Understanding Trump's 'Unprecedented' Tax Credit For School Vouchers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding Trump's 'Unprecedented' Tax Credit for School Vouchers: A Deep Dive

Donald Trump's proposed expansion of school choice through a significant tax credit for school vouchers ignited a firestorm of debate. While touted as an unprecedented step towards educational freedom, the plan's complexities and potential consequences remain a subject of intense scrutiny. This article delves into the specifics of the proposal, examining its potential impact on public education, parental choice, and the overall economic landscape.

What was the proposed tax credit?

Trump's plan centered around a substantial federal tax credit for families utilizing private school tuition, effectively acting as a significant subsidy for school vouchers. The exact figures varied across different proposals, but the core concept remained consistent: a considerable reduction in the tax burden for parents choosing private education over public schools. This differs significantly from existing voucher programs which often operate at a state or local level, with far smaller financial contributions. This scale was described by supporters as "unprecedented."

Arguments for the Tax Credit:

Proponents of the plan argued that it would dramatically increase parental choice in education, allowing families to select the best learning environment for their children, regardless of their socioeconomic background. This increased competition, they claimed, would spur innovation and improvement within both public and private schools. Key arguments included:

- Increased Parental Choice: Parents deserve the freedom to choose the educational setting best suited to their children's needs.

- Improved Educational Outcomes: Competition fosters innovation, leading to better educational results overall.

- Economic Benefits: Increased private school enrollment could stimulate the economy by creating jobs and supporting private businesses.

Arguments Against the Tax Credit:

Critics raised several concerns, arguing that the plan would exacerbate existing inequalities within the education system. Key objections included:

- Undermining Public Schools: The diversion of funds away from public schools could lead to their decline and further disadvantage underserved communities.

- Lack of Accountability: Private schools are often less accountable than public schools, potentially leading to lower educational standards and less transparency.

- Exacerbating Inequality: The tax credit primarily benefits wealthier families, potentially widening the gap between affluent and low-income students. [Link to a relevant study on educational inequality].

- Constitutional Concerns: Some legal experts questioned the constitutionality of using federal funds to support religious private schools, raising concerns about the separation of church and state.

The Unintended Consequences:

Beyond the core arguments, there are potential secondary effects to consider. These include:

- The burden on taxpayers: Even with a tax credit, the overall cost to the federal government could be substantial, potentially impacting other important social programs.

- The potential for fraud and abuse: Robust oversight mechanisms would be critical to prevent misuse of the tax credit system.

The Future of School Choice:

The debate surrounding Trump's proposed tax credit highlights the ongoing tension between school choice and public education funding. While the specific proposal may not have come to fruition, the underlying issues remain central to the national conversation about educational reform. Understanding the complexities of school choice initiatives, including their potential benefits and drawbacks, is vital for informed policy discussions. Further research is needed to fully understand the long-term impacts of similar initiatives in other states and countries. [Link to a relevant article on school choice debates].

Call to Action: Stay informed about educational policy developments by following reputable news sources and engaging in thoughtful discussions about the future of education in your community.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding Trump's 'Unprecedented' Tax Credit For School Vouchers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Familys Genetic Puzzle Why This Dad Doesnt Resemble His Parents

Jun 08, 2025

Familys Genetic Puzzle Why This Dad Doesnt Resemble His Parents

Jun 08, 2025 -

Finfluencer Fraud Wave Of Arrests Follows Regulatory Scrutiny

Jun 08, 2025

Finfluencer Fraud Wave Of Arrests Follows Regulatory Scrutiny

Jun 08, 2025 -

Late Inning Acquisition Why The Phillies Should Consider Matt Kemp

Jun 08, 2025

Late Inning Acquisition Why The Phillies Should Consider Matt Kemp

Jun 08, 2025 -

Mangiones Diary Points To Motive In United Healthcare Ceo Homicide Say Prosecutors

Jun 08, 2025

Mangiones Diary Points To Motive In United Healthcare Ceo Homicide Say Prosecutors

Jun 08, 2025 -

Wrong Plane Wrong Destination American Airlines Passenger Mishap

Jun 08, 2025

Wrong Plane Wrong Destination American Airlines Passenger Mishap

Jun 08, 2025

Latest Posts

-

Bankruptcy Looms For Jaguar Land Rover Suppliers In Wake Of Cyberattack

Sep 14, 2025

Bankruptcy Looms For Jaguar Land Rover Suppliers In Wake Of Cyberattack

Sep 14, 2025 -

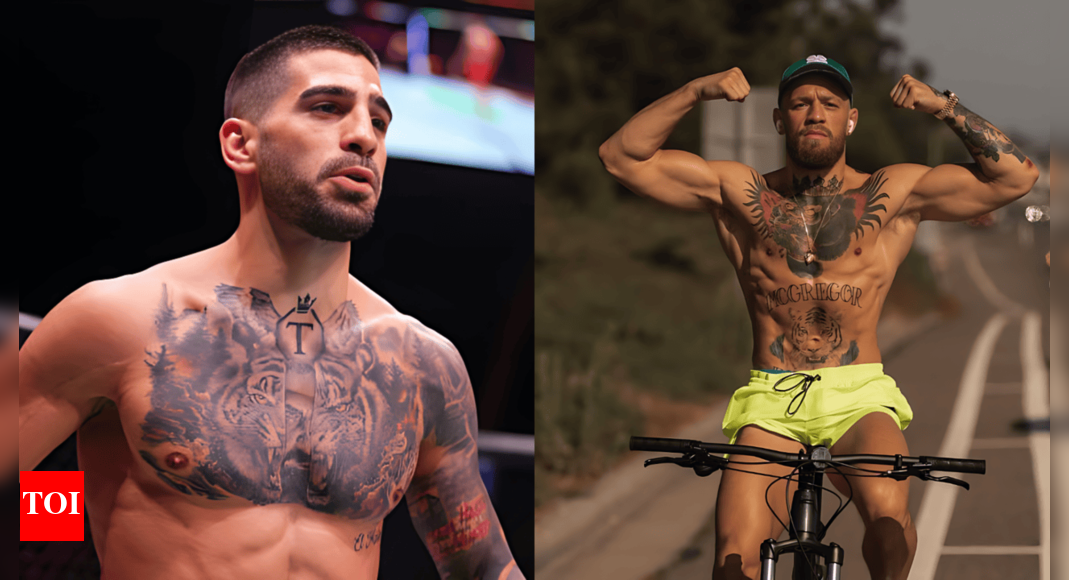

Ilia Topuria Hints At Return But Offers No Concrete Ufc Timeline

Sep 14, 2025

Ilia Topuria Hints At Return But Offers No Concrete Ufc Timeline

Sep 14, 2025 -

Terence Crawfords Partner Alindra Person And Their Family Life

Sep 14, 2025

Terence Crawfords Partner Alindra Person And Their Family Life

Sep 14, 2025 -

Ufc Fighter Ilia Topuria Remains Elusive About His Comeback Date

Sep 14, 2025

Ufc Fighter Ilia Topuria Remains Elusive About His Comeback Date

Sep 14, 2025 -

Ufc Star Ilia Topuria Teases Presidential Bid Leaving Fans Intrigued

Sep 14, 2025

Ufc Star Ilia Topuria Teases Presidential Bid Leaving Fans Intrigued

Sep 14, 2025