Understanding The Potential $420,000 Retirement Loss Under The New GOP Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Potential $420,000 Retirement Loss Under the New GOP Plan

A looming threat to retirement savings? Recent proposals from the Republican Party regarding changes to retirement savings plans have sparked considerable concern among Americans nearing retirement or already enjoying their golden years. One particularly alarming figure circulating is the potential loss of $420,000 in retirement savings for some individuals. Let's delve into the details and explore the potential impact of these proposed changes.

The specific proposals vary, but a common thread involves modifications to existing tax advantages associated with retirement accounts like 401(k)s and IRAs. These accounts currently offer significant tax benefits, encouraging individuals to save for their future. However, the proposed changes could significantly reduce these benefits, leading to a substantial decrease in overall retirement savings.

How could you lose $420,000?

The $420,000 figure isn't a fixed number applicable to everyone. It represents a potential loss calculated based on several factors, including:

- Current tax rates: The current tax-advantaged status of retirement accounts significantly boosts savings over time. Proposed changes could eliminate or reduce these advantages.

- Investment growth: The longer you invest, the more impactful these tax changes become. The $420,000 figure likely reflects a projection over several decades of compounding growth.

- Individual savings contributions: The higher your contributions, the greater the potential impact of reduced tax benefits.

Proposed Changes and Their Potential Impact

While the exact details are still evolving, many proposed GOP plans involve:

- Higher taxes on withdrawals: Increasing the tax rates on withdrawals from retirement accounts would directly reduce the amount of money available for retirees.

- Reduced tax deductions for contributions: Making contributions less tax-deductible diminishes the incentive to save, resulting in lower overall retirement funds.

- Changes to Required Minimum Distributions (RMDs): Alterations to RMDs could force individuals to withdraw funds earlier than planned, potentially impacting their overall retirement security and increasing tax liability.

Who is most at risk?

Individuals most vulnerable to significant losses under these proposed changes are:

- Higher-income earners: Those in higher tax brackets will experience a more substantial impact from increased taxes on withdrawals and reduced deductions.

- Those relying heavily on retirement savings: Individuals heavily reliant on retirement savings for their post-retirement income face greater financial vulnerability.

- Long-term investors: Those who have been consistently contributing to their retirement accounts for many years will see the effects of compounded growth impacted by reduced tax benefits.

What can you do?

While the future remains uncertain, there are steps you can take to mitigate the potential impact:

- Stay informed: Keep abreast of the latest developments regarding these proposed changes. Consult reputable financial news sources and your financial advisor.

- Diversify your investments: Diversification can help reduce risk and potentially offset some of the negative effects of these changes.

- Consult a financial advisor: A qualified financial advisor can help you assess your individual situation and develop a strategy to minimize potential losses. They can offer personalized guidance based on your specific circumstances and risk tolerance.

The Bottom Line:

The potential loss of $420,000 in retirement savings under the new GOP plan is a serious concern. Understanding the proposed changes and their potential impact is crucial for making informed decisions about your retirement planning. Don't hesitate to seek professional financial advice to navigate this complex landscape and protect your future financial security. Stay informed, plan proactively, and seek expert guidance to safeguard your retirement dreams.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Potential $420,000 Retirement Loss Under The New GOP Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get To Know Carl Nassib His Journey And Contributions To The Nfl

Jun 05, 2025

Get To Know Carl Nassib His Journey And Contributions To The Nfl

Jun 05, 2025 -

Elon Musks Government Role Exit Jon Stewarts Scathing Commentary

Jun 05, 2025

Elon Musks Government Role Exit Jon Stewarts Scathing Commentary

Jun 05, 2025 -

May Jobs Report Weak Private Sector Hiring Signals Economic Slowdown

Jun 05, 2025

May Jobs Report Weak Private Sector Hiring Signals Economic Slowdown

Jun 05, 2025 -

Nvidias Core Weave A Us Business Powerhouse

Jun 05, 2025

Nvidias Core Weave A Us Business Powerhouse

Jun 05, 2025 -

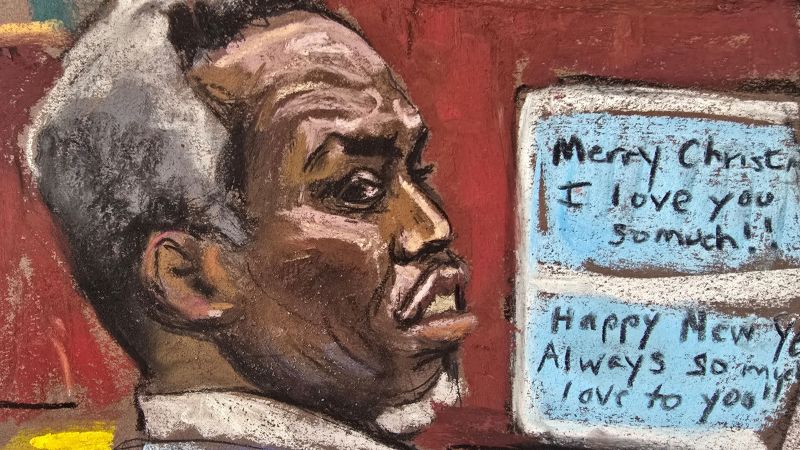

Sean Diddy Combs Faces Court The Current Status Of The Legal Proceedings

Jun 05, 2025

Sean Diddy Combs Faces Court The Current Status Of The Legal Proceedings

Jun 05, 2025

Latest Posts

-

Trump And Putins Alaska Summit A Comprehensive Review

Aug 17, 2025

Trump And Putins Alaska Summit A Comprehensive Review

Aug 17, 2025 -

Air Canada Delays And Cancellations What Travelers Need To Know

Aug 17, 2025

Air Canada Delays And Cancellations What Travelers Need To Know

Aug 17, 2025 -

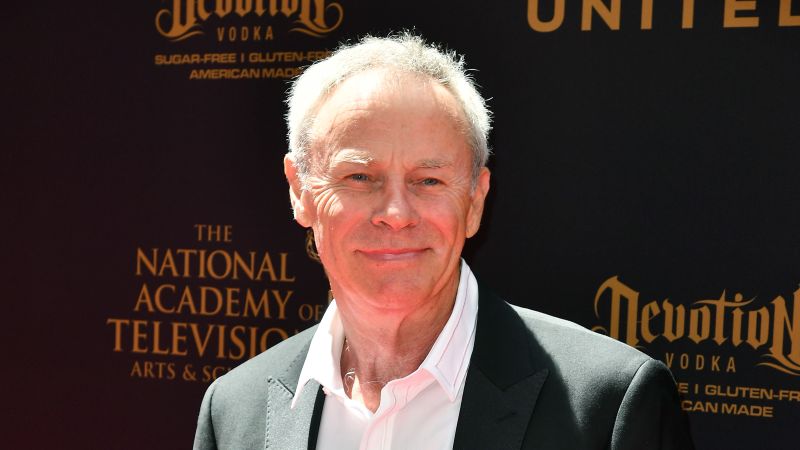

Remembering Tristan Rogers Beloved General Hospital Actor Dead At 79

Aug 17, 2025

Remembering Tristan Rogers Beloved General Hospital Actor Dead At 79

Aug 17, 2025 -

S T A L K E R 2 Heart Of Chornobyls Ps 5 Release Date Confirmed For 2025

Aug 17, 2025

S T A L K E R 2 Heart Of Chornobyls Ps 5 Release Date Confirmed For 2025

Aug 17, 2025 -

Bidens Dc Crime Prediction Of 1992 A Historical Context For Current Political Debates

Aug 17, 2025

Bidens Dc Crime Prediction Of 1992 A Historical Context For Current Political Debates

Aug 17, 2025