Understanding Coca-Cola's (KO) Financial Health: A Guide For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding Coca-Cola's (KO) Financial Health: A Guide for Investors

Coca-Cola (KO) is a name synonymous with refreshment, but for investors, understanding its financial health goes beyond the iconic red and white logo. This in-depth guide explores key aspects of Coca-Cola's financial performance, providing insights for both seasoned investors and those just starting their journey.

Coca-Cola's (KO) Strong Foundation: A Deep Dive into Financials

Coca-Cola's financial strength rests on several pillars. Its diverse portfolio of beverages, spanning sparkling soft drinks, waters, juices, and teas, provides resilience against market fluctuations. This diversification, coupled with a global presence, allows the company to tap into various consumer markets and mitigate risks associated with regional economic downturns. Analyzing Coca-Cola’s financial health requires looking beyond headline numbers and delving into specific metrics:

1. Revenue and Profitability:

-

Consistent Revenue Growth: While fluctuating yearly, Coca-Cola generally demonstrates consistent revenue growth driven by both volume sales and price increases. Analyzing quarterly earnings reports is crucial to track this trend. Look for consistent increases in net revenue and operating income. [Link to Coca-Cola's investor relations page]

-

Profit Margins: Monitoring Coca-Cola's gross profit margin and operating profit margin provides insights into its pricing strategies and efficiency in managing costs. Healthy margins indicate pricing power and efficient operations. Investors should pay close attention to changes in these margins and understand the underlying reasons.

-

Dividend History: Coca-Cola boasts a long history of dividend payouts, making it an attractive option for income-seeking investors. However, always evaluate the sustainability of the dividend payout ratio relative to earnings. A high payout ratio might indicate reduced future dividend growth potential.

2. Debt and Liquidity:

-

Debt Levels: Coca-Cola maintains a debt level that needs to be carefully evaluated within the context of its cash flow generation capabilities. A high debt-to-equity ratio could signal financial risk, while a healthy level indicates responsible financial management.

-

Cash Flow: Strong operating cash flow is vital for Coca-Cola's financial health. This cash flow fuels reinvestment in the business, debt repayments, and dividend payments. Investors should analyze the trend in free cash flow (FCF) to assess the company's ability to generate cash after accounting for capital expenditures.

3. Growth Strategies and Future Outlook:

-

Innovation and Product Diversification: Coca-Cola's continued investment in research and development, along with its efforts to expand its product portfolio into healthier options and new markets, are key drivers of future growth. Monitoring the success of these initiatives is critical for assessing long-term prospects.

-

Brand Strength: Coca-Cola's powerful global brands provide a strong competitive advantage. However, understanding consumer preferences and adapting to changing tastes is vital for maintaining brand relevance.

-

Sustainability Initiatives: Increasingly, investors are considering Environmental, Social, and Governance (ESG) factors. Coca-Cola's commitment to sustainability initiatives influences its brand perception and attracts investors prioritizing socially responsible investing.

4. Key Financial Ratios for Coca-Cola (KO) Analysis:

Investors should utilize key financial ratios to analyze Coca-Cola's performance, including:

- Price-to-Earnings Ratio (P/E): Compares the company's stock price to its earnings per share.

- Return on Equity (ROE): Measures the profitability of a company in relation to its shareholders' equity.

- Debt-to-Equity Ratio: Indicates the proportion of a company's financing that comes from debt versus equity.

Conclusion:

Coca-Cola's financial health is a complex picture. By carefully analyzing its revenue, profitability, debt levels, cash flow, and growth strategies – alongside relevant financial ratios – investors can gain a comprehensive understanding of its current standing and potential for future success. Remember to consult financial news sources and professional financial advisors for the most up-to-date information and personalized investment advice. Regular monitoring and a long-term perspective are crucial for navigating the complexities of investing in Coca-Cola (KO).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Coca-Cola's (KO) Financial Health: A Guide For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

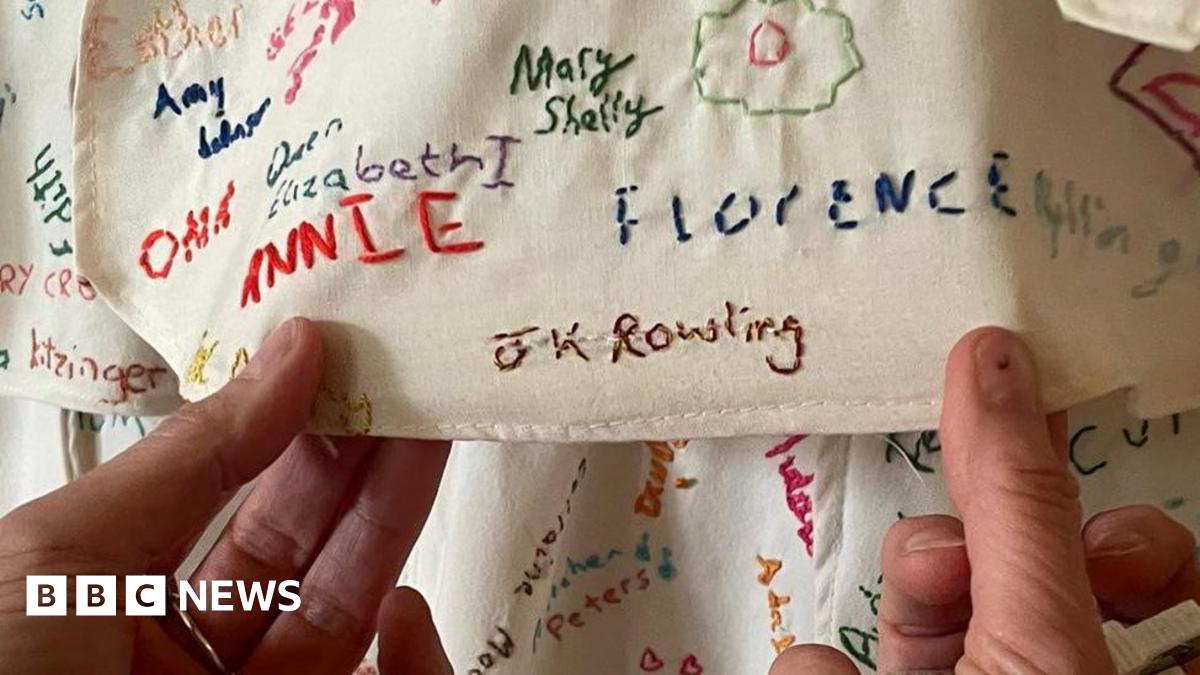

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025

National Trust Investigation Damaged Artwork Featuring J K Rowling In Derbyshire

Jun 06, 2025 -

Robinhood Hood Stock Jumps 6 46 On June 3rd Market Rally Or Short Squeeze

Jun 06, 2025

Robinhood Hood Stock Jumps 6 46 On June 3rd Market Rally Or Short Squeeze

Jun 06, 2025 -

2026 Patriot League Football Villanovas Addition Reshapes The Conference

Jun 06, 2025

2026 Patriot League Football Villanovas Addition Reshapes The Conference

Jun 06, 2025 -

Investigation Underway Police Examine Fatal Heart Surgeries At Nhs Trust

Jun 06, 2025

Investigation Underway Police Examine Fatal Heart Surgeries At Nhs Trust

Jun 06, 2025 -

Patriot League Welcomes Villanova As Football Associate Member Beginning 2026

Jun 06, 2025

Patriot League Welcomes Villanova As Football Associate Member Beginning 2026

Jun 06, 2025

Latest Posts

-

Watch Meghan Markles Moving Pregnancy Dance

Jun 07, 2025

Watch Meghan Markles Moving Pregnancy Dance

Jun 07, 2025 -

Two Households One Reality Managing A Complex Lifestyle

Jun 07, 2025

Two Households One Reality Managing A Complex Lifestyle

Jun 07, 2025 -

Investigation Launched Into President Bidens Autopen Use And Actions Following Trumps Claims

Jun 07, 2025

Investigation Launched Into President Bidens Autopen Use And Actions Following Trumps Claims

Jun 07, 2025 -

Matthew Hussey Former Partner Of Camila Cabello Expecting First Child

Jun 07, 2025

Matthew Hussey Former Partner Of Camila Cabello Expecting First Child

Jun 07, 2025 -

Uk Tax Authorities Ban Ex World Darts Champion Rob Cross From Company Directorships

Jun 07, 2025

Uk Tax Authorities Ban Ex World Darts Champion Rob Cross From Company Directorships

Jun 07, 2025