Understanding The New Spending Bill: Your Chances Of Receiving A Stimulus Check

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the New Spending Bill: Your Chances of Receiving a Stimulus Check

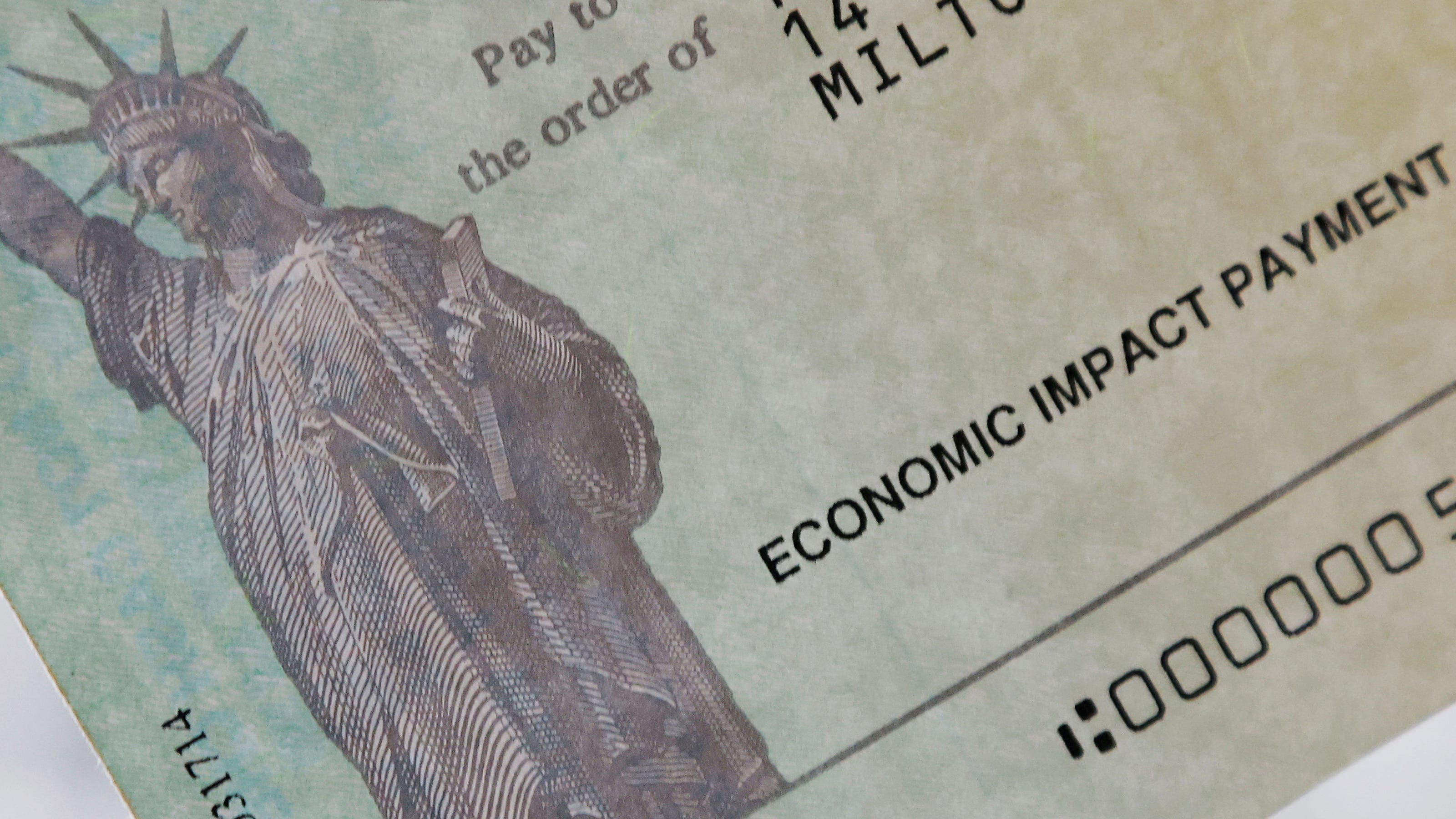

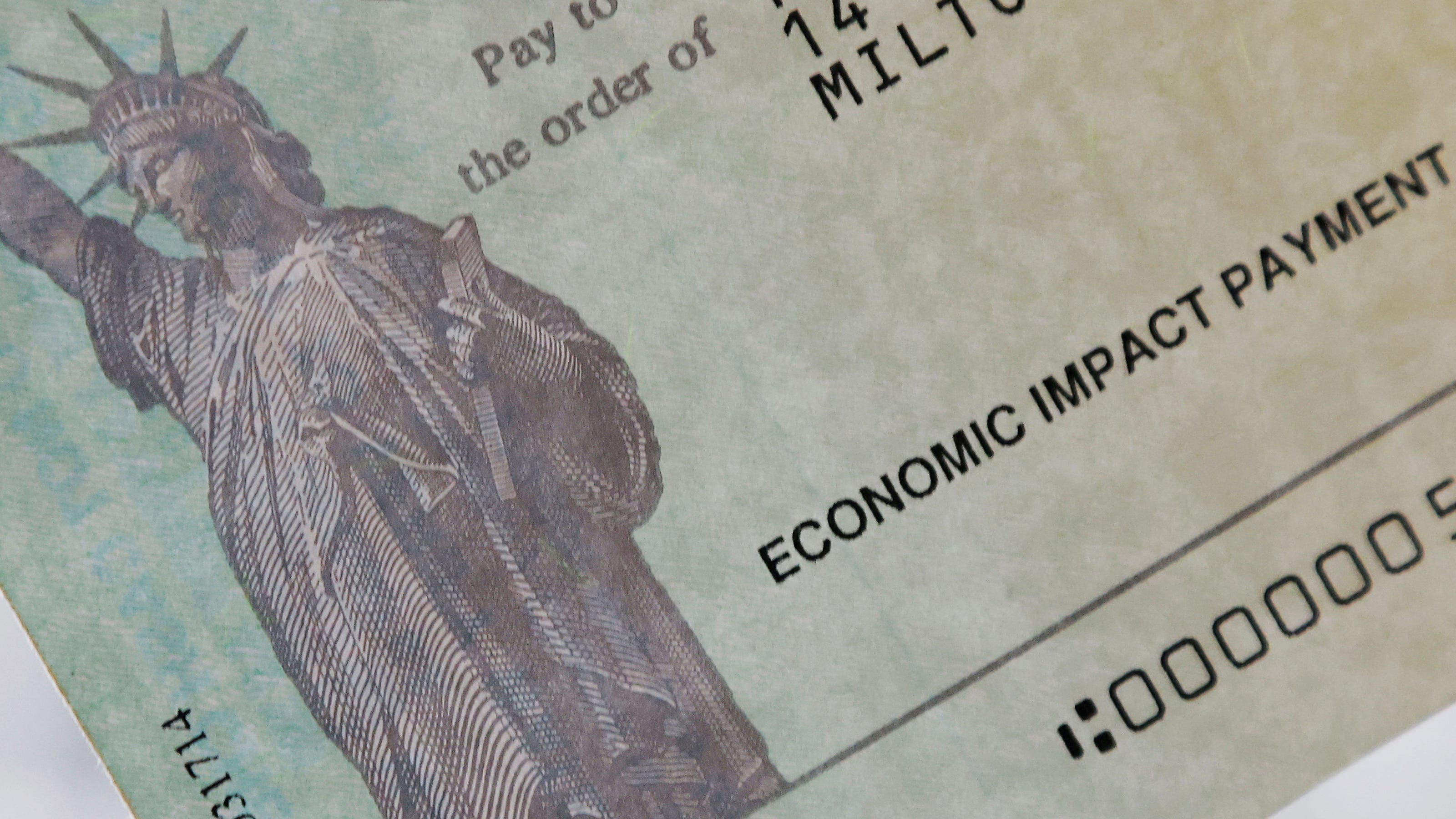

The recently passed spending bill has ignited a firestorm of debate, with many Americans wondering: will I get a stimulus check? The short answer is complex, depending heavily on individual circumstances and the specific provisions within the lengthy legislation. This article breaks down the key elements and helps you assess your chances of receiving a payment.

What's in the Bill? A Look at the Stimulus Provisions

Unlike previous stimulus packages that featured broad, easily understood eligibility criteria, this bill is far more nuanced. While it doesn't include a standalone, universal stimulus check program like those seen in 2020 and 2021, it does contain targeted tax credits and benefits that could result in payments similar to stimulus checks for eligible individuals and families.

These include, but are not limited to:

- The Earned Income Tax Credit (EITC): This credit has been expanded, potentially increasing the amount received by low-to-moderate-income working families. Eligibility requirements remain, focusing on income levels and the number of dependents. [Link to IRS EITC page]

- The Child Tax Credit (CTC): While not as generous as during the pandemic, the CTC still provides significant tax relief for families with children. The amount depends on the child's age and the family's income. [Link to IRS CTC page]

- Other Targeted Assistance Programs: The bill also includes funding for various social programs, such as affordable housing initiatives, childcare subsidies, and nutrition assistance programs. Access to these benefits often depends on meeting specific income and residency requirements.

Who is Most Likely to Receive a Payment?

Based on the provisions outlined above, individuals most likely to receive payments resembling stimulus checks are:

- Low-to-moderate-income workers with dependents: The expansion of the EITC and the continued CTC offer substantial financial relief to these families.

- Individuals utilizing other social programs: Access to expanded funding for programs like SNAP (Supplemental Nutrition Assistance Program) or housing assistance can provide crucial financial support.

How to Determine Your Eligibility

Navigating the complexities of the new spending bill can be challenging. To determine your eligibility for any potential payments, you should:

- Consult the IRS website: The IRS website provides comprehensive information on the EITC and CTC, including eligibility requirements and calculation tools. [Link to IRS website]

- Seek professional tax advice: A tax professional can help you understand the various tax credits and benefits you may be eligible for and how they might impact your tax return.

- Check with your state's social services agencies: Information on state-specific programs and assistance is typically available through your state's website or local social services offices.

Important Considerations:

- Filing your taxes: Many of these benefits are claimed through your tax return. Ensuring you file accurately and on time is crucial to receiving your entitled payments.

- Income thresholds: Keep in mind that income thresholds for eligibility exist for most programs. These thresholds can vary depending on the specific program and your family size.

Conclusion: Understanding Your Chances

While the new spending bill doesn't feature a broad stimulus check distribution, it does contain significant provisions that can provide substantial financial assistance to eligible individuals and families. By understanding the key elements and taking the steps outlined above, you can determine your chances of receiving payments and access the support available to you. Remember to consult official government resources and seek professional advice when needed. Stay informed, and don't hesitate to seek help navigating these complex regulations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The New Spending Bill: Your Chances Of Receiving A Stimulus Check. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Two Proteas Players Earn Maiden Test Call Ups

Jul 06, 2025

Two Proteas Players Earn Maiden Test Call Ups

Jul 06, 2025 -

Three Years Post Launch 988 Lifelines Success And Shortcomings For Lgbtq Youth

Jul 06, 2025

Three Years Post Launch 988 Lifelines Success And Shortcomings For Lgbtq Youth

Jul 06, 2025 -

Bunbury Buzz Tillys Event Creates A Frenzy

Jul 06, 2025

Bunbury Buzz Tillys Event Creates A Frenzy

Jul 06, 2025 -

Zarah Sultanas Shock Departure New Party With Corbyn

Jul 06, 2025

Zarah Sultanas Shock Departure New Party With Corbyn

Jul 06, 2025 -

Oasis Reunion The Biggest Music News Since Reeves Tax Controversy

Jul 06, 2025

Oasis Reunion The Biggest Music News Since Reeves Tax Controversy

Jul 06, 2025

Latest Posts

-

Oasis Comeback 1995 And Beyond

Jul 06, 2025

Oasis Comeback 1995 And Beyond

Jul 06, 2025 -

Top 500 Apple Music Songs 2010 2019 Sheeran Drake The Weeknd Lead The Pack

Jul 06, 2025

Top 500 Apple Music Songs 2010 2019 Sheeran Drake The Weeknd Lead The Pack

Jul 06, 2025 -

Ketamine Treatment A High Risk Gamble For Mental Health

Jul 06, 2025

Ketamine Treatment A High Risk Gamble For Mental Health

Jul 06, 2025 -

Julian Mc Mahon 56 A Look Back At The Life And Career Of The Beloved Actor

Jul 06, 2025

Julian Mc Mahon 56 A Look Back At The Life And Career Of The Beloved Actor

Jul 06, 2025 -

Apple Musics Decade Defining Hits Shape Of You Leads The Pack

Jul 06, 2025

Apple Musics Decade Defining Hits Shape Of You Leads The Pack

Jul 06, 2025