Understanding Coca-Cola's (KO) Appeal To Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding Coca-Cola's (KO) Enduring Appeal to Investors

Coca-Cola (KO). The name conjures images of iconic branding, refreshing beverages, and a seemingly unshakeable market presence. But what makes this beverage giant so attractive to investors, year after year? Beyond the sugary fizz, lies a complex tapestry of financial stability, strategic diversification, and global reach that continues to draw significant investor interest. This article delves into the key factors driving Coca-Cola's enduring appeal.

H2: A Dividend King's Consistent Returns

One of the most compelling reasons for investors to embrace Coca-Cola is its unwavering commitment to dividend payouts. For decades, KO has consistently increased its dividend, earning it the prestigious title of a Dividend King – a company that has increased its dividend for 50 consecutive years or more. This consistent track record provides investors with a reliable stream of income, particularly attractive in uncertain economic times. The high dividend yield further enhances its appeal to income-seeking investors. [Link to a reputable financial news source discussing dividend stocks]

H2: Global Brand Recognition and Market Dominance

Coca-Cola's brand recognition is unparalleled. Its iconic logo and refreshing taste are instantly recognizable across the globe. This global reach translates into immense market power and pricing flexibility. Even amidst growing health consciousness and competition from healthier alternatives, Coca-Cola's vast portfolio, encompassing sparkling drinks, juices, teas, and waters, ensures broad appeal to diverse consumer segments. This diversified product portfolio mitigates risks associated with relying on a single product category.

H3: Strategic Acquisitions and Brand Extensions

Coca-Cola's strategic acquisitions and brand extensions have played a crucial role in its continued success. By acquiring smaller beverage companies and expanding its product line, Coca-Cola has consistently adapted to changing consumer preferences and market trends. This proactive approach ensures its relevance in a dynamic market. [Link to an article discussing a recent Coca-Cola acquisition]

H2: Navigating Changing Consumer Preferences: A Focus on Health and Sustainability

While sugary drinks face increasing scrutiny, Coca-Cola isn't standing still. The company is actively diversifying its portfolio to include healthier options, responding to growing consumer demand for low-sugar and healthier alternatives. Furthermore, Coca-Cola is increasingly emphasizing sustainability initiatives, aiming to reduce its environmental impact and enhance its brand image amongst environmentally conscious consumers. This focus on ESG (Environmental, Social, and Governance) factors is attracting socially responsible investors.

H2: Financial Strength and Stability

Coca-Cola boasts a strong balance sheet and consistent profitability. This financial stability provides investors with a degree of confidence, particularly during periods of market volatility. The company's efficient supply chain and global distribution network further contribute to its strong financial performance.

H2: Potential Risks and Challenges

Despite its strengths, Coca-Cola faces challenges. Fluctuating currency exchange rates, increased competition, and evolving consumer preferences represent potential headwinds. Furthermore, regulatory pressures related to sugar consumption remain a concern. Investors should carefully consider these risks before investing.

H2: Conclusion: A Strong Contender in a Competitive Market

Coca-Cola's long history of dividend growth, global brand recognition, strategic diversification, and commitment to sustainability make it a compelling investment for many. While challenges remain, the company's proven ability to adapt and innovate suggests its continued appeal to investors in the years to come. However, potential investors should conduct thorough due diligence and consider their individual risk tolerance before making any investment decisions. [Link to Coca-Cola's investor relations page]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Coca-Cola's (KO) Appeal To Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

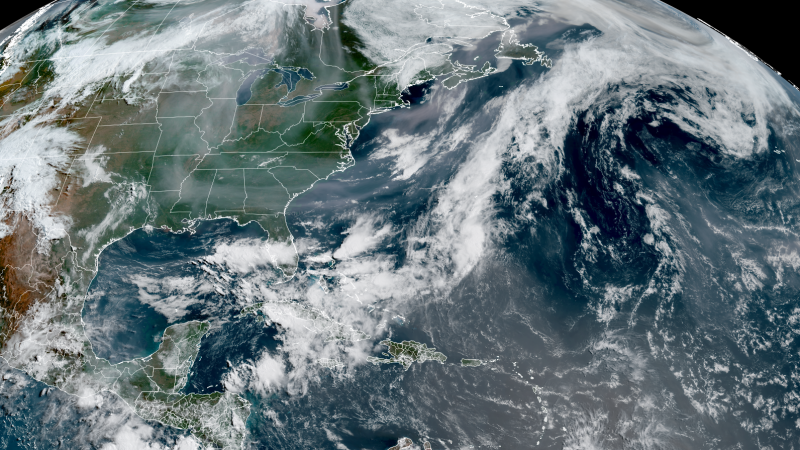

Air Quality Alert Canadian Smoke And African Dust To Mix Over The Southern United States

Jun 05, 2025

Air Quality Alert Canadian Smoke And African Dust To Mix Over The Southern United States

Jun 05, 2025 -

Post Earnings Broadcom Stock Price Predictions From Market Traders

Jun 05, 2025

Post Earnings Broadcom Stock Price Predictions From Market Traders

Jun 05, 2025 -

Paige De Sorbos Summer House Departure Confirmed Whats Next For The Reality Star

Jun 05, 2025

Paige De Sorbos Summer House Departure Confirmed Whats Next For The Reality Star

Jun 05, 2025 -

Blow For Thames Water As Key Partner Withdraws

Jun 05, 2025

Blow For Thames Water As Key Partner Withdraws

Jun 05, 2025 -

Amanda Seyfrieds Premiere Look A Black Rabanne Fringe Dress

Jun 05, 2025

Amanda Seyfrieds Premiere Look A Black Rabanne Fringe Dress

Jun 05, 2025

Latest Posts

-

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025

Newly Found Documents Shed Light On Trump Putin Meeting In Alaska

Aug 17, 2025 -

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025

Actor Tristan Rogers Iconic General Hospital Star Passes Away At 79

Aug 17, 2025 -

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025

Premier League Racism Antoine Semenyo Details Abuse During Liverpool Game

Aug 17, 2025 -

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025

The Untold Story Of A Wwii Veteran A Vj Day Memory That Moved Queen Camilla

Aug 17, 2025 -

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025

Battlefield 6 Map Size Controversy Players React To Latest Mini Map

Aug 17, 2025