Understanding The Impact Of New Buy Now, Pay Later Regulations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Impact of New Buy Now, Pay Later Regulations

Buy Now, Pay Later (BNPL) services exploded in popularity in recent years, offering consumers a seemingly effortless way to purchase goods and services. However, this rapid growth has led to increased scrutiny from regulators worldwide, resulting in a wave of new regulations designed to protect consumers and ensure responsible lending practices. Understanding these changes is crucial for both consumers and businesses operating within the BNPL ecosystem.

The Rise and Fall (and Rise Again?) of Unregulated BNPL:

The initial appeal of BNPL was undeniable. Its simple application process and immediate access to credit made it a tempting option for online shoppers, particularly younger demographics. However, the lack of stringent regulation in the early days led to concerns about:

- Debt accumulation: The ease of access coupled with the often-delayed repayment schedule contributed to a rise in consumer debt, with many struggling to manage multiple BNPL accounts.

- Lack of transparency: Fees and interest charges were sometimes unclear, leading to unexpected costs for unsuspecting borrowers.

- Impact on credit scores: While some BNPL providers now report to credit bureaus, the initial lack of reporting caused confusion and potential negative impacts on creditworthiness for some users.

- Aggressive marketing: The ubiquitous nature of BNPL advertising, particularly targeting vulnerable populations, raised ethical concerns.

New Regulations: A Shift Towards Consumer Protection:

Recognizing these risks, regulators globally are implementing stricter rules for BNPL providers. These regulations vary by region but often include:

- Enhanced credit checks: More thorough assessments of borrower affordability to prevent over-indebtedness.

- Clearer disclosure of fees and interest: Transparent pricing information to avoid hidden costs and promote informed decision-making.

- Improved debt management tools: Features to help consumers track their repayments and manage their BNPL accounts effectively.

- Restrictions on marketing practices: Limitations on targeted advertising, especially towards vulnerable groups.

- Mandated reporting to credit bureaus: Enabling a more accurate reflection of a consumer's financial standing.

The Impact on Consumers and Businesses:

These regulatory changes are significantly impacting both consumers and businesses:

For Consumers:

- Increased financial responsibility: Consumers are now required to be more mindful of their spending habits and repayment capabilities.

- Greater transparency: Improved clarity regarding fees and interest rates empowers consumers to make informed choices.

- Better debt management tools: Access to tools designed to help manage BNPL accounts effectively can prevent debt spirals.

For Businesses:

- Increased compliance costs: BNPL providers face higher costs associated with meeting regulatory requirements.

- Potential reduction in customer base: Stricter lending criteria may lead to a decrease in the number of approved applications.

- Need for innovative solutions: Businesses need to adapt their strategies to comply with new regulations while maintaining customer satisfaction.

The Future of BNPL:

The future of the BNPL industry hinges on its ability to adapt to the evolving regulatory landscape. While the stricter rules may initially impact growth, they are ultimately designed to promote sustainable and responsible lending practices. This move towards increased transparency and consumer protection is likely to foster greater trust and long-term stability within the industry.

Call to Action: Stay informed about the latest BNPL regulations in your region. Understanding these changes will help you make responsible financial decisions and navigate the evolving landscape of online payments. Learn more about responsible borrowing practices by visiting [link to a reputable financial literacy resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Impact Of New Buy Now, Pay Later Regulations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Record Investments Over 5 B Poured Into Bitcoin Etfs Whats Driving The Rally

May 20, 2025

Record Investments Over 5 B Poured Into Bitcoin Etfs Whats Driving The Rally

May 20, 2025 -

Death Toll Rises After Israeli Strikes On Northern Gazas Last Hospital

May 20, 2025

Death Toll Rises After Israeli Strikes On Northern Gazas Last Hospital

May 20, 2025 -

President Bidens Health Understanding Prostate Cancer And Its Implications

May 20, 2025

President Bidens Health Understanding Prostate Cancer And Its Implications

May 20, 2025 -

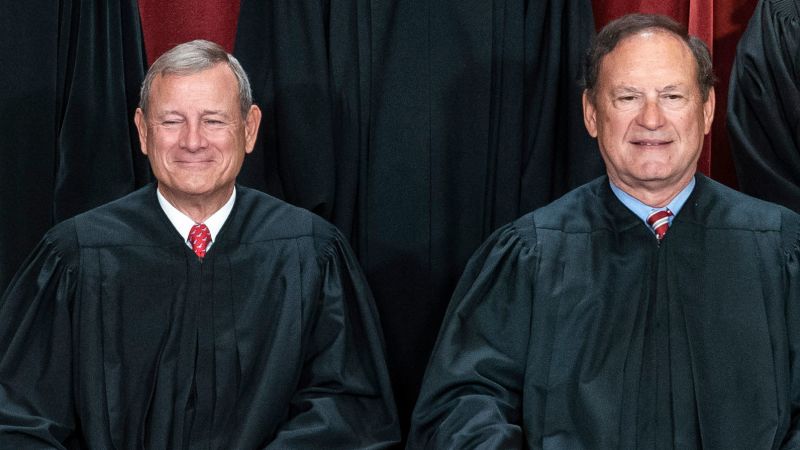

Supreme Court Justices Alito And Roberts Examining Their Long Term Influence

May 20, 2025

Supreme Court Justices Alito And Roberts Examining Their Long Term Influence

May 20, 2025 -

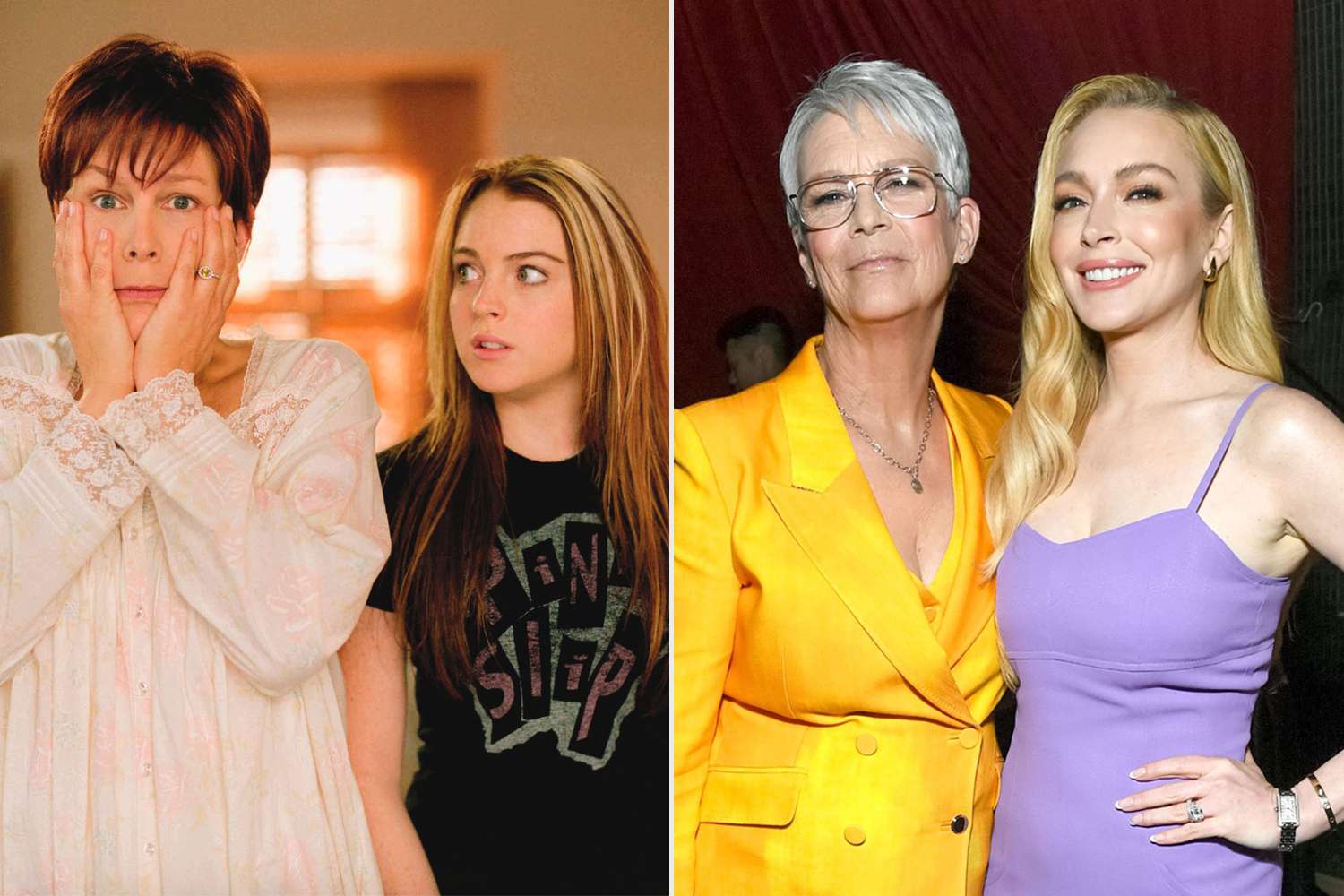

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025

Jamie Lee Curtis And Lindsay Lohan Their Post Freaky Friday Friendship

May 20, 2025

Latest Posts

-

Stock Market Today S And P 500s Six Day Rally Continues Amidst Moodys Action

May 21, 2025

Stock Market Today S And P 500s Six Day Rally Continues Amidst Moodys Action

May 21, 2025 -

Days After St Louis Tornado Assessing The Damage And The Road To Recovery

May 21, 2025

Days After St Louis Tornado Assessing The Damage And The Road To Recovery

May 21, 2025 -

Alito And Roberts Near 30 Years On The Supreme Court An Analysis

May 21, 2025

Alito And Roberts Near 30 Years On The Supreme Court An Analysis

May 21, 2025 -

Water Vole Conservation The Surprising Role Of Glitter In Wales Ecosystems

May 21, 2025

Water Vole Conservation The Surprising Role Of Glitter In Wales Ecosystems

May 21, 2025 -

Peaky Blinders Creator Reveals Plans For A New Series With Significant Shift

May 21, 2025

Peaky Blinders Creator Reveals Plans For A New Series With Significant Shift

May 21, 2025