Understanding The Property Tax Shake-Up: Implications Of The "Suited Not Booted" Headline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Property Tax Shake-Up: Implications of the "Suited Not Booted" Headline

The recent headline, "Suited Not Booted," has sent shockwaves through the property tax landscape, leaving many homeowners wondering what it all means. This seemingly cryptic phrase encapsulates a significant shift in how property valuations and subsequent tax assessments are being handled, potentially impacting millions of taxpayers. This article will break down the implications of this change and offer guidance for navigating this complex situation.

What Does "Suited Not Booted" Mean?

The phrase "Suited Not Booted" is a colloquialism referencing a perceived shift in the assessors' approach. Traditionally, assessors, often seen as representing the "boots on the ground," relied heavily on physical inspections and in-person appraisals. The "suited" element implies a move towards a more data-driven, desk-based assessment process, leveraging sophisticated algorithms and computer models. This change has raised concerns about accuracy and fairness.

Key Implications of the Shift:

- Increased Reliance on Data: This new method relies heavily on automated valuation models (AVMs) using publicly available data like comparable sales, property characteristics, and even satellite imagery. While efficient, AVMs might not capture nuanced details that a physical inspection would reveal.

- Potential for Inaccuracies: The absence of in-person inspections increases the risk of inaccurate assessments. Unique property features, recent renovations, or market fluctuations not reflected in the data could lead to over- or under-valuation.

- Challenges for Homeowners: Disputes over assessments may become more challenging to resolve. Challenging a data-driven assessment requires a strong understanding of the algorithms and the data used, putting homeowners at a disadvantage.

- Impact on Tax Revenue: Depending on the accuracy of the new valuation methods, this could either increase or decrease overall tax revenue collected by local governments. This has significant implications for public services funding.

H2: How to Protect Yourself:

Given these potential pitfalls, it's crucial for homeowners to take proactive steps:

- Review Your Assessment: Carefully examine your property tax assessment notice. Compare it to similar properties in your area. Look for discrepancies and inconsistencies.

- Gather Supporting Documentation: If you believe your assessment is inaccurate, gather evidence to support your claim. This could include recent appraisals, renovation permits, or comparable sales data.

- Understand Your Rights: Familiarize yourself with the process for appealing your property tax assessment. Each jurisdiction has specific procedures and deadlines. Check your local government website for detailed instructions.

- Seek Professional Help: If you're unsure about how to proceed, consider consulting a property tax specialist or attorney. They can help you navigate the appeals process and present a strong case.

H2: The Future of Property Tax Assessments:

The "Suited Not Booted" approach highlights the increasing role of technology in property tax administration. While efficiency gains are possible, ensuring fairness and accuracy remains paramount. Ongoing debates and legislative actions will likely shape the future of property tax assessments, potentially leading to improvements in transparency and accountability. Stay informed about developments in your area to protect your property tax interests.

Call to Action: Check your property tax assessment today and don't hesitate to contact your local assessor's office or a property tax professional if you have concerns. Understanding your rights and the implications of this shift is crucial to protecting your financial well-being.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Property Tax Shake-Up: Implications Of The "Suited Not Booted" Headline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cleveland Guardians Arizona Facility Demolition

Aug 21, 2025

Cleveland Guardians Arizona Facility Demolition

Aug 21, 2025 -

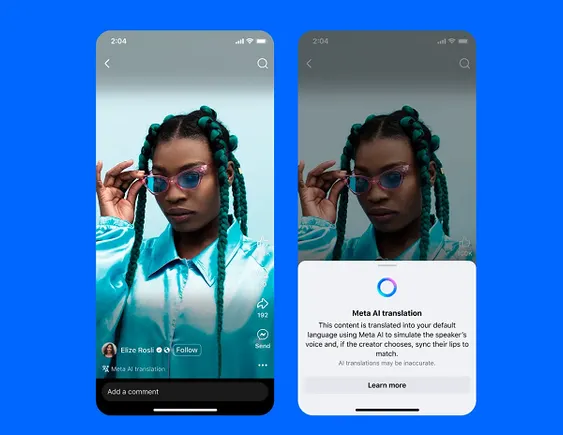

Meta Launches Ai Powered Video Audio Translation

Aug 21, 2025

Meta Launches Ai Powered Video Audio Translation

Aug 21, 2025 -

Ohio Lottery Pick 3 Midday And Mega Millions Results For August 19th 2025

Aug 21, 2025

Ohio Lottery Pick 3 Midday And Mega Millions Results For August 19th 2025

Aug 21, 2025 -

Mounting Pressure Councils Consider Lawsuits Over Asylum Hotel Placement

Aug 21, 2025

Mounting Pressure Councils Consider Lawsuits Over Asylum Hotel Placement

Aug 21, 2025 -

More Than A Pitcher Analyzing Alvarados Return To The Phillies

Aug 21, 2025

More Than A Pitcher Analyzing Alvarados Return To The Phillies

Aug 21, 2025

Latest Posts

-

Zelensky Putin Talks Kremlin Downplays Prospects Trump Raises Concerns

Aug 21, 2025

Zelensky Putin Talks Kremlin Downplays Prospects Trump Raises Concerns

Aug 21, 2025 -

Noel Gallaghers Proud Declaration Liams Success Celebrated

Aug 21, 2025

Noel Gallaghers Proud Declaration Liams Success Celebrated

Aug 21, 2025 -

Breaking New Evidence Points To Travis Decker In Daughters Killings

Aug 21, 2025

Breaking New Evidence Points To Travis Decker In Daughters Killings

Aug 21, 2025 -

Massachusetts State Trooper Dragged Multi State Manhunt Ends In Arrest

Aug 21, 2025

Massachusetts State Trooper Dragged Multi State Manhunt Ends In Arrest

Aug 21, 2025 -

Second Lottery Win Woman Claims 1 Million From Scratch Off Ticket

Aug 21, 2025

Second Lottery Win Woman Claims 1 Million From Scratch Off Ticket

Aug 21, 2025