Understanding The Energy Price Implications Of Trump's Proposed Tax Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Energy Price Implications of Trump's Proposed Tax Cuts

The potential impact of proposed tax cuts on energy prices is a complex issue with significant implications for consumers and the economy. While former President Trump's proposed tax cuts aimed to stimulate economic growth, their effect on energy prices wasn't straightforward and remains a topic of ongoing debate among economists and energy analysts. This article delves into the multifaceted relationship between tax policy and energy costs, exploring the potential consequences of such reductions.

The Direct Impact on Energy Companies:

Trump's proposed tax cuts, primarily focused on corporate tax reductions, would have directly affected energy companies. Lower corporate tax rates could lead to increased profitability for oil and gas producers, potentially boosting investment in exploration and production. This increased supply could theoretically lead to lower energy prices for consumers. However, this is not a guaranteed outcome. Several factors could counteract this effect.

- Increased Investment, Not Always Lower Prices: Increased investment doesn't automatically translate into lower prices. Companies might prioritize shareholder returns over expanding production, maintaining existing price levels or even increasing them to maximize profits in the new lower-tax environment.

- Pass-Through Effects: While some cost savings might be passed on to consumers through lower prices, companies may retain a portion of the tax savings to increase profits or fund other initiatives. The extent to which price reductions occur would depend on market competition and individual company strategies.

Indirect Effects on Energy Demand and Supply:

The broader economic effects of tax cuts also play a crucial role. Stimulating economic growth through tax cuts could increase energy demand, potentially offsetting any price reductions from increased supply. Higher demand could lead to upward pressure on energy prices, negating the positive effects of lower corporate taxes on energy producers.

- Economic Growth and Energy Consumption: A robust economy typically translates to higher energy consumption across various sectors – manufacturing, transportation, and residential use. This increased demand can push energy prices higher.

- Inflationary Pressures: Significant tax cuts can contribute to inflationary pressures, impacting the cost of all goods and services, including energy. Inflation erodes the purchasing power of consumers, partially mitigating any benefits from lower energy prices.

Environmental Considerations:

It's also crucial to consider the environmental implications. Lower energy prices could stimulate increased energy consumption, potentially hindering efforts to reduce greenhouse gas emissions and combat climate change. This presents a complex trade-off between economic growth and environmental sustainability.

Conclusion:

Predicting the precise impact of Trump's proposed tax cuts on energy prices is challenging. While lower corporate tax rates could theoretically lead to increased energy production and lower prices, the effect is likely to be complex and influenced by multiple factors, including market dynamics, company strategies, and overall economic conditions. The interplay between increased supply, heightened demand, and inflationary pressures makes it difficult to definitively state whether consumers would have experienced lower energy costs under this policy. Further research and analysis are necessary to fully understand the long-term consequences.

Further Reading:

This article provides a balanced overview, acknowledging the complexities and uncertainties inherent in analyzing the relationship between tax policy and energy prices. It avoids making definitive claims and encourages readers to explore the issue further through additional research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Energy Price Implications Of Trump's Proposed Tax Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Big Beautiful Bill Power Play Before Deadline

Jul 02, 2025

Trumps Big Beautiful Bill Power Play Before Deadline

Jul 02, 2025 -

New Details Emerge Air France Passengers Arrest After Water Request And Privacy Violation

Jul 02, 2025

New Details Emerge Air France Passengers Arrest After Water Request And Privacy Violation

Jul 02, 2025 -

Vivienne Found Deceased In Bath Friends Call Leads To Discovery

Jul 02, 2025

Vivienne Found Deceased In Bath Friends Call Leads To Discovery

Jul 02, 2025 -

Police Investigation Launched Following Bob Vylan And Kneecaps Glastonbury Sets

Jul 02, 2025

Police Investigation Launched Following Bob Vylan And Kneecaps Glastonbury Sets

Jul 02, 2025 -

Trump Seeks Sweeping Changes As Big Beautiful Bill Deadline Approaches

Jul 02, 2025

Trump Seeks Sweeping Changes As Big Beautiful Bill Deadline Approaches

Jul 02, 2025

Latest Posts

-

Florida Doctor Charged With Murder In Daughters Drowning Death

Jul 03, 2025

Florida Doctor Charged With Murder In Daughters Drowning Death

Jul 03, 2025 -

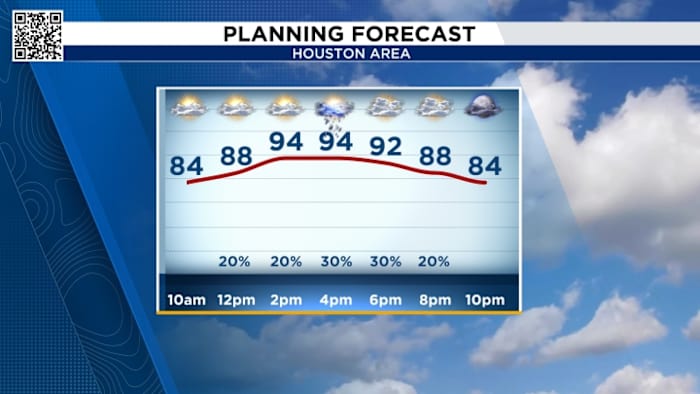

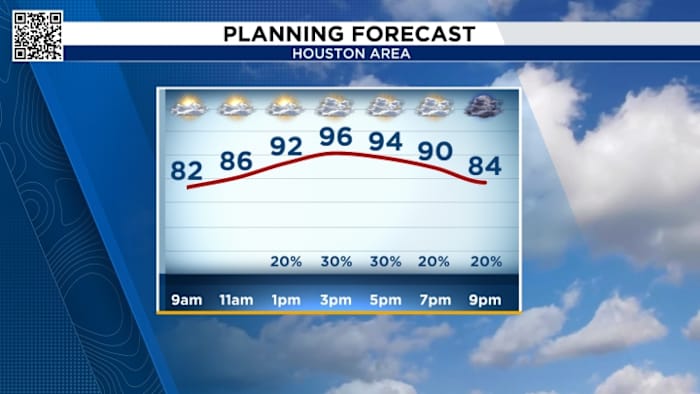

Houston Weather Alert Extreme Heat And Haze Expected For Independence Day

Jul 03, 2025

Houston Weather Alert Extreme Heat And Haze Expected For Independence Day

Jul 03, 2025 -

Houston Heatwave Hazy Skies And Dusty Conditions For July 4th Weekend

Jul 03, 2025

Houston Heatwave Hazy Skies And Dusty Conditions For July 4th Weekend

Jul 03, 2025 -

Murder Charge Filed Against Oklahoma Doctor After Daughters Pool Death

Jul 03, 2025

Murder Charge Filed Against Oklahoma Doctor After Daughters Pool Death

Jul 03, 2025 -

Search Ends Missing Ayers Brothers Located Safe In Pinal County

Jul 03, 2025

Search Ends Missing Ayers Brothers Located Safe In Pinal County

Jul 03, 2025