Understanding The 1000% Jump In SBET Stock Price: Investment Insights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Jump in SBET Stock Price: Investment Insights

The recent astronomical surge in SBET stock price, a staggering 1000% increase, has left investors both exhilarated and bewildered. This dramatic rise demands a closer look, analyzing the contributing factors and exploring the implications for future investment strategies. Understanding this unprecedented growth requires examining both the company's internal developments and broader market forces.

What Drove SBET's Meteoric Rise?

Several interconnected factors fueled SBET's remarkable performance. It's crucial to avoid simplistic explanations and delve into the nuanced reality:

1. Breakthrough Technological Advancements: SBET's recent announcement regarding a significant breakthrough in [mention specific technology – e.g., AI-powered software, renewable energy solution] has been a major catalyst. This innovative technology positions the company as a potential leader in the rapidly expanding [mention relevant industry – e.g., AI software market, green energy sector], attracting significant investor interest. Details regarding the technology's potential applications and market impact can be found in SBET's recent press release [link to press release if available].

2. Strategic Acquisitions and Partnerships: The company's strategic acquisition of [mention acquired company, if applicable] and partnerships with key players like [mention key partners, if applicable] have broadened its market reach and strengthened its competitive advantage. These strategic moves significantly enhance SBET's long-term growth prospects.

3. Positive Market Sentiment and Investor Confidence: The broader market's positive sentiment towards [mention relevant sector – e.g., technology stocks, renewable energy investments] has undoubtedly contributed to SBET's surge. Increased investor confidence, driven by factors such as [mention relevant market trends – e.g., decreasing interest rates, government incentives], has created a favorable environment for high-growth companies.

4. Strong Financial Performance: SBET's robust financial performance in recent quarters, reflected in [mention specific financial indicators – e.g., increased revenue, improved profit margins], has solidified investor confidence and fueled the stock price increase. Analyzing their quarterly reports [link to financial reports if available] offers a clearer picture of this positive trajectory.

5. Short Squeeze Potential: While not the sole driver, the possibility of a short squeeze cannot be entirely discounted. A significant short interest prior to the recent surge could have contributed to the amplified price increase as short sellers covered their positions. Understanding short selling dynamics is crucial for comprehending the volatility within the stock market. [Link to an article explaining short squeezes].

Is SBET Overvalued? Investment Considerations:

The 1000% jump raises the question of whether SBET is currently overvalued. While the company's prospects appear bright, such rapid growth often raises concerns about a potential correction. Investors should carefully consider the following:

- Valuation Metrics: Analyze key valuation metrics such as the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to assess whether the current price reflects the company's intrinsic value.

- Future Growth Potential: Evaluate SBET's long-term growth potential based on its technological advancements, market position, and competitive landscape.

- Risk Assessment: Understand the inherent risks associated with investing in high-growth stocks, including market volatility and potential setbacks.

- Diversification: Remember the importance of diversification in any investment portfolio. Don't allocate excessive funds to a single stock, no matter how promising it seems.

Conclusion:

The 1000% surge in SBET's stock price is a remarkable event, driven by a combination of technological breakthroughs, strategic moves, and positive market sentiment. While the future remains uncertain, investors should conduct thorough due diligence, considering both the opportunities and risks before making any investment decisions. Remember to always seek professional financial advice tailored to your individual circumstances.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance does not guarantee future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Jump In SBET Stock Price: Investment Insights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jaume Munar Vs Arthur Fils Expert Prediction For Their 2025 French Open Encounter

May 30, 2025

Jaume Munar Vs Arthur Fils Expert Prediction For Their 2025 French Open Encounter

May 30, 2025 -

A1 Northumberland Derelict Homes Abandoned After Route Cancellation

May 30, 2025

A1 Northumberland Derelict Homes Abandoned After Route Cancellation

May 30, 2025 -

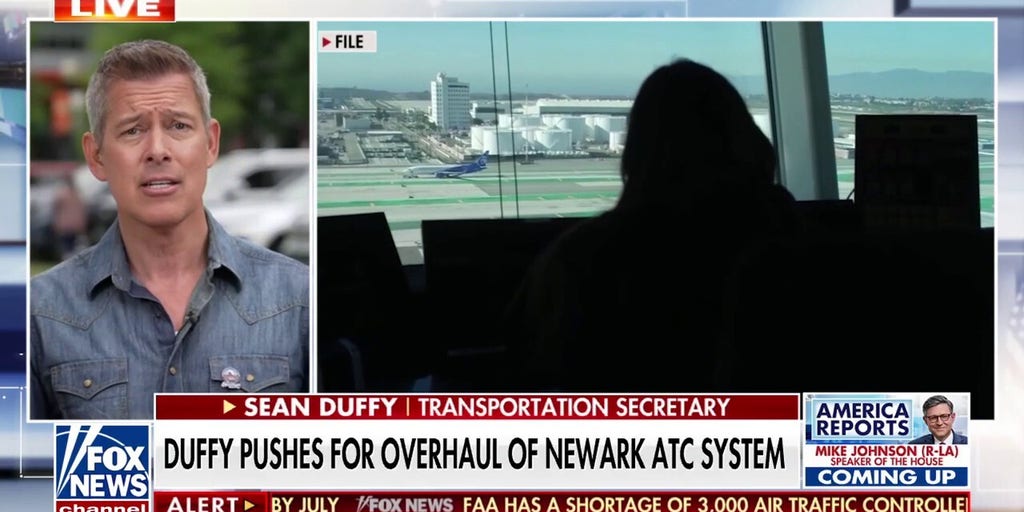

Air Traffic Control Overhaul Newark Delays Highlight Challenges Of Sec Duffys Plan

May 30, 2025

Air Traffic Control Overhaul Newark Delays Highlight Challenges Of Sec Duffys Plan

May 30, 2025 -

2025 French Open Day 5 Betting Jaume Munar Arthur Fils Jack Draper Gael Monfils Match Analysis

May 30, 2025

2025 French Open Day 5 Betting Jaume Munar Arthur Fils Jack Draper Gael Monfils Match Analysis

May 30, 2025 -

The Aep Rate Hike Explained A Look At The Past And The Future

May 30, 2025

The Aep Rate Hike Explained A Look At The Past And The Future

May 30, 2025

Latest Posts

-

Uche Ojeh Husband Of Sheinelle Jones Passes Away At 45

May 31, 2025

Uche Ojeh Husband Of Sheinelle Jones Passes Away At 45

May 31, 2025 -

Data Center Surge Challenges Georgia Powers Grid Projections Is The Forecast Accurate

May 31, 2025

Data Center Surge Challenges Georgia Powers Grid Projections Is The Forecast Accurate

May 31, 2025 -

Historic Data Center Growth Tests Georgia Powers Predictions A Capacity Crisis Looms

May 31, 2025

Historic Data Center Growth Tests Georgia Powers Predictions A Capacity Crisis Looms

May 31, 2025 -

Paul Doyles Court Appearance Liverpool Fc Parade Crash Case

May 31, 2025

Paul Doyles Court Appearance Liverpool Fc Parade Crash Case

May 31, 2025 -

Analysis Michael O Learys Potential E100 Million Ryanair Bonus

May 31, 2025

Analysis Michael O Learys Potential E100 Million Ryanair Bonus

May 31, 2025