Understanding VRNA Data On Your My Stocks Page

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Decoding Your VRNA Data: Understanding Your Investment Performance on My Stocks Page

Are you scratching your head looking at your investment portfolio's VRNA data on your "My Stocks" page? Don't worry, you're not alone! Many investors find navigating the complexities of financial data daunting. This article will demystify VRNA data, explaining what it represents and how to use it to make informed decisions about your investments.

What does VRNA stand for?

While the specific meaning of "VRNA" can vary depending on the brokerage platform you use, it generally refers to Valuation Rate of Net Assets. This key metric reflects the current market value of your investments, offering a snapshot of your portfolio's overall performance. It's crucial to distinguish VRNA from other metrics like your initial investment amount or unrealized gains/losses, as it provides a real-time picture of your assets' worth. Different platforms may label this slightly differently (e.g., "Net Asset Value," or NAV). Always consult your platform's help section to confirm the exact definition.

Understanding the Components of VRNA:

VRNA calculation typically involves several factors:

- Market Value of Securities: This is the current market price of all your stocks, bonds, and other securities. Fluctuations in the market directly impact this component.

- Cash and Equivalents: This includes any cash balances held within your brokerage account, as well as highly liquid assets like money market funds.

- Accrued Interest and Dividends: Any interest earned on bonds or dividends received from stocks will be included in the calculation, contributing to your overall VRNA.

- Liabilities: This may include any outstanding margin debt or other liabilities associated with your account. This is subtracted from the asset values to arrive at the net asset value.

How to Interpret VRNA Data on Your My Stocks Page:

Your "My Stocks" page likely presents your VRNA alongside other important metrics. To effectively use this information:

- Compare VRNA to your initial investment: This helps you understand your overall return on investment (ROI). A higher VRNA than your initial investment signifies a profit, while a lower value indicates a loss.

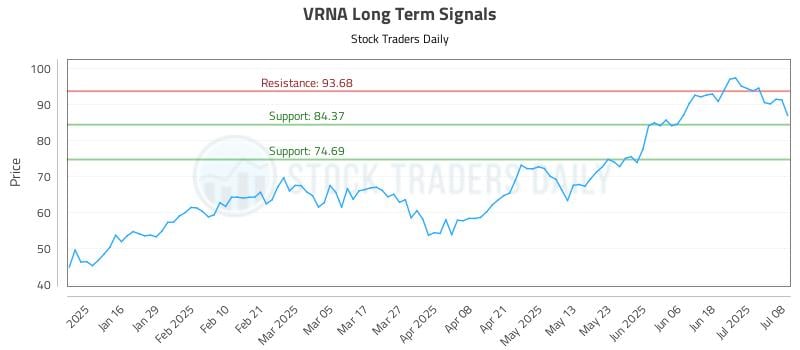

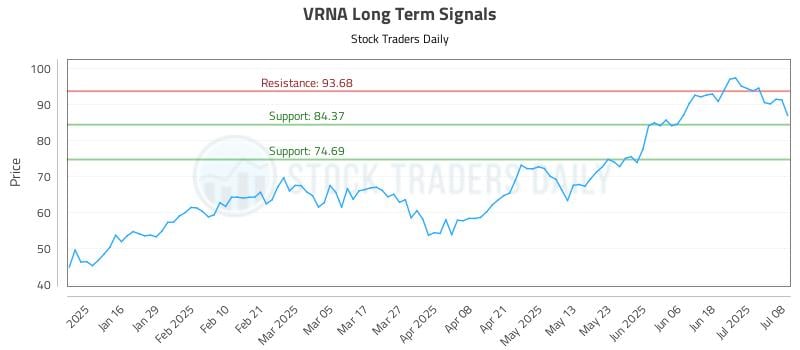

- Track VRNA over time: Monitor your VRNA on a regular basis to observe trends and patterns in your portfolio's performance. This allows for timely adjustments to your investment strategy based on market changes.

- Consider VRNA in the context of your goals: Your investment goals (e.g., retirement savings, buying a house) should guide your interpretation of VRNA data. Don't solely focus on short-term fluctuations; consider the long-term picture.

Using VRNA for Informed Investment Decisions:

By understanding your VRNA and its components, you can make more informed decisions about your investments. This includes:

- Rebalancing your portfolio: If your VRNA shows a significant shift in asset allocation away from your target, rebalancing can help mitigate risk and maintain your desired investment strategy. Learn more about portfolio rebalancing .

- Adjusting your investment strategy: Consistent monitoring of your VRNA can help you identify underperforming assets and potentially make adjustments to your investment strategy.

- Tax planning: Understanding your VRNA is crucial for tax planning, especially when it comes to capital gains and losses.

Beyond VRNA: Other Key Metrics to Consider:

While VRNA is a valuable metric, it shouldn't be the sole indicator of your investment performance. Consider other factors such as:

- Return on Investment (ROI): Measures the profitability of your investment.

- Risk Tolerance: Your personal comfort level with investment risk should guide your investment decisions.

- Diversification: A well-diversified portfolio reduces overall risk.

Conclusion:

Understanding your VRNA data is crucial for effective investment management. By consistently monitoring this metric and considering it alongside other relevant factors, you can gain valuable insights into your portfolio's performance and make informed decisions to achieve your financial goals. Remember to always consult with a qualified financial advisor for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding VRNA Data On Your My Stocks Page. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

100th Win For Pogacar Analysis Of Tour De France 2025 Stage Four

Jul 10, 2025

100th Win For Pogacar Analysis Of Tour De France 2025 Stage Four

Jul 10, 2025 -

Drought Emergency Hosepipe Ban Coming To Yorkshire

Jul 10, 2025

Drought Emergency Hosepipe Ban Coming To Yorkshire

Jul 10, 2025 -

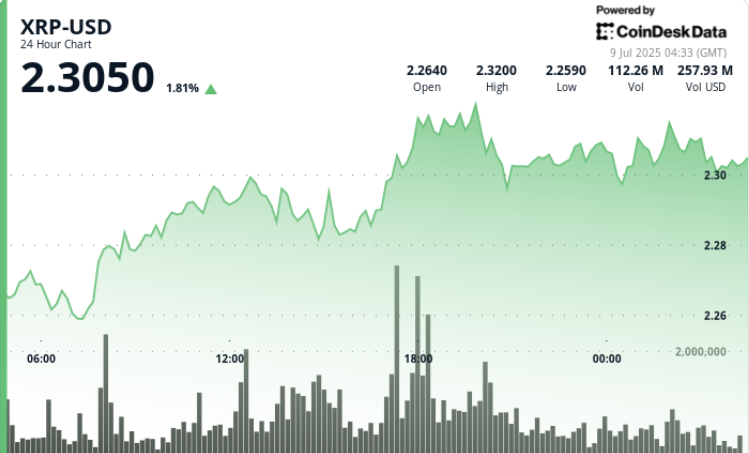

Xrp Price Analysis 2 28 Breakout And The Path To 2 30

Jul 10, 2025

Xrp Price Analysis 2 28 Breakout And The Path To 2 30

Jul 10, 2025 -

Genocide Allegations Israeli Experts Detail Hamass Use Of Sexual Violence

Jul 10, 2025

Genocide Allegations Israeli Experts Detail Hamass Use Of Sexual Violence

Jul 10, 2025 -

Thaksin Shinawatra Forbes Ranks Former Pm 11th Richest In Thailand 2025

Jul 10, 2025

Thaksin Shinawatra Forbes Ranks Former Pm 11th Richest In Thailand 2025

Jul 10, 2025