Understanding The Implications Of Trump's School Voucher Tax Credit Proposal

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Implications of Trump's School Voucher Tax Credit Proposal

Donald Trump's proposed nationwide school voucher tax credit plan is sparking intense debate, promising significant changes to the American education landscape. While proponents hail it as a pathway to school choice and improved educational outcomes, critics raise concerns about its potential impact on public schools and equity. Understanding the nuances of this proposal is crucial for anyone invested in the future of American education.

What is the Proposed Tax Credit?

The plan, a cornerstone of Trump's broader education platform, would offer a federal tax credit to families who choose private schools, including religious schools, over public education. The exact details regarding the credit amount remain somewhat fluid, but the core concept revolves around providing financial assistance to offset private school tuition costs. This differs from direct voucher programs where the government directly funds private school tuition. Instead, the tax credit acts as an incentive, allowing families to reduce their tax burden by the amount of the credit.

Potential Benefits:

- Increased School Choice: Supporters argue the tax credit expands school choice, empowering families to select the best educational environment for their children, regardless of their socioeconomic status. This is particularly beneficial for families in underperforming school districts.

- Competition and Innovation: The increased competition among schools, both public and private, could spur innovation and improvement in educational practices and offerings across the board. Private schools may be forced to adapt and innovate to remain competitive.

- Parental Empowerment: The proposal places greater control over educational decisions in the hands of parents, allowing them to tailor their children's education to their specific needs and preferences.

Potential Drawbacks and Concerns:

- Financial Strain on Public Schools: Critics fear a significant exodus of students from public schools, leading to reduced funding and potentially exacerbating existing resource disparities in already underfunded districts. This could disproportionately affect low-income communities.

- Equity and Accessibility: The tax credit may not be equally accessible to all families. Low-income families may still struggle to afford private school tuition even with the tax credit, potentially widening the achievement gap rather than closing it.

- Accountability and Oversight: Private schools receiving students through this system may face less stringent accountability measures than public schools, raising concerns about quality control and transparency.

- Religious Freedom Concerns: The inclusion of religious schools raises concerns about the separation of church and state, particularly regarding potential government funding of religious institutions. Legal challenges are highly anticipated.

Comparison to Other School Choice Initiatives:

Trump's proposed tax credit differs from other school choice initiatives, such as direct voucher programs or charter school expansion. While all aim to increase school choice, the tax credit approach relies on individual tax benefits rather than direct government funding of private schools. This subtle difference has significant implications for funding mechanisms and potential legal challenges. For instance, the Supreme Court's Espinoza v. Montana Department of Revenue decision, which upheld the constitutionality of school choice programs that include religious schools, offers a framework, but its application to a nationwide tax credit program remains to be seen.

Looking Ahead:

The future of Trump's proposed school voucher tax credit remains uncertain. Its passage would depend on gaining political support and overcoming legal hurdles. The plan's long-term effects on the American education system are complex and require careful consideration of both its potential benefits and drawbacks. Further analysis, including detailed cost-benefit studies and impact assessments, is essential to fully understand its potential consequences. The debate surrounding this proposal is likely to remain a central topic in the ongoing discussion about education reform in the United States. Stay informed and engage in constructive dialogue to shape the future of education for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Implications Of Trump's School Voucher Tax Credit Proposal. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Launched American Airlines Pilots Italy Flight Mix Up

Jun 08, 2025

Investigation Launched American Airlines Pilots Italy Flight Mix Up

Jun 08, 2025 -

Analysis The Political Message Behind Trump Billboards In Damascus

Jun 08, 2025

Analysis The Political Message Behind Trump Billboards In Damascus

Jun 08, 2025 -

Euro 2025 Preparations Shaken Assessing The Impact Of Englands Recent Turmoil

Jun 08, 2025

Euro 2025 Preparations Shaken Assessing The Impact Of Englands Recent Turmoil

Jun 08, 2025 -

West Virginias Controversial Stance Could Miscarriages Result In Criminal Charges

Jun 08, 2025

West Virginias Controversial Stance Could Miscarriages Result In Criminal Charges

Jun 08, 2025 -

American Airlines Miscalculation Oversized Plane Denied Landing In Italy

Jun 08, 2025

American Airlines Miscalculation Oversized Plane Denied Landing In Italy

Jun 08, 2025

Latest Posts

-

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025

Iva Jovic Jugara La Final Del Gdl Open Akron 2025 Contra Emiliana Arango

Sep 14, 2025 -

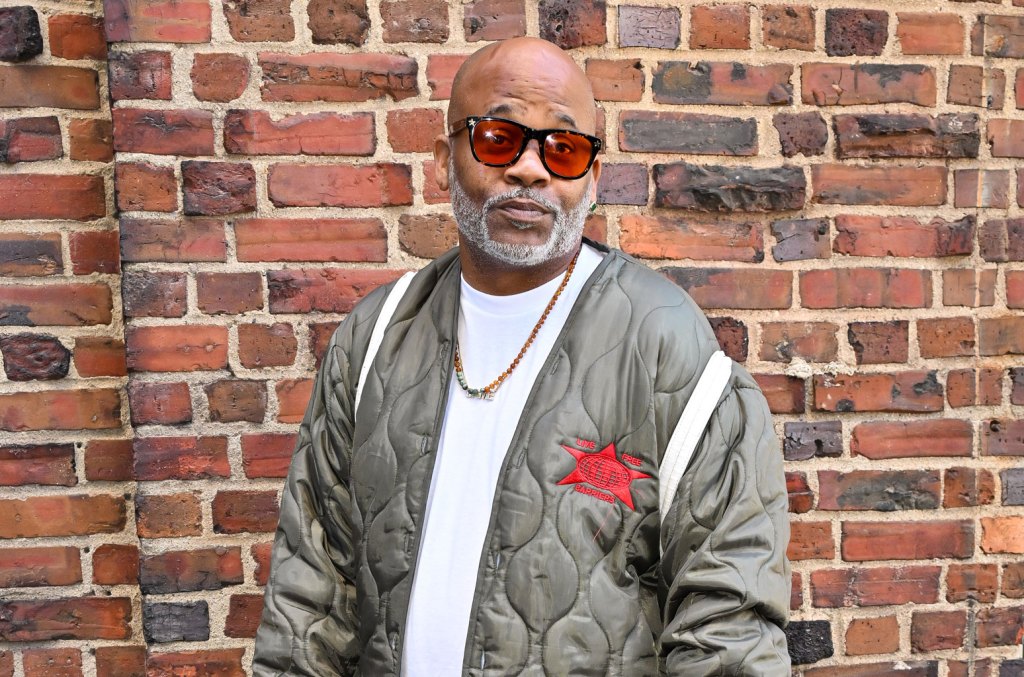

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025

Cam Ron And 50 Cents Paid In Full Dame Dashs Heated Response

Sep 14, 2025 -

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025

Snl Season 51 Cast Announced Bowen Yang Chloe Fineman And More Return

Sep 14, 2025 -

Co Stars React Noah Schnapp On Millie Bobby Browns New Baby

Sep 14, 2025

Co Stars React Noah Schnapp On Millie Bobby Browns New Baby

Sep 14, 2025 -

Arango Derrota A Jacquemot Y Avanza A La Final En Guadalajara

Sep 14, 2025

Arango Derrota A Jacquemot Y Avanza A La Final En Guadalajara

Sep 14, 2025