Understanding The Potential $420,000 Retirement Cut In The GOP Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Potential $420,000 Retirement Cut in the GOP Plan: What it Means for You

The Republican Party's proposed changes to Social Security and Medicare have sparked widespread debate, particularly concerning a potential significant reduction in retirement benefits. While the exact figures are subject to ongoing negotiations and may vary depending on the final legislation, reports suggest a potential $420,000 cut to retirement benefits for some individuals. This article delves into the potential implications of these proposed changes and what they could mean for your retirement planning.

What's the Source of the $420,000 Figure?

The $420,000 figure isn't a single, universally agreed-upon number. Instead, it represents an estimate derived from analyses of various Republican proposals aimed at reforming Social Security. These proposals generally focus on altering benefit formulas, raising the retirement age, or changing the way cost-of-living adjustments (COLAs) are calculated. These changes, when aggregated over a typical retirement lifespan, could result in significant reductions for many retirees, potentially reaching $420,000 or more for some high earners or those retiring later in life. Different analyses yield slightly different results, but the core message remains: substantial cuts are on the table.

Who Would Be Most Affected?

While the impact will vary, several groups are likely to experience the most significant reductions:

- Higher earners: Proposals often target higher earners, potentially reducing their benefits more drastically than those with lower incomes.

- Those retiring later: Changes to the retirement age could disproportionately affect individuals planning to retire later in life.

- Individuals relying heavily on Social Security: Those who depend primarily on Social Security for retirement income will be particularly vulnerable to benefit reductions.

How Could This Affect Your Retirement Plans?

The potential $420,000 cut underscores the critical need for proactive retirement planning. This isn't just about Social Security; it highlights the importance of diversification. Consider these actions:

- Increase Retirement Savings: If you're concerned about potential Social Security cuts, aggressively saving and investing in retirement accounts like 401(k)s and IRAs becomes even more crucial.

- Diversify Investments: Don't rely solely on Social Security. Explore various investment options to build a robust retirement portfolio.

- Review Your Retirement Budget: Re-evaluate your retirement spending plan, considering the potential impact of reduced Social Security benefits. Are there areas where you can adjust your expenses?

- Stay Informed: Keep abreast of the ongoing political discussions and proposed legislation. Understand how these changes might affect your personal circumstances.

Beyond the Numbers: The Broader Implications

The debate surrounding Social Security reform extends beyond the specific dollar amounts. It touches on broader questions of generational equity, economic security, and the future of the social safety net. These changes could have significant ramifications for millions of Americans and necessitate a careful examination of their potential long-term consequences.

Where to Find More Information:

For further information on Social Security and retirement planning, explore resources like the official Social Security Administration website () and the AARP (). Consulting with a qualified financial advisor can also provide personalized guidance.

Call to Action: Understanding the potential impacts of proposed legislative changes is crucial for securing your financial future. Take the necessary steps to plan for a comfortable retirement, regardless of potential adjustments to Social Security benefits. Don't delay – your future self will thank you.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Potential $420,000 Retirement Cut In The GOP Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dutch Coalition On The Brink Wilders Exit Shakes Government

Jun 05, 2025

Dutch Coalition On The Brink Wilders Exit Shakes Government

Jun 05, 2025 -

Australias Energy Future At Risk Key Battery Suppliers Existential Threat

Jun 05, 2025

Australias Energy Future At Risk Key Battery Suppliers Existential Threat

Jun 05, 2025 -

This Neck Cream Has Halle Berrys Stamp Of Approval We Tried It

Jun 05, 2025

This Neck Cream Has Halle Berrys Stamp Of Approval We Tried It

Jun 05, 2025 -

Financial Headwinds Hit Powin Company Addresses Difficult Financial Situation

Jun 05, 2025

Financial Headwinds Hit Powin Company Addresses Difficult Financial Situation

Jun 05, 2025 -

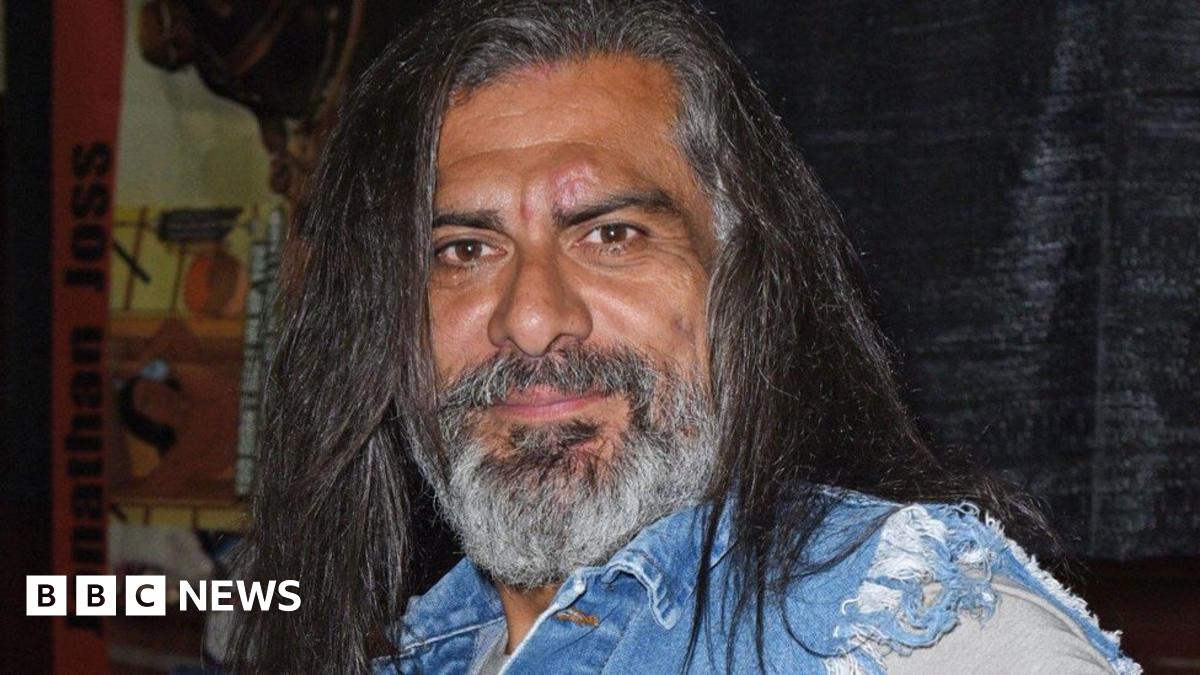

Tragic News Jonathan Joss Beloved King Of The Hill Actor Fatally Shot

Jun 05, 2025

Tragic News Jonathan Joss Beloved King Of The Hill Actor Fatally Shot

Jun 05, 2025

Latest Posts

-

Ph D Level Ai Assessing Chat Gpts Performance On Real World Challenges

Aug 17, 2025

Ph D Level Ai Assessing Chat Gpts Performance On Real World Challenges

Aug 17, 2025 -

Taylor Swifts Dazzling Showgirl Transformation Look Of The Week

Aug 17, 2025

Taylor Swifts Dazzling Showgirl Transformation Look Of The Week

Aug 17, 2025 -

Putins Deal Overture And The 80th Anniversary Of Vj Day A Historic Convergence

Aug 17, 2025

Putins Deal Overture And The 80th Anniversary Of Vj Day A Historic Convergence

Aug 17, 2025 -

China Japan Relations The Unresolved Trauma Of The Nanjing Massacre

Aug 17, 2025

China Japan Relations The Unresolved Trauma Of The Nanjing Massacre

Aug 17, 2025 -

Nba Star Michael Porter Jr Sounds Alarm On Sports Bettings Influence

Aug 17, 2025

Nba Star Michael Porter Jr Sounds Alarm On Sports Bettings Influence

Aug 17, 2025