Unexpected Rise In Government Borrowing: April Figures Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unexpected Rise in Government Borrowing: April Figures Analyzed

The UK government's borrowing figures for April have sent shockwaves through financial markets, revealing a far steeper rise than economists predicted. The unexpected surge raises serious questions about the government's fiscal strategy and its ability to meet its debt reduction targets. This article delves into the key findings, explores potential causes, and analyzes the implications for the UK economy.

April's Shocking Numbers: A Deeper Dive

The Office for National Statistics (ONS) reported that government borrowing in April reached £20.6 billion, significantly exceeding the £10 billion forecast by economists. This represents a stark contrast to the £1.5 billion surplus recorded in April 2022, highlighting a dramatic shift in the country's fiscal position. The increase is particularly concerning given the government's commitment to fiscal responsibility and its stated aim to reduce the national debt.

This unexpected jump is the highest April borrowing figure since records began, underscoring the gravity of the situation. The figures immediately sparked debate amongst financial analysts and raised concerns about the potential impact on interest rates and inflation.

Factors Contributing to the Unexpected Rise

Several factors contributed to this significant increase in government borrowing:

- Higher-than-expected inflation: Persistent inflation has driven up the cost of public services, increasing government spending and putting pressure on the public purse. The increased cost of energy, in particular, has placed a significant strain on government finances.

- Tax receipts below projections: While tax revenues are generally expected to rise with inflation, the actual figures fell short of forecasts. This could be attributed to various factors, including slower-than-anticipated economic growth and potential tax avoidance strategies.

- Increased government spending: The government has increased spending in several key areas, including healthcare and social welfare programs, in response to the cost-of-living crisis. While necessary to support vulnerable populations, this additional spending has added to the borrowing burden.

Implications for the UK Economy and Future Outlook

The implications of this unexpected rise in government borrowing are significant and far-reaching:

- Increased national debt: The substantial increase in borrowing will contribute to a further expansion of the national debt, potentially impacting the UK's credit rating and increasing the cost of future borrowing.

- Pressure on interest rates: The Bank of England may feel compelled to increase interest rates further to combat inflationary pressures, potentially stifling economic growth and impacting household finances.

- Fiscal policy review: The government is likely to face pressure to review its fiscal policy and explore options for reducing spending or increasing revenue. This could involve difficult decisions regarding public services and taxation.

What's Next? Analyzing the Path Forward

The unexpected rise in government borrowing in April presents a considerable challenge for the UK government. Addressing this situation requires a multi-pronged approach, including careful management of public spending, exploration of revenue-raising measures, and a commitment to sustainable economic growth. The upcoming budget will be crucial in outlining the government's plan to navigate these challenges and restore fiscal stability. Further analysis of the underlying economic factors will be vital in understanding the long-term implications and devising appropriate policy responses. The coming months will be crucial in determining the government's success in managing this unexpected and significant economic hurdle.

Stay informed about the latest developments in UK economic policy. Subscribe to our newsletter for regular updates and in-depth analysis. (This is a subtle CTA).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unexpected Rise In Government Borrowing: April Figures Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Court Blocks Uk Governments Chagos Islands Transfer

May 24, 2025

Court Blocks Uk Governments Chagos Islands Transfer

May 24, 2025 -

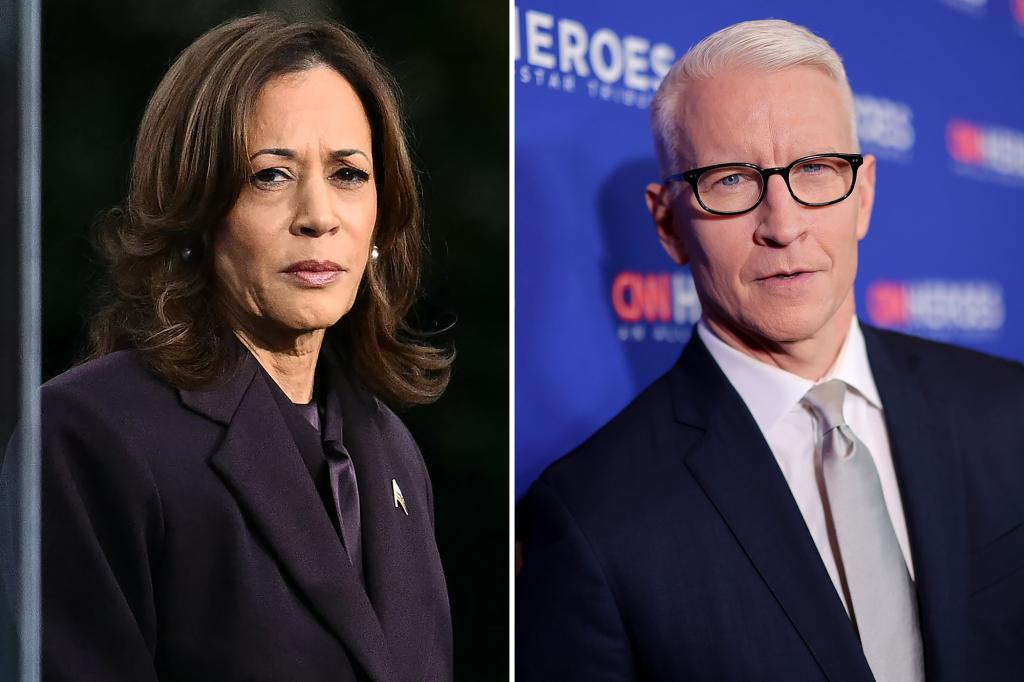

Kamala Harriss Heated Exchange Strong Words For Anderson Cooper After Biden Debate Discussion

May 24, 2025

Kamala Harriss Heated Exchange Strong Words For Anderson Cooper After Biden Debate Discussion

May 24, 2025 -

Memorial Day 2025 Wantaghs Parade And Weekend Events Schedule

May 24, 2025

Memorial Day 2025 Wantaghs Parade And Weekend Events Schedule

May 24, 2025 -

Pacquiao Vs Barrios Retirement Over Las Vegas Title Fight Set

May 24, 2025

Pacquiao Vs Barrios Retirement Over Las Vegas Title Fight Set

May 24, 2025 -

Trump Ramaphosa Summit Controversy Over Presidents Burial Site Remark

May 24, 2025

Trump Ramaphosa Summit Controversy Over Presidents Burial Site Remark

May 24, 2025

Latest Posts

-

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025

Tsmc Q2 Profit Jumps 61 Exceeding Expectations Amidst Robust Ai Chip Demand

Jul 17, 2025 -

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025

Nvidias Ai Chip Sales To China A Reversal Of Us Export Controls

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025

Love Island Usas Amaya And Bryan Post Show Relationship Update

Jul 17, 2025 -

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025

Ynw Melly Double Murder Case Retrial Set For September Following Mistrial

Jul 17, 2025 -

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025

De Chambeau Explains Why Public Courses Present Unexpected Challenges

Jul 17, 2025