Understanding The 1000% Jump In SBET Stock Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Jump in SBET Stock Price: A Deep Dive into the Surge

The recent astronomical rise in SBET stock price, a staggering 1000% increase, has sent shockwaves through the financial markets. This unprecedented surge has left many investors scrambling to understand the factors driving this dramatic growth and whether this trend is sustainable. This article will delve into the key contributing factors behind this phenomenal jump, examining both the positive catalysts and potential risks associated with this volatile situation.

The Meteoric Rise: A Closer Look at the Numbers

The sheer scale of the SBET stock price increase is undeniably captivating. From a relatively modest price point, the stock has skyrocketed, creating significant wealth for early investors and sparking intense interest from both seasoned professionals and newcomers to the market. This rapid appreciation presents a compelling case study in market dynamics and the power of investor sentiment. Understanding the magnitude of this jump is crucial for assessing its implications.

Key Factors Fueling the SBET Stock Price Surge:

Several factors have converged to propel SBET's stock price to such dizzying heights. While pinpointing the exact cause is challenging, these key elements are widely considered to be significant contributors:

-

Positive Earnings Reports: Recent financial reports from SBET have showcased significantly improved earnings and revenue, exceeding analysts' expectations. This positive financial performance has boosted investor confidence, leading to increased buying pressure. [Link to SBET's official financial reports, if available].

-

Strategic Partnerships & Acquisitions: SBET has been actively pursuing strategic partnerships and acquisitions, expanding its market reach and diversifying its revenue streams. These moves have been perceived favorably by investors, signaling a promising future for the company. [Link to news articles about recent partnerships/acquisitions].

-

Innovative Product Launches: The introduction of a groundbreaking new product or service has often been a catalyst for significant stock price increases. Investigating SBET's recent product launches is essential to understanding this surge. [Link to SBET's product announcements, if available].

-

Market Speculation & Hype: It's undeniable that market speculation and hype play a role in such dramatic price swings. Social media discussions and online forums can amplify positive news, creating a self-fulfilling prophecy that drives further price increases. However, this factor also introduces significant risk.

-

Short Squeeze: A potential short squeeze, where investors who bet against the stock are forced to buy shares to cover their positions, could have contributed to the rapid price appreciation. This scenario often leads to even more dramatic price movements.

Potential Risks and Future Outlook:

While the current situation appears positive, it's crucial to acknowledge the inherent risks associated with such a volatile stock. The 1000% increase might not be sustainable, and a significant correction could occur. Investors should exercise caution and conduct thorough due diligence before making any investment decisions.

-

Overvaluation Concerns: The current stock price may be significantly overvalued compared to the company's fundamental value. A decline in investor sentiment could trigger a sharp price drop.

-

Market Volatility: External market factors could impact SBET's stock price negatively. Global economic uncertainty, interest rate changes, and geopolitical events can significantly influence investor behavior.

-

Regulatory Scrutiny: Increased regulatory scrutiny of SBET's operations could lead to negative consequences for the stock price.

Conclusion:

The 1000% jump in SBET's stock price is a remarkable event, driven by a confluence of positive factors. However, the inherent risks associated with this rapid growth cannot be ignored. Investors should approach this situation with caution, conducting thorough research and carefully assessing the potential risks before making any investment decisions. Understanding the underlying factors contributing to this surge is key to navigating this volatile market situation. Stay informed and consult with a financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Jump In SBET Stock Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Tariffs Deemed Illegal Us Trade Court Decision On Presidential Power

May 30, 2025

Trumps Tariffs Deemed Illegal Us Trade Court Decision On Presidential Power

May 30, 2025 -

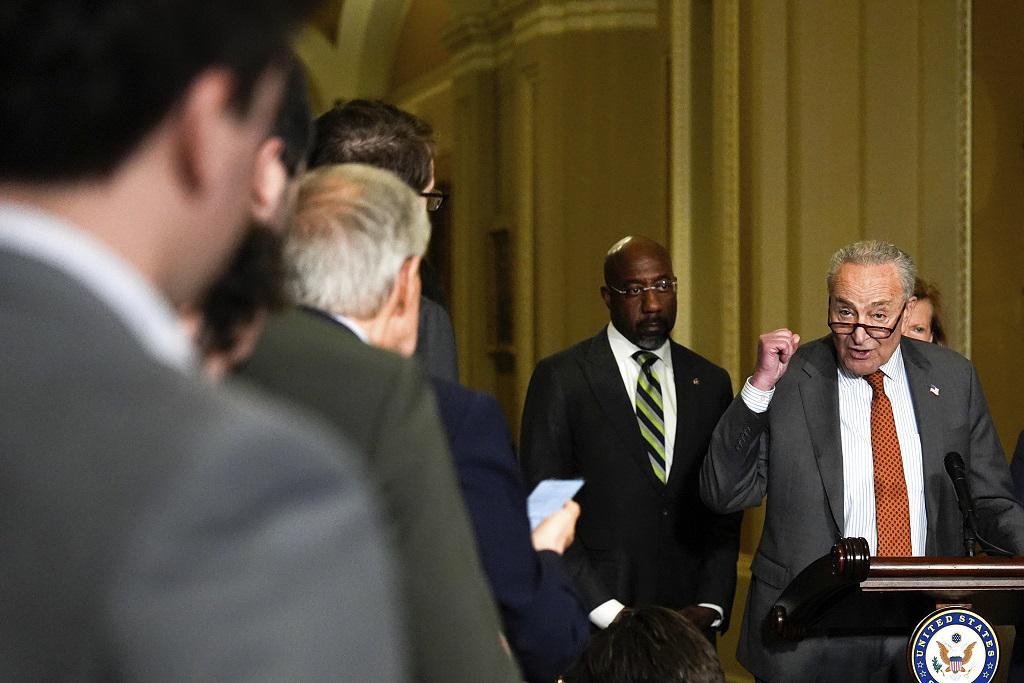

Senate Democrats Armed With New Tool To Block Controversial Legislation

May 30, 2025

Senate Democrats Armed With New Tool To Block Controversial Legislation

May 30, 2025 -

From Laughter To Controversy Unpacking The Reasons For The Ellen De Generes Show S Conclusion

May 30, 2025

From Laughter To Controversy Unpacking The Reasons For The Ellen De Generes Show S Conclusion

May 30, 2025 -

Russias Summer Offensive Looms Ukraines Urgent Drone Defense Preparations

May 30, 2025

Russias Summer Offensive Looms Ukraines Urgent Drone Defense Preparations

May 30, 2025 -

Neglect And Decay Homes Abandoned Along Northumberlands Scrapped A1 Route

May 30, 2025

Neglect And Decay Homes Abandoned Along Northumberlands Scrapped A1 Route

May 30, 2025

Latest Posts

-

Uche Ojeh Husband Of Sheinelle Jones Dies Unexpectedly

Jun 01, 2025

Uche Ojeh Husband Of Sheinelle Jones Dies Unexpectedly

Jun 01, 2025 -

Trumps Attack On California Funding Who Is The Transgender Student

Jun 01, 2025

Trumps Attack On California Funding Who Is The Transgender Student

Jun 01, 2025 -

Husband Of Nbcs Sheinelle Jones Passes Away At 45 Details Emerge

Jun 01, 2025

Husband Of Nbcs Sheinelle Jones Passes Away At 45 Details Emerge

Jun 01, 2025 -

Trumps Pardon Power A Closer Look At The Michael Grimm Case And Others

Jun 01, 2025

Trumps Pardon Power A Closer Look At The Michael Grimm Case And Others

Jun 01, 2025 -

Western Indirect Funding Of Russias War In Ukraine Unintentional Aid

Jun 01, 2025

Western Indirect Funding Of Russias War In Ukraine Unintentional Aid

Jun 01, 2025