Understanding Amazon's (AMZN) Stock Momentum: Risks And Rewards

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding Amazon's (AMZN) Stock Momentum: Risks and Rewards

Amazon (AMZN) remains a titan of the e-commerce and cloud computing worlds, but its stock performance has seen significant fluctuations recently. Understanding the current momentum of AMZN stock requires a careful examination of both its considerable strengths and inherent risks. For investors, this means navigating a complex landscape of opportunity and potential pitfalls.

Amazon's Strengths: A Foundation for Growth

Amazon's dominance in online retail is undeniable. Its Prime membership program, coupled with its vast selection and efficient logistics network, provides a significant competitive advantage. This translates into consistent revenue streams and a loyal customer base. Beyond e-commerce, Amazon Web Services (AWS) is a powerhouse in cloud computing, generating substantial profits and driving significant growth. AWS's market leadership and expanding services offer a compelling long-term investment narrative.

- E-commerce Dominance: Amazon controls a massive share of the online retail market, offering a resilient base for revenue generation.

- AWS Leadership: AWS remains the undisputed leader in cloud computing, providing consistent profitability and future growth potential.

- Prime Membership: The Prime membership program fosters customer loyalty and drives recurring revenue.

- Innovation & Expansion: Amazon continuously invests in new technologies and expands into new markets, showcasing its adaptability and future potential.

Navigating the Risks: Potential Headwinds for AMZN

Despite its impressive strengths, several factors contribute to the risks associated with investing in AMZN stock. These include increased competition, economic uncertainty, and regulatory scrutiny.

- Increased Competition: The e-commerce landscape is increasingly competitive, with established players and disruptive startups vying for market share. This pressure could impact Amazon's growth trajectory.

- Economic Uncertainty: Global economic downturns can significantly impact consumer spending, potentially reducing demand for Amazon's products and services. Inflation and rising interest rates also impact profitability.

- Regulatory Scrutiny: Amazon faces ongoing scrutiny from regulators concerning antitrust issues and labor practices. Negative regulatory outcomes could lead to significant financial penalties and operational challenges.

- Dependence on AWS: While a strength, over-reliance on AWS for profitability exposes Amazon to risks associated with the cloud computing market's competitive dynamics.

Analyzing the Stock Momentum: A Balanced Perspective

AMZN's stock price reflects the interplay between these strengths and risks. Recent market volatility highlights the importance of a long-term investment perspective. While Amazon's future remains bright, investors should carefully consider the potential headwinds before making any investment decisions.

What to Watch For:

- Quarterly Earnings Reports: Closely monitor Amazon's financial performance, paying attention to revenue growth in both e-commerce and AWS.

- Competitive Landscape: Track the actions of Amazon's competitors and assess their potential impact on market share.

- Regulatory Developments: Stay informed about ongoing regulatory investigations and potential legislative changes that could affect Amazon.

- Economic Indicators: Monitor macroeconomic indicators to assess the potential impact on consumer spending and overall economic conditions.

Conclusion: A Long-Term Play with Calculated Risks

Investing in Amazon (AMZN) involves a careful assessment of both its substantial potential and the inherent risks. While its dominance in e-commerce and cloud computing provides a strong foundation for future growth, investors should remain aware of competitive pressures, economic uncertainty, and regulatory scrutiny. A long-term perspective, coupled with thorough due diligence, is crucial for navigating the complexities of AMZN stock and maximizing potential returns while mitigating risks. Consult with a financial advisor before making any investment decisions. Remember, this is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Amazon's (AMZN) Stock Momentum: Risks And Rewards. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Food Inflation Hits Year High Peak The Impact Of Rising Beef Prices

May 28, 2025

Food Inflation Hits Year High Peak The Impact Of Rising Beef Prices

May 28, 2025 -

Us Backed Aid Group Begins Distribution In Gaza

May 28, 2025

Us Backed Aid Group Begins Distribution In Gaza

May 28, 2025 -

Trump Vs Harvard The Battle Over Elite Higher Education

May 28, 2025

Trump Vs Harvard The Battle Over Elite Higher Education

May 28, 2025 -

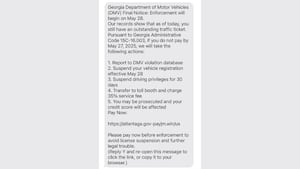

Beware Fake Text Messages From Ga Department Of Driver Services

May 28, 2025

Beware Fake Text Messages From Ga Department Of Driver Services

May 28, 2025 -

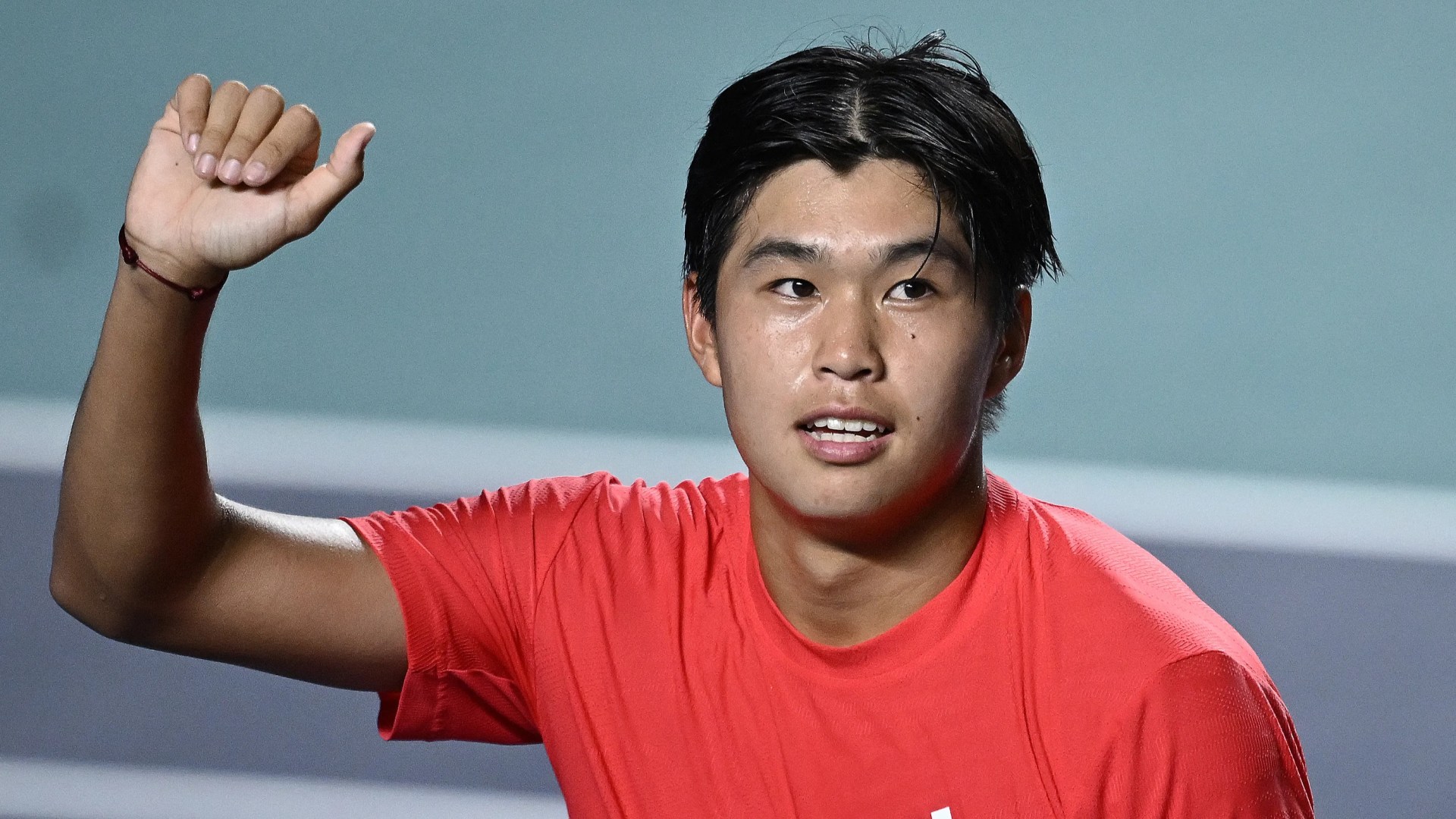

Us Tennis Prodigy Named After Moms Profession Challenges Top 3

May 28, 2025

Us Tennis Prodigy Named After Moms Profession Challenges Top 3

May 28, 2025

Latest Posts

-

Sinner Pegula Djokovic Lead Day 5 Action At French Open 2025 Live Updates

May 29, 2025

Sinner Pegula Djokovic Lead Day 5 Action At French Open 2025 Live Updates

May 29, 2025 -

Roland Garros De Jongs Incredible Fightback Wins Against Passaro

May 29, 2025

Roland Garros De Jongs Incredible Fightback Wins Against Passaro

May 29, 2025 -

Cassie Ventura Receives Apology From Diddys Party Escort

May 29, 2025

Cassie Ventura Receives Apology From Diddys Party Escort

May 29, 2025 -

Trumps Controversial Pardon Reality Show Duo Freed From Bank Fraud And Tax Convictions

May 29, 2025

Trumps Controversial Pardon Reality Show Duo Freed From Bank Fraud And Tax Convictions

May 29, 2025 -

Grief And Outrage Palestinian Ambassador On The Death Of 1300 Children

May 29, 2025

Grief And Outrage Palestinian Ambassador On The Death Of 1300 Children

May 29, 2025