Understanding The Dramatic 1000% Increase In SBET Share Price

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Dramatic 1000% Increase in SBET Share Price: A Deep Dive

The recent surge in SBET share price, a staggering 1000% increase in a relatively short timeframe, has sent shockwaves through the financial markets. This dramatic rise begs the question: what's behind this phenomenal growth, and is it sustainable? This article delves deep into the factors driving SBET's unprecedented success and explores the potential risks and future outlook for investors.

The Meteoric Rise of SBET: Key Factors

Several key factors have contributed to SBET's astonishing 1000% share price increase. While no single element can fully explain this dramatic growth, the confluence of these factors paints a clearer picture:

-

Exceptional Q3 Earnings: SBET's recently released Q3 earnings report significantly exceeded analysts' expectations, showcasing impressive revenue growth and profitability. This positive financial performance instilled considerable confidence among investors. [Link to SBET Q3 Earnings Report – if publicly available]

-

Strategic Partnerships & Acquisitions: The company has been aggressively pursuing strategic partnerships and acquisitions, expanding its market reach and diversifying its revenue streams. These strategic moves have positioned SBET for significant long-term growth. Specific details of these partnerships and acquisitions should be further investigated for a deeper understanding of their impact.

-

Innovation and Technological Advancements: SBET has consistently invested in research and development, resulting in innovative products and services that have resonated strongly with consumers. This commitment to innovation has solidified the company's competitive edge. For example, their recent launch of [mention a specific product or service, if applicable] has been a significant driver of growth.

-

Positive Market Sentiment: The overall positive sentiment in the technology sector, coupled with increasing investor confidence in the company's future prospects, has played a crucial role in driving up the share price. This positive market environment has fueled speculative investment in high-growth stocks like SBET.

-

Short Squeeze: While not confirmed, the possibility of a short squeeze cannot be entirely discounted. A large number of short positions against SBET could have been forced to cover, leading to a rapid increase in demand and price. [Link to article discussing short squeezes – if applicable]

Is This Growth Sustainable? Potential Risks and Challenges

While the current surge is impressive, the sustainability of this 1000% increase remains a significant concern. Several factors could temper future growth:

-

Market Volatility: The stock market is inherently volatile, and SBET's share price is susceptible to fluctuations based on broader market trends and investor sentiment. A sudden shift in market conditions could trigger a significant correction.

-

Competition: Increased competition from established players and new entrants could impact SBET's market share and profitability. The company needs to maintain its innovative edge to stay ahead of the curve.

-

Overvaluation: Some analysts suggest that SBET's current valuation might be inflated, leading to a potential price correction in the future. A thorough fundamental analysis is crucial before making any investment decisions.

-

Regulatory Scrutiny: Increased regulatory scrutiny could pose challenges for SBET's future growth and operations. Compliance with evolving regulations is essential for the company's continued success.

Conclusion: A Cautious Approach

The 1000% increase in SBET's share price is undeniably remarkable, driven by a combination of strong financial performance, strategic initiatives, and market sentiment. However, investors should approach this situation with caution. The sustainability of this growth remains uncertain, and potential risks need to be carefully considered before investing. Thorough due diligence, including a comprehensive analysis of the company's financials and future prospects, is essential for informed investment decisions. Remember to consult with a qualified financial advisor before making any investment choices. This information is for educational purposes only and not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Dramatic 1000% Increase In SBET Share Price. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing The 1000 Surge Understanding Sbets Stock Performance

May 31, 2025

Analyzing The 1000 Surge Understanding Sbets Stock Performance

May 31, 2025 -

Water Main Replacement Expect Road Closures And Delays In Wilkes Barre

May 31, 2025

Water Main Replacement Expect Road Closures And Delays In Wilkes Barre

May 31, 2025 -

Shock Liverpool Crash Driver Appears In Court City Awaits Answers

May 31, 2025

Shock Liverpool Crash Driver Appears In Court City Awaits Answers

May 31, 2025 -

North Sea Ship Collision Captain Enters Not Guilty Plea

May 31, 2025

North Sea Ship Collision Captain Enters Not Guilty Plea

May 31, 2025 -

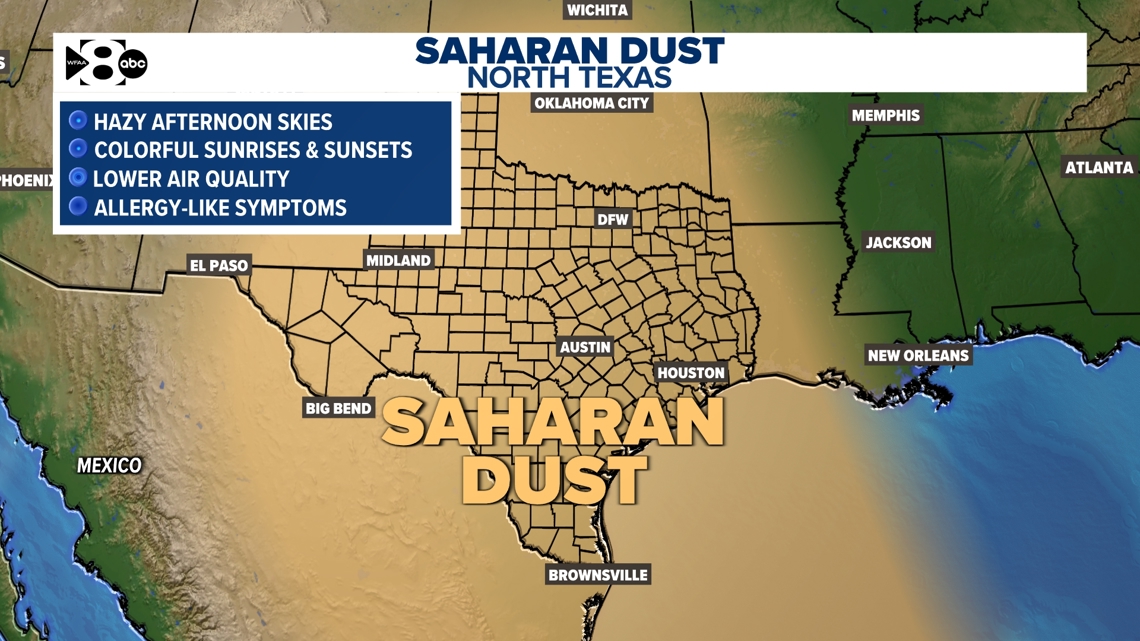

North Texas Sky Suffocated Saharan Dusts Epic 5 000 Mile Trek

May 31, 2025

North Texas Sky Suffocated Saharan Dusts Epic 5 000 Mile Trek

May 31, 2025

Latest Posts

-

Alcaraz And Sinners Us Open 2025 Paths A Comparative Draw Analysis

Aug 23, 2025

Alcaraz And Sinners Us Open 2025 Paths A Comparative Draw Analysis

Aug 23, 2025 -

How To Stream Or Watch The Detroit Lions Vs Houston Texans Preseason Game Live

Aug 23, 2025

How To Stream Or Watch The Detroit Lions Vs Houston Texans Preseason Game Live

Aug 23, 2025 -

Noel Clarkes Libel Case Against The Guardian Dismissed

Aug 23, 2025

Noel Clarkes Libel Case Against The Guardian Dismissed

Aug 23, 2025 -

Hawaii Rainbow Warriors Face Stanford In Season Opener National Tv Broadcast

Aug 23, 2025

Hawaii Rainbow Warriors Face Stanford In Season Opener National Tv Broadcast

Aug 23, 2025 -

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025

Country Star Weighs In Charley Crocketts Public Backing Of Beyonce Amidst Ongoing Debate

Aug 23, 2025