Understanding IBM's Recent Stock Market Underperformance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding IBM's Recent Stock Market Underperformance

IBM, a tech giant with a storied history, has recently faced headwinds in the stock market, underperforming compared to its tech peers. This underperformance isn't a sudden event, but rather the culmination of several factors impacting investor sentiment and future growth projections. Understanding these underlying issues is crucial for investors considering IBM as part of their portfolio.

The Shifting Sands of the Tech Landscape:

IBM's struggles are partly a reflection of the broader changes sweeping the tech industry. The rapid growth of cloud computing, spearheaded by companies like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, has presented a significant challenge. While IBM offers its own cloud services through IBM Cloud, it hasn't captured the same market share as its competitors. This intense competition in a rapidly evolving market puts pressure on IBM's revenue streams and profitability. The shift away from traditional on-premise infrastructure solutions further exacerbates this challenge.

IBM's Transformation Strategy: A Work in Progress:

IBM has been actively trying to reposition itself, moving away from its legacy hardware business and focusing on high-growth areas like artificial intelligence (AI), hybrid cloud, and consulting services. This transformation, however, is a long-term process, and investors are understandably cautious about the timeline and ultimate success. The transition requires significant investment and restructuring, impacting short-term earnings and potentially delaying the realization of long-term gains. This strategic shift, while necessary for long-term viability, is currently contributing to the company's underperformance in the short term.

Financial Performance and Investor Concerns:

Several key financial indicators have contributed to investor concern:

- Revenue Growth: IBM's revenue growth has been relatively stagnant compared to other tech giants, leading to concerns about its ability to compete effectively in the current market.

- Profit Margins: Maintaining healthy profit margins in a fiercely competitive landscape is a constant struggle. Pressure on pricing and increased investment in new technologies can impact profitability.

- Return on Investment (ROI): Investors are looking for a strong ROI. IBM's current performance hasn't met the expectations of some investors, leading to a decrease in stock valuation.

Looking Ahead: Potential for Growth and Recovery?

Despite the current challenges, IBM possesses several key strengths:

- Strong Brand Recognition: IBM remains a globally recognized brand with a strong reputation for reliability and innovation.

- Extensive Client Base: Its long-standing relationships with large enterprises provide a solid foundation for future growth.

- Investments in AI and Hybrid Cloud: IBM's strategic investments in these high-growth areas position it for potential future success.

However, the success of IBM's transformation hinges on its ability to execute its strategy effectively and compete aggressively in the cloud computing market. Investors will be closely watching key performance indicators (KPIs) such as revenue growth, market share in cloud services, and profitability to gauge the effectiveness of its strategic repositioning. The coming quarters will be critical in determining whether IBM can overcome these challenges and regain investor confidence.

Conclusion:

IBM's recent stock market underperformance is a complex issue stemming from industry-wide shifts and the company's ongoing transformation. While challenges remain, IBM’s strong brand recognition, extensive client base, and strategic investments offer potential for future growth. Investors need to carefully consider both the short-term challenges and the long-term potential before making any investment decisions. Further analysis of IBM's financial reports and industry trends is crucial for a comprehensive understanding of its future prospects. Staying informed about the latest news and developments surrounding IBM will be key for investors navigating this evolving situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding IBM's Recent Stock Market Underperformance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dismal Jobs Report Only 37 000 Private Sector Jobs Added In May Signaling Economic Slowdown

Jun 06, 2025

Dismal Jobs Report Only 37 000 Private Sector Jobs Added In May Signaling Economic Slowdown

Jun 06, 2025 -

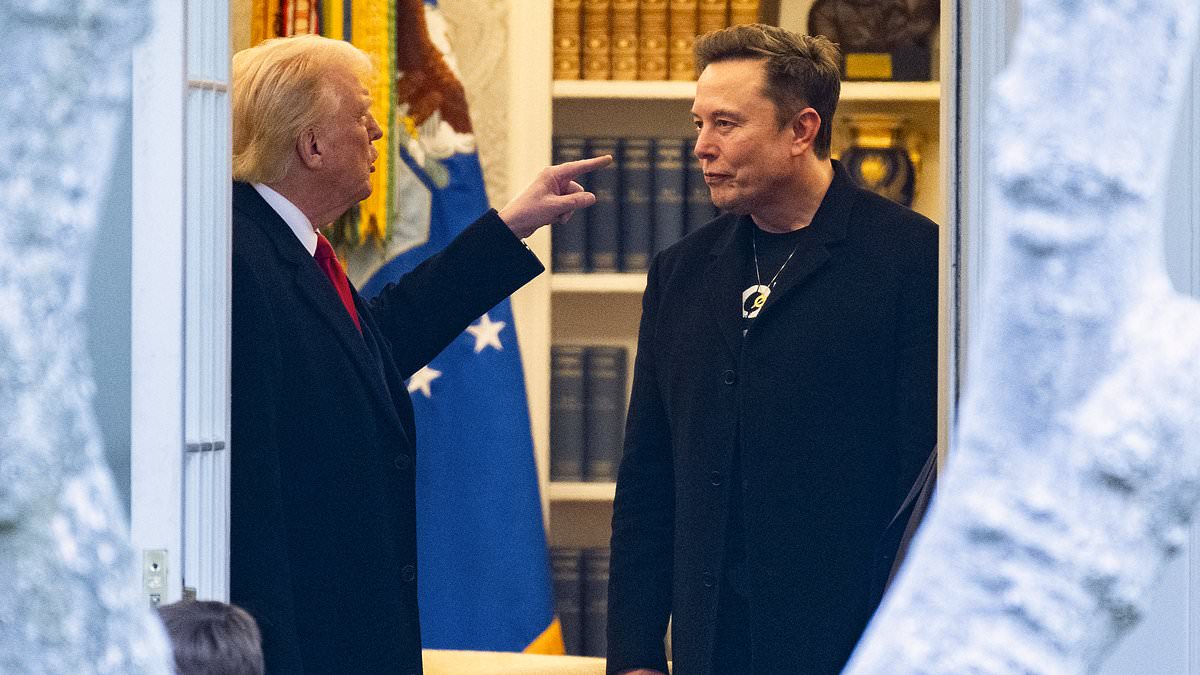

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025

Key Trump Advisor At Center Of Musk Trump Feud

Jun 06, 2025 -

Man Arrested In New York For California Fertility Clinic Blast Fbi Investigation

Jun 06, 2025

Man Arrested In New York For California Fertility Clinic Blast Fbi Investigation

Jun 06, 2025 -

Private Sector Hiring Plummets To 37 000 In May Concerns Rise Over Economic Slowdown

Jun 06, 2025

Private Sector Hiring Plummets To 37 000 In May Concerns Rise Over Economic Slowdown

Jun 06, 2025 -

Ryan Goslings Potential As White Black Panther Examining The Mcus Possibilities

Jun 06, 2025

Ryan Goslings Potential As White Black Panther Examining The Mcus Possibilities

Jun 06, 2025

Latest Posts

-

Apld Secures 5 Billion For Accelerated Hyperscale Data Center Growth

Jun 07, 2025

Apld Secures 5 Billion For Accelerated Hyperscale Data Center Growth

Jun 07, 2025 -

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Film

Jun 07, 2025

Steve Guttenberg Takes On Dark Role In Upcoming Lifetime Film

Jun 07, 2025 -

Playoff Failure Costs Peter De Boer His Job With The San Jose Sharks

Jun 07, 2025

Playoff Failure Costs Peter De Boer His Job With The San Jose Sharks

Jun 07, 2025 -

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetime Movie

Jun 07, 2025

From Comedy To Crime Steve Guttenbergs Shocking Transformation In Lifetime Movie

Jun 07, 2025 -

Bidens Autopen Use And Recent Actions Trump Orders Investigation Citing Cognitive Concerns

Jun 07, 2025

Bidens Autopen Use And Recent Actions Trump Orders Investigation Citing Cognitive Concerns

Jun 07, 2025