Unexpected Rise In Government Borrowing Figures For April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unexpected Rise in Government Borrowing Figures for April: What Does it Mean?

The UK government's borrowing figures for April have shocked economists, revealing a significantly higher-than-expected level of debt. The announcement has sent ripples through financial markets and sparked intense debate about the government's fiscal strategy. This unexpected surge raises serious questions about the nation's economic outlook and potential implications for taxpayers.

A Stark Departure from Projections:

The Office for National Statistics (ONS) reported government borrowing of £20.6 billion for April, a figure substantially exceeding the £10 billion forecast by economists. This represents the second-highest April borrowing since records began and is a dramatic increase compared to the £1.7 billion borrowed in April 2022. This unexpected rise significantly impacts the government's already ambitious fiscal targets.

Factors Contributing to the Unexpected Rise:

Several factors contributed to this unexpected jump in borrowing figures. Analysts point to a confluence of issues, including:

-

High Inflation and Increased Spending: Persistently high inflation continues to exert pressure on government finances. Increased costs across various sectors, particularly energy and social welfare payments, necessitate greater government spending. This increased expenditure directly impacts borrowing figures.

-

Tax Revenue Underperformance: While tax receipts are generally expected to rise with inflation, the actual increase has fallen short of projections. This discrepancy could be attributed to various factors, including a slowdown in economic growth and changes in tax policies. A deeper dive into the specific tax revenue streams is needed to understand this shortfall.

-

Impact of the Cost of Living Crisis: The ongoing cost of living crisis, fuelled by high inflation and energy prices, has placed considerable strain on household budgets. This economic downturn can indirectly impact government revenue streams.

Implications for the UK Economy:

This unexpected rise in government borrowing has significant implications for the UK economy:

-

Increased National Debt: The higher-than-expected borrowing contributes to the already substantial national debt, raising concerns about long-term fiscal sustainability. This increasing debt burden could potentially limit the government's ability to respond to future economic shocks.

-

Interest Rate Hikes: The increased borrowing could put further upward pressure on interest rates. The Bank of England might be forced to consider more aggressive interest rate hikes to control inflation, potentially further impacting economic growth and household finances.

-

Fiscal Policy Scrutiny: The unexpected figures are likely to intensify scrutiny of the government's fiscal policy. The government will likely face increased pressure to implement measures to reduce the deficit and ensure long-term fiscal stability.

Looking Ahead:

The coming months will be crucial in assessing the government's response to this unexpected development. Further analysis of the data, including a breakdown of individual spending areas and tax revenue sources, is needed to gain a more comprehensive understanding of the situation. The government's upcoming budget will be closely watched for any measures aimed at addressing the rising debt levels. This event underscores the need for careful monitoring of economic indicators and proactive fiscal management to ensure the stability of the UK economy.

Keywords: Government borrowing, UK economy, national debt, inflation, interest rates, fiscal policy, ONS, economic outlook, cost of living crisis, tax revenue, April borrowing figures.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unexpected Rise In Government Borrowing Figures For April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Viral Tik Tok Womans Unexpected Encounter With Pope Leo Her Former Bishop

May 23, 2025

Viral Tik Tok Womans Unexpected Encounter With Pope Leo Her Former Bishop

May 23, 2025 -

Cassie Venturas Testimony Supported Diddy Trial Expert Witness Analysis

May 23, 2025

Cassie Venturas Testimony Supported Diddy Trial Expert Witness Analysis

May 23, 2025 -

Hope From Gaza You Tube Star Ms Rachels Song With A Young Double Amputee

May 23, 2025

Hope From Gaza You Tube Star Ms Rachels Song With A Young Double Amputee

May 23, 2025 -

Rayners Secret Memo Calls For Tax Increases Exposed

May 23, 2025

Rayners Secret Memo Calls For Tax Increases Exposed

May 23, 2025 -

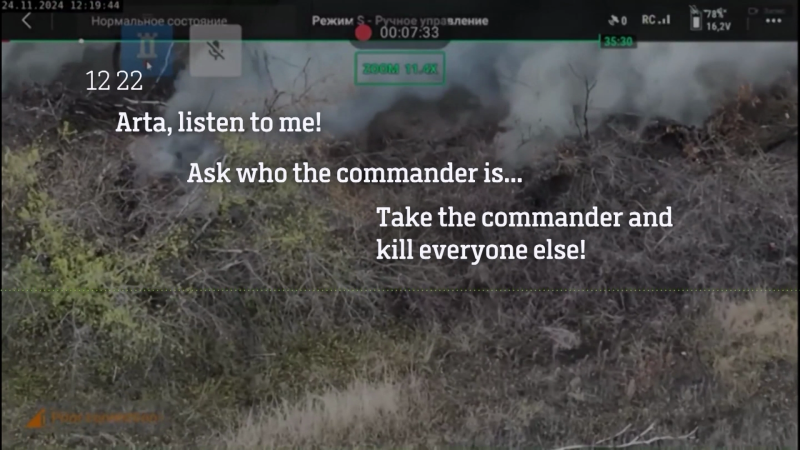

Disturbing Revelations Analysis Of Intercepted Russian Military Radio Transmissions

May 23, 2025

Disturbing Revelations Analysis Of Intercepted Russian Military Radio Transmissions

May 23, 2025

Latest Posts

-

Italy Eases Citizenship Requirements Great Grandparent Descent Now Allowed

May 23, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent Now Allowed

May 23, 2025 -

Dense Breasts Campaign Urges Nhs For Additional Cancer Scans

May 23, 2025

Dense Breasts Campaign Urges Nhs For Additional Cancer Scans

May 23, 2025 -

Wordle Puzzle May 22 2024 Guide Hints And Answer

May 23, 2025

Wordle Puzzle May 22 2024 Guide Hints And Answer

May 23, 2025 -

Dc Shooting Israeli Embassy Staff Targeted What We Know So Far

May 23, 2025

Dc Shooting Israeli Embassy Staff Targeted What We Know So Far

May 23, 2025 -

Mickey 17 Officially Arrives On Max Streaming Details Revealed

May 23, 2025

Mickey 17 Officially Arrives On Max Streaming Details Revealed

May 23, 2025