Understanding The 1000% Rise: An Analysis Of SBET Stock Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the 1000% Rise: An Analysis of SBET Stock Performance

The stock market can be a volatile beast, and few examples highlight this better than the meteoric rise of SBET stock. This lesser-known company has seen its share price increase by a staggering 1000% in the past year, leaving investors both stunned and eager to understand the factors driving this phenomenal growth. But is this a sustainable trend, or is SBET poised for a significant correction? Let's delve into the details and attempt to answer these crucial questions.

The SBET Phenomenon: A Closer Look at the Numbers

The 1000% surge in SBET's stock price is undoubtedly impressive. While many factors contribute to such dramatic growth, understanding the underlying reasons is crucial for informed investment decisions. This isn't just a case of blind luck; a confluence of events and strategic decisions has propelled SBET to the forefront.

Key Drivers Behind SBET's Explosive Growth:

Several key factors contributed to SBET's astonishing performance:

-

Innovative Product Launch: SBET recently launched a groundbreaking new product that has disrupted its industry. This innovative technology has garnered significant media attention and attracted a surge of new customers, directly impacting revenue and investor confidence. [Link to relevant news article about product launch]

-

Strategic Partnerships: Strategic alliances with industry giants have provided SBET with access to wider markets and established distribution channels. These partnerships have significantly boosted brand recognition and market share. [Link to information on partnerships]

-

Strong Financial Performance: The company's financial reports reveal robust revenue growth and increasing profitability. These positive figures have fueled investor optimism and attracted significant institutional investment. [Link to SBET financial reports]

-

Positive Analyst Sentiment: Leading financial analysts have issued bullish forecasts for SBET, citing the company's strong growth trajectory and potential for further expansion. This positive sentiment has contributed to the upward momentum of the stock price. [Link to analyst reports]

-

Increased Investor Interest: The combination of positive news and strong financial performance has naturally drawn the attention of investors, leading to increased demand for SBET shares and driving up the price.

Risks and Considerations: Is the Growth Sustainable?

While the rise of SBET is undeniably impressive, it's crucial to acknowledge potential risks. The rapid growth could be unsustainable if the company fails to maintain its momentum. Investors should consider:

-

Market Volatility: The stock market is inherently volatile, and rapid growth can be followed by equally sharp corrections. SBET’s price may be susceptible to market downturns.

-

Competition: Increased competition could erode SBET’s market share and impact future growth.

-

Regulatory Scrutiny: Rapid growth can sometimes attract regulatory scrutiny, potentially impacting the company's operations.

-

Overvaluation: Some analysts argue that SBET's current valuation may be inflated, making it susceptible to a price correction.

Investing in SBET: A Calculated Risk?

Investing in SBET requires a careful assessment of both its potential and its risks. While the 1000% growth is undeniably alluring, it’s essential to conduct thorough due diligence before making any investment decisions. Consider consulting a financial advisor to assess your risk tolerance and determine if SBET aligns with your investment strategy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The 1000% Rise: An Analysis Of SBET Stock Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Swiss Village Of Blatten Buried Under Collapsed Glacier

May 30, 2025

Swiss Village Of Blatten Buried Under Collapsed Glacier

May 30, 2025 -

Us Open Under Fire Ticket Presale Issues Spark Outrage Among Tennis Fans

May 30, 2025

Us Open Under Fire Ticket Presale Issues Spark Outrage Among Tennis Fans

May 30, 2025 -

Us Open Faces Backlash Fans Expose Problems With 2025 Ticket Sales

May 30, 2025

Us Open Faces Backlash Fans Expose Problems With 2025 Ticket Sales

May 30, 2025 -

Dc Weather Alert Flood Watch Issued Following Wet Wednesday Downpour

May 30, 2025

Dc Weather Alert Flood Watch Issued Following Wet Wednesday Downpour

May 30, 2025 -

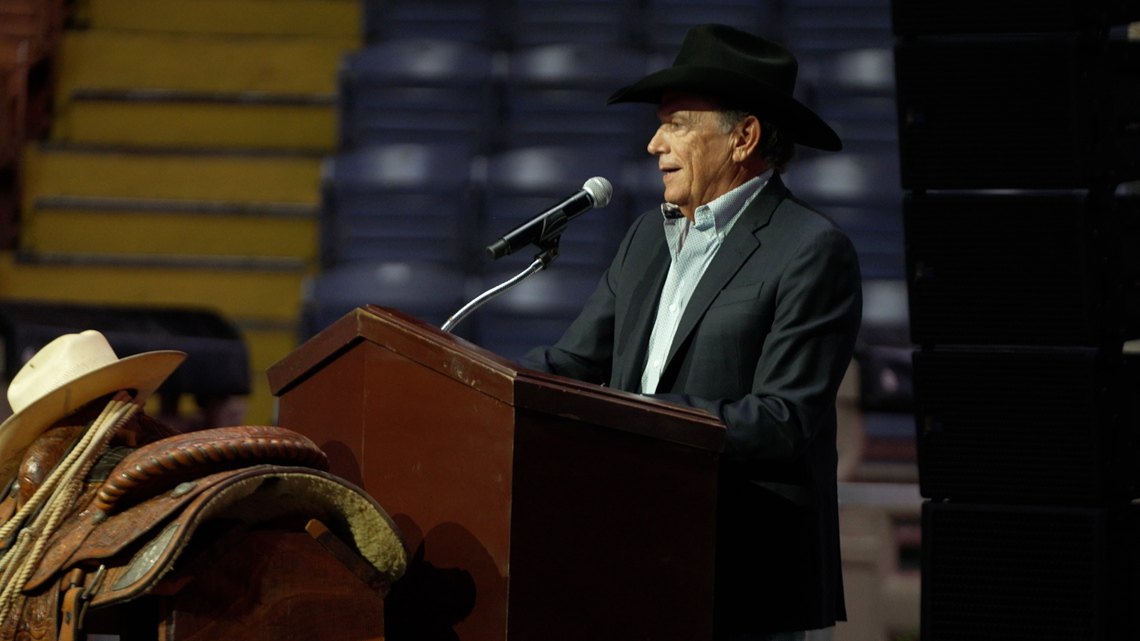

North Texas House Fire Claims Life Of George Straits Hero Singer Pays Respects

May 30, 2025

North Texas House Fire Claims Life Of George Straits Hero Singer Pays Respects

May 30, 2025

Latest Posts

-

Captain Pleads Not Guilty In North Sea Collision Case

Jun 01, 2025

Captain Pleads Not Guilty In North Sea Collision Case

Jun 01, 2025 -

Support For Sheinelle Jones Today Shows Presence At Uche Ojehs Funeral

Jun 01, 2025

Support For Sheinelle Jones Today Shows Presence At Uche Ojehs Funeral

Jun 01, 2025 -

Reviving Extinct Blooms A Fragrance Companys Innovative Approach To Scent Recreation

Jun 01, 2025

Reviving Extinct Blooms A Fragrance Companys Innovative Approach To Scent Recreation

Jun 01, 2025 -

Indirect Financing How The West Inadvertently Supports Russias War Against Ukraine

Jun 01, 2025

Indirect Financing How The West Inadvertently Supports Russias War Against Ukraine

Jun 01, 2025 -

How Western Businesses And Sanctions Ironically Aid Russias Ukraine Invasion

Jun 01, 2025

How Western Businesses And Sanctions Ironically Aid Russias Ukraine Invasion

Jun 01, 2025