Understanding The New Rules For Buy Now, Pay Later Services

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the New Rules for Buy Now, Pay Later Services: What Consumers Need to Know

Buy Now, Pay Later (BNPL) services exploded in popularity, offering a seemingly effortless way to purchase goods and services. However, the rapid growth brought increased scrutiny, leading to new regulations designed to protect consumers. This article breaks down the key changes and what they mean for you.

The Rise and Fall (and Rise Again) of BNPL's Unregulated Era

BNPL services, such as Klarna, Afterpay (now part of Square), and Affirm, promised a convenient alternative to credit cards. Their appeal was simple: buy now, pay later in installments, often with little to no interest. This accessibility, particularly for younger generations and those with limited credit history, fueled their meteoric rise. However, the lack of stringent regulation also led to concerns about debt accumulation, overspending, and inadequate consumer protection.

New Regulations: A Shift Towards Greater Consumer Protection

Recognizing these risks, regulatory bodies worldwide are implementing stricter rules for BNPL providers. These changes aim to increase transparency, improve affordability, and prevent irresponsible lending practices. Key areas of focus include:

-

Credit Checks and Affordability Assessments: Many jurisdictions are now mandating more thorough credit checks and affordability assessments before approving BNPL applications. This aims to ensure consumers only borrow amounts they can realistically repay.

-

Clearer Disclosure of Fees and Interest: Previously, some BNPL services lacked transparency regarding late payment fees and interest charges. New regulations require clear and upfront disclosure of all costs associated with using the service. Understanding these fees is crucial to making informed financial decisions.

-

Debt Collection Practices: Stricter regulations are being enforced regarding debt collection practices. Aggressive tactics are being curtailed, and greater protections are being put in place for consumers struggling to repay their debts. This includes clearer guidelines on communication and debt management strategies.

-

Improved Data Protection: The handling of consumer data is also under greater scrutiny. Regulations are being implemented to ensure responsible data collection and usage, protecting consumer privacy.

What This Means for Consumers

The new rules translate to a more responsible and transparent BNPL landscape. For consumers, this means:

-

Increased Financial Responsibility: You'll need to demonstrate financial stability before being approved for a BNPL loan. This is a positive step towards preventing over-indebtedness.

-

Greater Transparency: All fees and potential interest charges will be clearly outlined upfront, allowing you to make informed purchasing decisions.

-

Stronger Consumer Protections: In case of difficulties repaying your debts, clearer guidelines and stronger protections are in place to safeguard your rights.

Tips for Using BNPL Services Responsibly

- Only use BNPL for purchases you can afford. Don't let the ease of access tempt you into overspending.

- Read the terms and conditions carefully. Understand all fees and interest charges before committing.

- Set up automatic payments. Avoid late payment fees by ensuring timely repayments.

- Monitor your spending. Track your BNPL purchases to stay on top of your finances.

- Consider alternatives. If you struggle to manage your finances, explore other payment options.

Looking Ahead

The future of BNPL services is evolving. While offering convenience, responsible use and awareness of the new regulations are essential. Staying informed about these changes empowers consumers to leverage the benefits of BNPL while mitigating potential risks. By understanding the new rules and practicing responsible spending habits, you can enjoy the convenience of Buy Now, Pay Later services without compromising your financial well-being. Learn more about specific regulations in your region by visiting your country's financial regulator's website.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The New Rules For Buy Now, Pay Later Services. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fan Fury Over Jon Jones Strip The Duck Comment Aspinall And The Future Of The Ufc Heavyweight Division

May 20, 2025

Fan Fury Over Jon Jones Strip The Duck Comment Aspinall And The Future Of The Ufc Heavyweight Division

May 20, 2025 -

Snl Celebrates 50 Years With Historic Season Finale

May 20, 2025

Snl Celebrates 50 Years With Historic Season Finale

May 20, 2025 -

Lufthansa Plane Flies Pilotless Co Pilot Fainting Triggers Safety Review

May 20, 2025

Lufthansa Plane Flies Pilotless Co Pilot Fainting Triggers Safety Review

May 20, 2025 -

Tom Aspinall Negotiations Stall Jon Jones Retirement Speculation Intensifies

May 20, 2025

Tom Aspinall Negotiations Stall Jon Jones Retirement Speculation Intensifies

May 20, 2025 -

Match Of The Day Host Gary Lineker Expected To Exit Bbc

May 20, 2025

Match Of The Day Host Gary Lineker Expected To Exit Bbc

May 20, 2025

Latest Posts

-

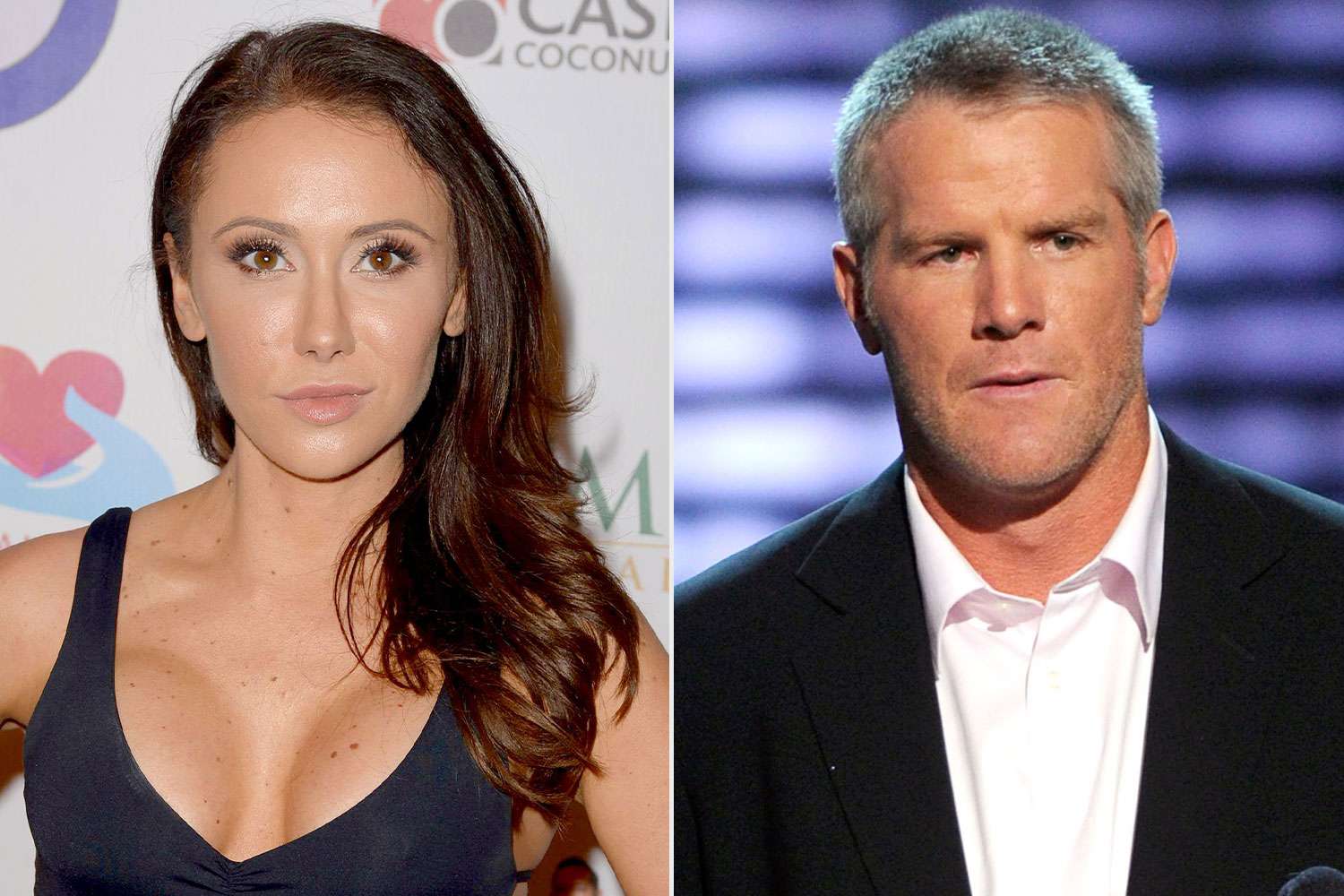

Brett Favre Sexting Scandal Jenn Sterger Recounts Her Experience And Its Aftermath

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Recounts Her Experience And Its Aftermath

May 20, 2025 -

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 20, 2025

New Wwi Movie Featuring Daniel Craig Cillian Murphy And Tom Hardy Streaming Now

May 20, 2025 -

Peaky Blinders Creator Announces New Series Detailing Key Departure

May 20, 2025

Peaky Blinders Creator Announces New Series Detailing Key Departure

May 20, 2025 -

Controversy Erupts Jon Jones And The Ufcs Handling Of Aspinall Injury

May 20, 2025

Controversy Erupts Jon Jones And The Ufcs Handling Of Aspinall Injury

May 20, 2025 -

Post Pectra Upgrade Investors Inject 200 Million Into Ethereum Funds

May 20, 2025

Post Pectra Upgrade Investors Inject 200 Million Into Ethereum Funds

May 20, 2025