Understanding The Changes: Why Federal Student Loans Are Still The Preferred Option

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Changes: Why Federal Student Loans Are Still the Preferred Option

The landscape of student financing is constantly shifting, with new private loan options and refinancing opportunities emerging regularly. Yet, despite the increasing competition, federal student loans remain the preferred choice for many prospective students and their families. But why? This article delves into the key advantages that make federal student loans a compelling option, even in today's dynamic market.

The Unwavering Advantages of Federal Student Loans

Federal student loans offer a suite of protections and benefits that private lenders simply can't match. These advantages are crucial, particularly given the potential financial strain of higher education.

1. Flexible Repayment Options: Navigating Your Financial Future

One of the most significant advantages is the range of repayment plans available. Federal loans offer income-driven repayment (IDR) plans, which tie your monthly payments to your income and family size. This crucial feature provides a safety net for borrowers facing unexpected financial hardship. Unlike private loans, which often lack such flexibility, federal loans offer options like:

- Income-Driven Repayment (IDR): Keeps your monthly payments manageable based on your income.

- Extended Repayment Plans: Allows for longer repayment periods, lowering monthly payments.

- Deferment and Forbearance: Provides temporary pauses in repayment under certain circumstances. (Note: Interest may still accrue during forbearance, so explore options carefully).

These options significantly reduce the risk of default, a serious consequence that can damage your credit score and financial future. Learn more about .

2. Robust Borrower Protections: A Safety Net Against Life's Unexpected Turns

Federal student loan programs include significant borrower protections, including:

- Loan Forgiveness Programs: Certain professions, like teaching and public service, may qualify for loan forgiveness programs, significantly reducing or eliminating the debt burden. These programs are constantly evolving, so staying informed is key.

- Consumer Protection Laws: Federal loans are subject to strict consumer protection laws, safeguarding borrowers from predatory lending practices.

Private loans often lack these vital protections, leaving borrowers vulnerable to potentially harsh repayment terms and limited options during financial difficulty.

3. Lower Interest Rates: Saving Money in the Long Run

While interest rates fluctuate, federal student loans generally offer lower interest rates than many private loans. This translates to significant savings over the life of the loan, reducing the overall cost of borrowing. It's always wise to before making a decision, but the initial advantage often lies with federal options.

4. Accessibility and Simplicity: Navigating the Application Process

The application process for federal student loans is generally simpler and more straightforward than for private loans. The is a centralized application that simplifies the process and helps determine your eligibility for federal aid.

The Bottom Line: Weighing Your Options Carefully

While private loans may seem appealing in certain circumstances, the comprehensive benefits and protections offered by federal student loans make them the preferred choice for many. The flexibility in repayment options, robust borrower protections, and potentially lower interest rates offer a significant advantage, minimizing financial risk and providing peace of mind during what can be a challenging financial period. Always thoroughly research and compare all options before making a decision, but the advantages of federal student loans are undeniable.

Call to Action: Visit the to learn more about federal student loan programs and determine your eligibility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Changes: Why Federal Student Loans Are Still The Preferred Option. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

350 Year Wait Ends Uk Names First Female Astronomer Royal

Aug 01, 2025

350 Year Wait Ends Uk Names First Female Astronomer Royal

Aug 01, 2025 -

Investigating The Comet Luxury Tragedy And A Modern Rebirth

Aug 01, 2025

Investigating The Comet Luxury Tragedy And A Modern Rebirth

Aug 01, 2025 -

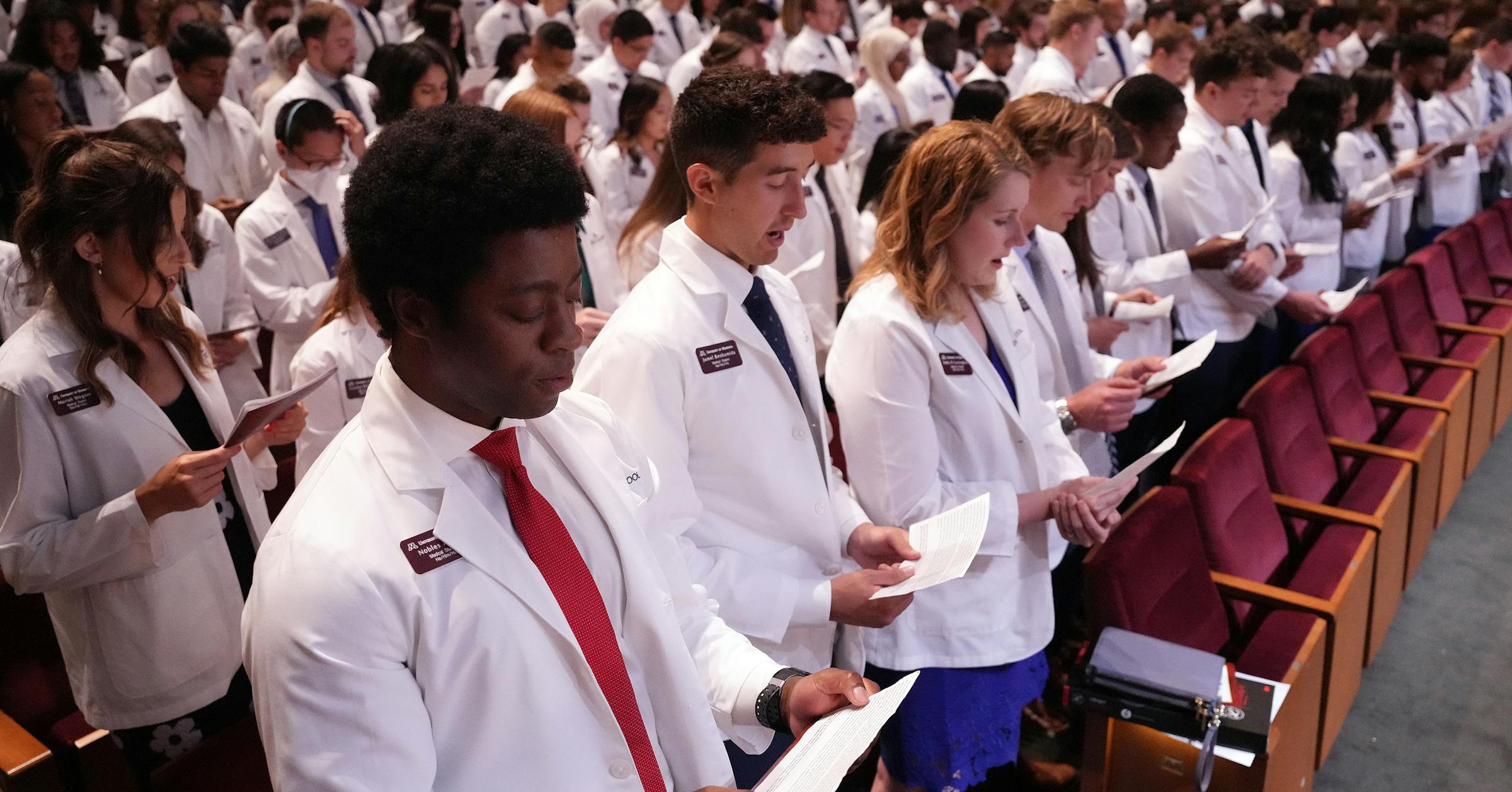

Law School And Medical School Aspirations Threatened By Lower Federal Student Loan Caps

Aug 01, 2025

Law School And Medical School Aspirations Threatened By Lower Federal Student Loan Caps

Aug 01, 2025 -

Siberian Ice Mummys 2 500 Year Old Tattoos Revealed

Aug 01, 2025

Siberian Ice Mummys 2 500 Year Old Tattoos Revealed

Aug 01, 2025 -

Heathrow Expansion Hotel Tycoon Unveils Bold Proposal

Aug 01, 2025

Heathrow Expansion Hotel Tycoon Unveils Bold Proposal

Aug 01, 2025

Latest Posts

-

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025

September Start Date Announced For Trumps 200 Million White House Ballroom

Aug 03, 2025 -

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025

Pattinson Out James Gunn Clarifies Dcu Batman Casting Speculation

Aug 03, 2025 -

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025

Norris Fastest In Hungarian Gp Practice A Strong Start For Mc Laren

Aug 03, 2025 -

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025

White House Ballroom Renovation 200 Million Project Begins This September

Aug 03, 2025 -

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025

X Qc Vs Kai Cenat Who Reigns Supreme In Streaming Net Worth

Aug 03, 2025