Understanding The 1000% Growth Of SBET Stock: Investment Insights And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Growth of SBET Stock: Investment Insights and Analysis

The meteoric rise of SBET stock, boasting a staggering 1000% increase in value, has captivated investors and sparked intense debate. This unprecedented growth begs the question: what fueled this phenomenal surge, and what does the future hold for SBET? Understanding the factors behind this success is crucial for investors considering adding SBET to their portfolio or those already holding the stock and wondering about their next move.

The Factors Behind SBET's Explosive Growth:

Several key factors contributed to SBET's remarkable performance. While past performance doesn't guarantee future results, analyzing these elements provides valuable insights for potential investors:

-

Innovative Product Launch: SBET's recent release of [mention specific product/service] disrupted the [relevant industry] market. This groundbreaking innovation attracted significant attention from consumers and industry experts alike, leading to increased demand and a subsequent surge in stock price. The product's unique features and strong market reception were pivotal in driving the stock's growth.

-

Strategic Partnerships: Strategic alliances with key players in the [relevant industry] further solidified SBET's market position. These collaborations opened new market avenues and provided access to resources and expertise, fueling further expansion and boosting investor confidence. For example, the partnership with [mention partner company, if applicable] significantly broadened SBET's reach and market share.

-

Strong Financial Performance: SBET's robust financial performance, characterized by [mention specific financial indicators, e.g., increasing revenue, strong earnings, etc.], reinforced investor confidence. Consistent positive financial results demonstrated the company's ability to translate innovation into tangible returns, further driving up the stock price. Investors often look for strong fundamentals as a measure of long-term stability and growth potential. Access to SBET's financial reports can be found on [link to SEC filings or company website].

-

Positive Market Sentiment: Overall positive market sentiment towards the [relevant industry] sector also played a crucial role. Growing investor optimism about the sector's future prospects contributed to increased investment in SBET and other related companies. This broader market trend amplified SBET's already impressive growth trajectory.

Investment Insights and Analysis:

While the 1000% growth is impressive, it's crucial to approach SBET with a balanced perspective. This level of growth is often unsustainable in the long term. Investors should consider the following:

-

Valuation: Assess SBET's current valuation relative to its peers and its future growth potential. Is the current price justified by its fundamentals and future prospects, or does it represent an overvalued asset? Consult reputable financial analysts and consider using valuation metrics like Price-to-Earnings (P/E) ratio to make an informed decision.

-

Risk Assessment: Like any investment, SBET carries inherent risks. Market volatility, competition, and changes in regulatory environments can significantly impact the stock's performance. Conduct thorough due diligence and understand the potential downsides before investing.

-

Diversification: Diversifying your investment portfolio is crucial to mitigate risk. Don't put all your eggs in one basket. Spread your investments across different asset classes and sectors to minimize potential losses.

-

Long-Term Perspective: Investing in the stock market is a long-term game. Avoid impulsive decisions based solely on short-term price fluctuations. Develop a long-term investment strategy based on your financial goals and risk tolerance.

Conclusion:

SBET's 1000% growth is a testament to its innovative product, strategic partnerships, and strong financial performance. However, investors must approach this stock with caution and conduct thorough research before making any investment decisions. Understanding the factors driving its growth, assessing its valuation and risks, and maintaining a long-term perspective are crucial for making informed investment choices. Remember to consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Growth Of SBET Stock: Investment Insights And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

French Open Day 7 Djokovic Misolic Showdown Our Predictions And Key Talking Points

May 31, 2025

French Open Day 7 Djokovic Misolic Showdown Our Predictions And Key Talking Points

May 31, 2025 -

Russias War Chest How Western Actions Contribute To Ukraine Conflict Financing

May 31, 2025

Russias War Chest How Western Actions Contribute To Ukraine Conflict Financing

May 31, 2025 -

Historic Data Center Growth Tests Georgia Powers Power Grid Predictions

May 31, 2025

Historic Data Center Growth Tests Georgia Powers Power Grid Predictions

May 31, 2025 -

Officials Acknowledge Delays In Newark Airport Air Traffic Control System Enhancement

May 31, 2025

Officials Acknowledge Delays In Newark Airport Air Traffic Control System Enhancement

May 31, 2025 -

Major Glacier Collapse Engulfs Swiss Village Of Blatten

May 31, 2025

Major Glacier Collapse Engulfs Swiss Village Of Blatten

May 31, 2025

Latest Posts

-

Construction Fraud Exposed The Story Of A Rogue Builder And His Victims

Aug 23, 2025

Construction Fraud Exposed The Story Of A Rogue Builder And His Victims

Aug 23, 2025 -

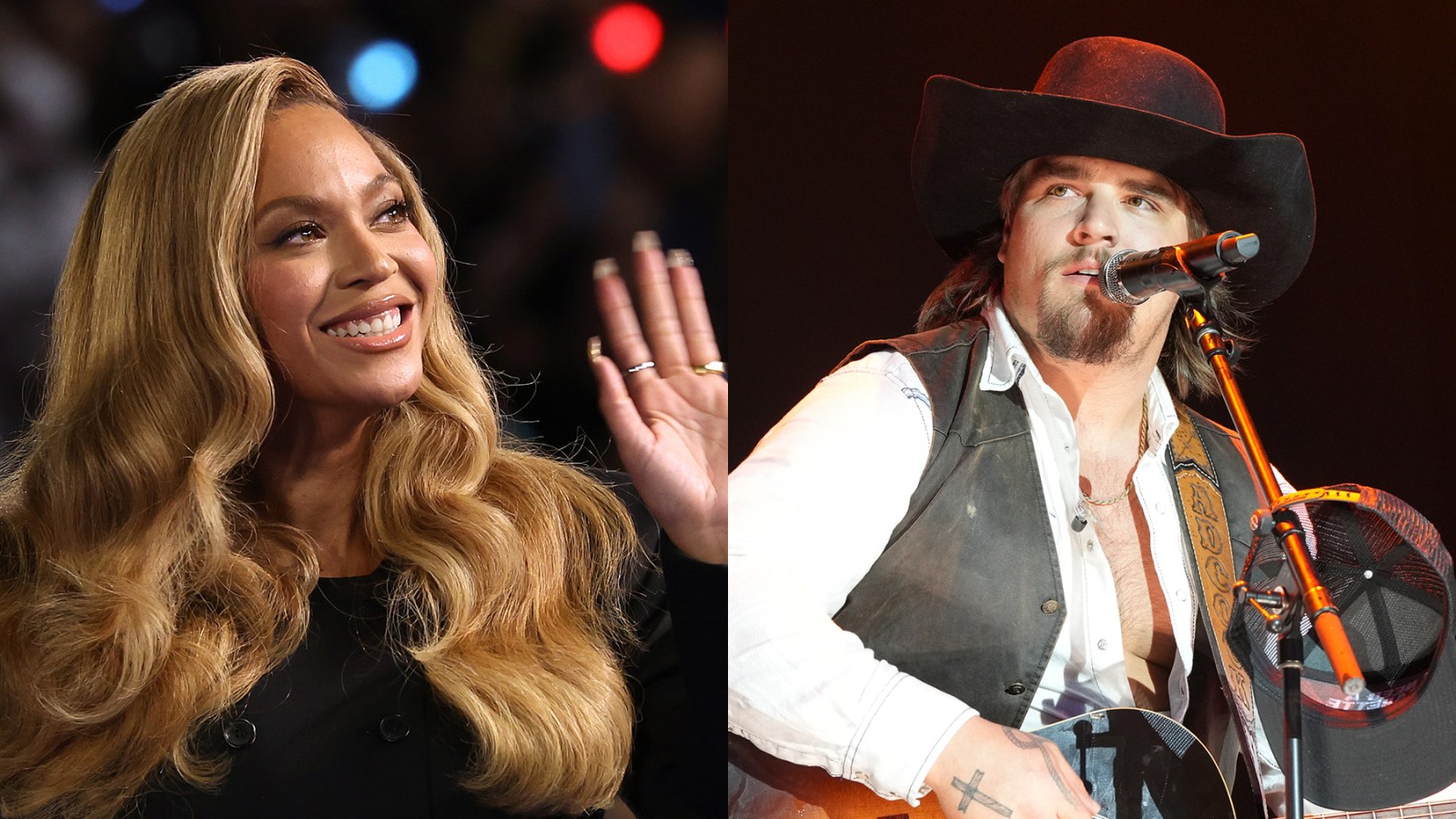

Is Beyonce Ignoring Country Fans Gavin Adcocks Perspective

Aug 23, 2025

Is Beyonce Ignoring Country Fans Gavin Adcocks Perspective

Aug 23, 2025 -

Cnn Business Reports Labubus Fuels Massive Profit Growth

Aug 23, 2025

Cnn Business Reports Labubus Fuels Massive Profit Growth

Aug 23, 2025 -

New England Patriots Polk Scheduled For Shoulder Operation

Aug 23, 2025

New England Patriots Polk Scheduled For Shoulder Operation

Aug 23, 2025 -

Dei Controversy At Target Pastors Statement Following Ceos Resignation

Aug 23, 2025

Dei Controversy At Target Pastors Statement Following Ceos Resignation

Aug 23, 2025