce and cloud computing. The company's strategic investments in diverse sectors such as:

- Amazon Prime: The subscription service continues to attract millions of subscribers, generating recurring revenue and bolstering customer loyalty.

- Amazon Devices (Alexa, Kindle, etc.): These devices create a connected ecosystem, strengthening brand loyalty and providing valuable data for targeted advertising.

- Logistics and Supply Chain: Amazon's vast logistics network provides a competitive advantage and creates opportunities for further expansion.

- Entertainment (Prime Video, Audible, Twitch): Amazon's foray into entertainment competes with industry giants and expands its user base.

Risks and Challenges:

While Amazon's future looks bright, several challenges remain:

- Antitrust Scrutiny: Regulatory pressure and antitrust concerns could impact the company's growth trajectory.

- Economic Slowdowns: Recessions could dampen consumer spending, affecting Amazon's core retail business.

- Competition: Intense competition from other tech giants and smaller players necessitates constant innovation and adaptation.

- Labor Relations: Maintaining positive relations with its workforce is vital for operational efficiency and public image.

Conclusion:

Amazon's stock momentum is fueled by a potent combination of factors. Its dominance in e-commerce, the robust growth of AWS, the expanding advertising business, and continuous diversification into new areas paint a picture of long-term growth potential. However, potential investors must also carefully consider the inherent risks and challenges before investing in AMZN. Understanding these drivers is paramount for making informed investment decisions. Conduct thorough research and consider consulting a financial advisor before making any investment choices. Stay informed about upcoming earnings reports and industry trends for the most up-to-date assessment of AMZN’s stock performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Amazon (AMZN) Stock: The Drivers Of Its Momentum. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hillsboroughs Memorial Day Parade A Community Tribute

May 27, 2025

Hillsboroughs Memorial Day Parade A Community Tribute

May 27, 2025 -

The Spread Of A Dangerous Fungus A Climate Change Consequence

May 27, 2025

The Spread Of A Dangerous Fungus A Climate Change Consequence

May 27, 2025 -

Pdd Holdings Q1 2025 Earnings Key Financial Highlights Expected

May 27, 2025

Pdd Holdings Q1 2025 Earnings Key Financial Highlights Expected

May 27, 2025 -

Jeanine Pirro Weighs In The Aftermath Of The Israeli Embassy Killings

May 27, 2025

Jeanine Pirro Weighs In The Aftermath Of The Israeli Embassy Killings

May 27, 2025 -

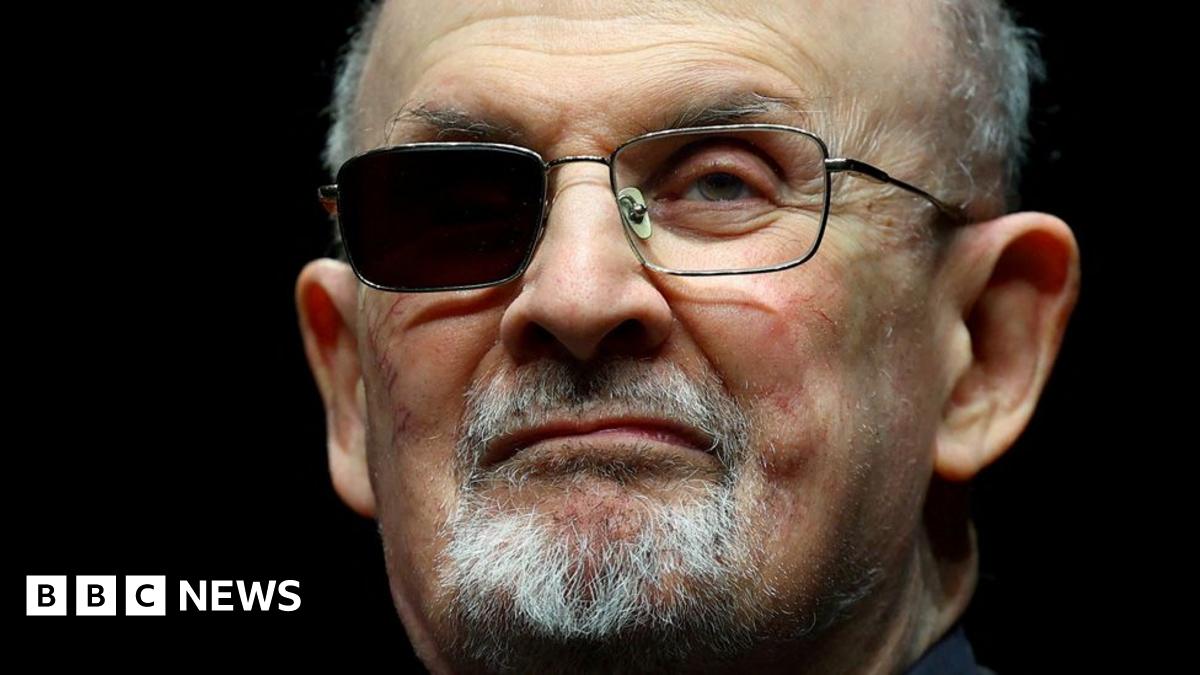

Salman Rushdie Satisfaction With Attackers Maximum Sentence

May 27, 2025

Salman Rushdie Satisfaction With Attackers Maximum Sentence

May 27, 2025

Latest Posts

-

From Lumber To Likes Shepmates Journey To Online Popularity

May 28, 2025

From Lumber To Likes Shepmates Journey To Online Popularity

May 28, 2025 -

Viral Video Sparks Controversy Macrons Explanation Of Incident With Wife

May 28, 2025

Viral Video Sparks Controversy Macrons Explanation Of Incident With Wife

May 28, 2025 -

Ultra Nationalist Israeli March In Jerusalem Heightened Tensions And International Concern

May 28, 2025

Ultra Nationalist Israeli March In Jerusalem Heightened Tensions And International Concern

May 28, 2025 -

Hundreds Feared Injured In Chinese Chemical Plant Blast Urgent Rescue Mission

May 28, 2025

Hundreds Feared Injured In Chinese Chemical Plant Blast Urgent Rescue Mission

May 28, 2025 -

Us Support For Gaza New Aid Group Commences Distribution Operations

May 28, 2025

Us Support For Gaza New Aid Group Commences Distribution Operations

May 28, 2025