Understanding State Farm's Emergency Rate Increase In California

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding State Farm's Emergency Rate Increase in California: What Homeowners Need to Know

State Farm's recent announcement of an emergency rate increase for homeowners insurance in California has sent shockwaves through the state. This significant hike, impacting thousands of policyholders, raises crucial questions about the future of home insurance affordability and the challenges facing the insurance industry in California. This article breaks down the key details and helps you understand what this means for you.

Why the Emergency Rate Increase?

State Farm, one of California's largest homeowners insurance providers, cites escalating costs associated with wildfires, natural disasters, and rising litigation as the primary reasons for the increase. The company argues that current rates are insufficient to cover the increasing payouts related to these events. California's unique geographical vulnerabilities and the high cost of rebuilding in the state contribute significantly to this problem.

How Much Will Premiums Increase?

The percentage increase varies depending on several factors, including location, the type of property, and coverage levels. While State Farm hasn't released exact figures for every policy, reports suggest increases ranging from a few percentage points to over 20% in some high-risk areas. This makes it crucial for homeowners to carefully review their policy documents and contact State Farm directly for personalized information.

What Can Homeowners Do?

Facing such a significant increase can be daunting. Here are some steps you can take:

- Review your policy: Understand your current coverage and identify areas where you might be able to reduce costs without compromising essential protection.

- Shop around: Compare rates from other insurers. While finding comparable coverage might be challenging in California's current market, exploring options is still crucial. Use online comparison tools or contact independent insurance agents to find the best deal.

- Consider mitigation measures: Home improvements that reduce wildfire risk, such as installing fire-resistant roofing or landscaping, can sometimes lead to lower premiums. Check with your insurer about potential discounts for risk mitigation.

- Contact your insurance agent: They can provide personalized advice, help you understand your options, and advocate on your behalf.

The Broader Context: California's Insurance Crisis

State Farm's action highlights a broader crisis in California's homeowners insurance market. Several insurers have either pulled out of the state entirely or severely restricted new policies due to escalating losses. This limited availability leads to higher premiums for those who can still obtain coverage.

What's Next?

The situation is likely to remain fluid. Expect further scrutiny from state regulators and ongoing discussions about how to address the underlying issues driving up insurance costs. Homeowners need to stay informed and proactively manage their insurance needs in this challenging environment.

Keywords: State Farm, California, homeowners insurance, rate increase, emergency rate increase, wildfire, natural disasters, insurance crisis, insurance premiums, home insurance cost, California homeowners insurance, insurance rates, insurance affordability.

Call to Action: Contact your State Farm agent or an independent insurance broker today to review your policy and explore your options. Don't wait until it's too late to secure adequate coverage.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding State Farm's Emergency Rate Increase In California. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dead Reckoning Part One Mission Impossibles Latest Installment Impresses With Its Action Packed Scenes

May 17, 2025

Dead Reckoning Part One Mission Impossibles Latest Installment Impresses With Its Action Packed Scenes

May 17, 2025 -

Ohtanis Two Home Runs Rushings Impressive Mlb Debut Fuel Dodgers Victory Over As

May 17, 2025

Ohtanis Two Home Runs Rushings Impressive Mlb Debut Fuel Dodgers Victory Over As

May 17, 2025 -

Dodgers Starting Pitcher Added To Roster Triple A Call Up

May 17, 2025

Dodgers Starting Pitcher Added To Roster Triple A Call Up

May 17, 2025 -

Ben Roberts Smiths War Crimes Allegations Appeal Outcome And Analysis

May 17, 2025

Ben Roberts Smiths War Crimes Allegations Appeal Outcome And Analysis

May 17, 2025 -

Independent Film Friendship Soars Detroit Showing And Wider Release

May 17, 2025

Independent Film Friendship Soars Detroit Showing And Wider Release

May 17, 2025

Latest Posts

-

Cannes Diary Wes Anderson The Phoenician Scheme And The Case For Two Viewings

May 17, 2025

Cannes Diary Wes Anderson The Phoenician Scheme And The Case For Two Viewings

May 17, 2025 -

Jansen Gives Up Walk Off Blast Analyzing The Loss

May 17, 2025

Jansen Gives Up Walk Off Blast Analyzing The Loss

May 17, 2025 -

Willie Nelson And Steve Perrys Faithfully Cover A Musical Collaboration

May 17, 2025

Willie Nelson And Steve Perrys Faithfully Cover A Musical Collaboration

May 17, 2025 -

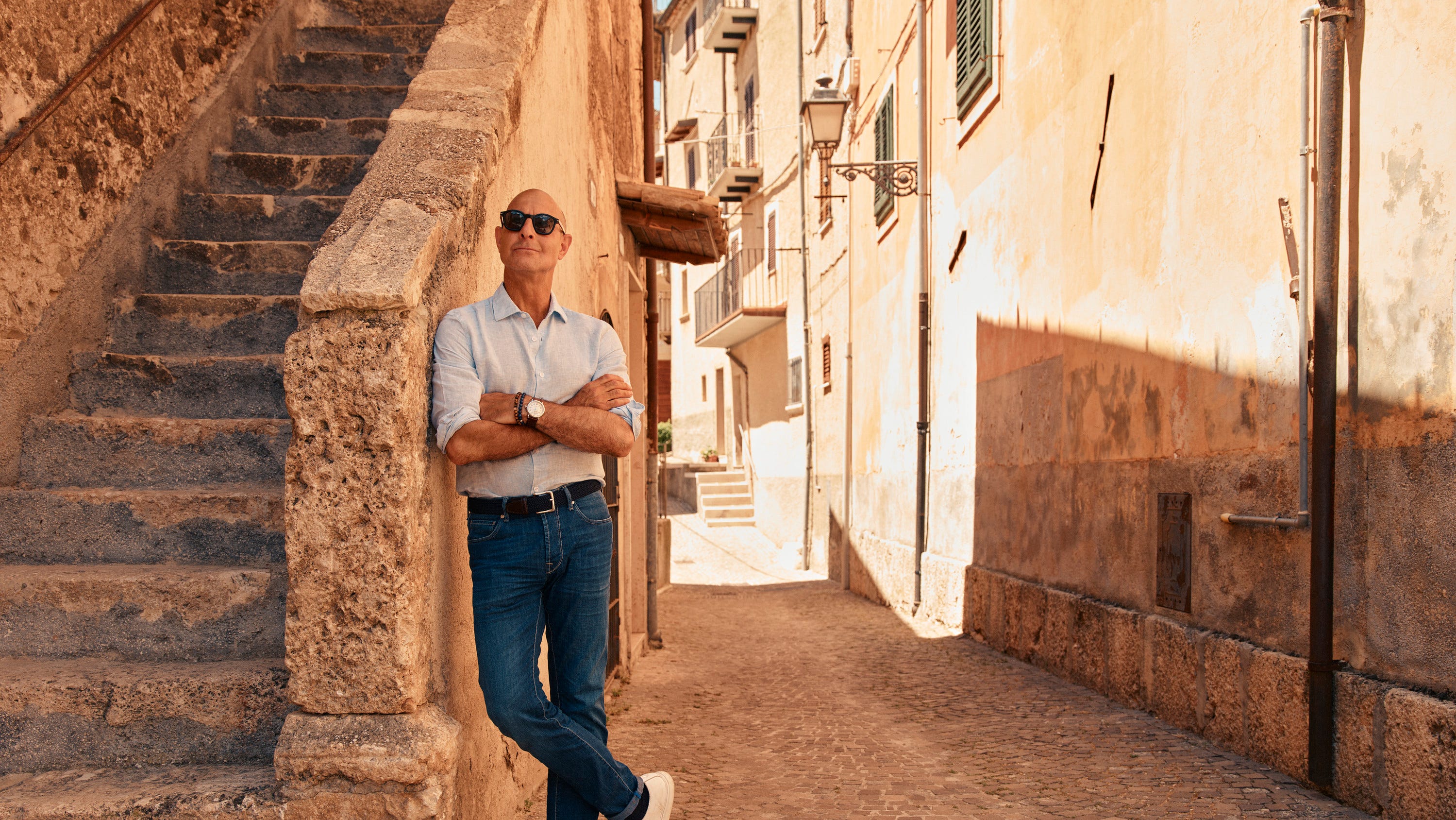

Nat Geo Explores Italy With Stanley Tucci A Delicious New Show

May 17, 2025

Nat Geo Explores Italy With Stanley Tucci A Delicious New Show

May 17, 2025 -

From Detroit To Top Ten Friendship Movie Success And New Specialty Film Releases

May 17, 2025

From Detroit To Top Ten Friendship Movie Success And New Specialty Film Releases

May 17, 2025