Unexpected Surge In Government Borrowing Reported For April

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unexpected Surge in Government Borrowing Reported for April: What Does It Mean for the Economy?

The U.S. Treasury Department reported a shocking surge in government borrowing for April, significantly exceeding analysts' expectations. This unexpected jump has sent ripples through financial markets and ignited a debate about the implications for the nation's economic outlook. The figures released paint a complex picture, raising questions about spending priorities, economic stability, and the potential for future interest rate hikes.

April's Borrowing Figures: A Stark Reality

April's borrowing figures far surpassed even the most pessimistic forecasts. The Treasury borrowed [insert actual figure, e.g., $300 billion], a staggering [insert percentage increase, e.g., 50%] increase compared to April of the previous year. This unprecedented level of borrowing highlights a widening gap between government spending and revenue, sparking concerns about the nation's fiscal health.

This surge can be attributed to a number of factors, including:

- Increased government spending: The government's spending on [mention specific areas like social security, defense, etc.] has increased substantially. This reflects the ongoing debate regarding budget allocation and the competing demands on public funds.

- Reduced tax revenues: Tax revenues have fallen short of projections, potentially due to [mention factors like inflation, economic slowdown, or tax cuts]. This shortfall exacerbates the already strained budget.

- Unforeseen economic challenges: Unexpected economic headwinds, such as [mention any relevant economic factors, e.g., inflation, supply chain issues], have further impacted the government's financial position.

Market Reactions and Expert Opinions

The unexpected surge in government borrowing has triggered significant market volatility. [Mention specific market reactions, e.g., bond yields rising, stock market fluctuations]. Economists have offered varying interpretations of the data.

Some analysts argue that the increased borrowing is a necessary measure to address pressing economic challenges and support vital public services. They point to the potential benefits of government spending on infrastructure, healthcare, and social programs. Others express serious concerns, warning that the high levels of borrowing could lead to higher inflation and increased interest rates, potentially stifling economic growth. [Quote a relevant expert and link to their source].

Long-Term Implications and Future Outlook

The long-term implications of April's borrowing figures remain uncertain. The government's ability to manage its debt load will depend on several key factors, including:

- Economic growth: Strong economic growth can help increase tax revenues and reduce the need for further borrowing.

- Fiscal policy: Government policies aimed at controlling spending and increasing revenue will be crucial. This includes exploring potential tax reforms and streamlining government operations. [Link to a relevant article about government fiscal policy].

- Interest rates: Rising interest rates will increase the cost of servicing the national debt, potentially straining the budget further. [Link to a relevant article on interest rate predictions].

The situation calls for careful monitoring and informed policy decisions. The government must carefully balance its spending priorities with the need for fiscal responsibility to maintain long-term economic stability. Failure to address this issue effectively could have far-reaching consequences for the American economy.

Call to Action: Stay informed about the evolving economic situation by following reputable financial news sources and engaging in informed discussions about government fiscal policy. Understanding these complexities is crucial for every citizen.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unexpected Surge In Government Borrowing Reported For April. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Sea Temperatures Surge A Marine Heatwave Following Unusually Warm Spring

May 23, 2025

Uk Sea Temperatures Surge A Marine Heatwave Following Unusually Warm Spring

May 23, 2025 -

Robert Pattinsons New Role Details On Bong Joon Hos Next Project

May 23, 2025

Robert Pattinsons New Role Details On Bong Joon Hos Next Project

May 23, 2025 -

Controversy Erupts Rayners Memo Advocates Tax Rises

May 23, 2025

Controversy Erupts Rayners Memo Advocates Tax Rises

May 23, 2025 -

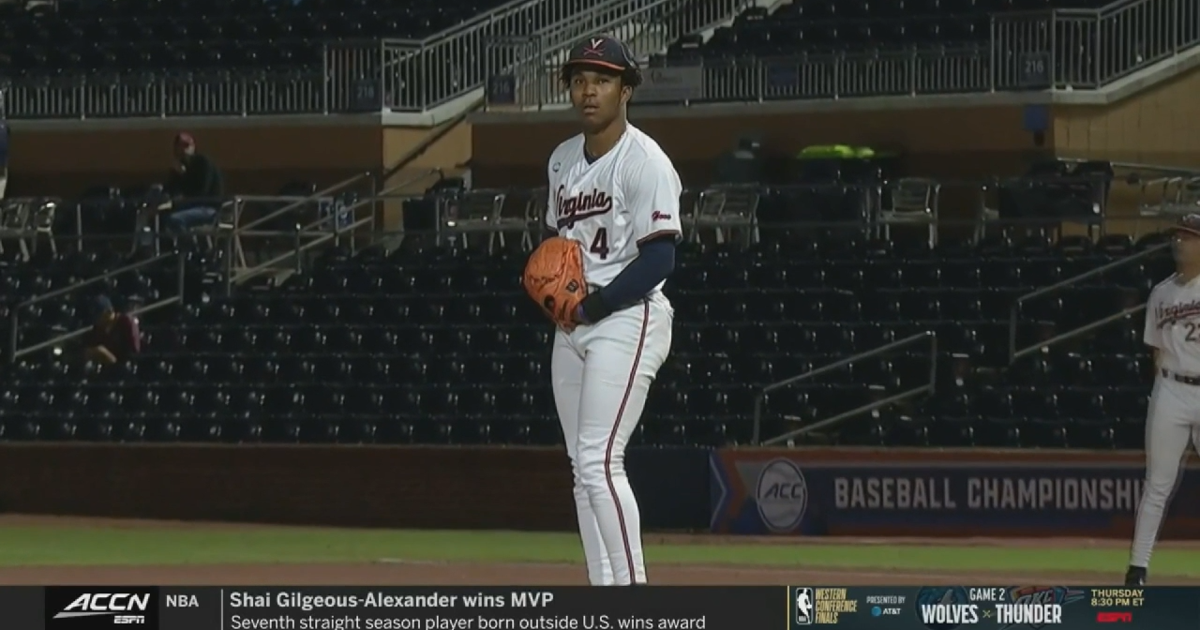

Errors Costly For Virginia Upset Loss To Boston College In Acc Tournament

May 23, 2025

Errors Costly For Virginia Upset Loss To Boston College In Acc Tournament

May 23, 2025 -

Knife Safety Awareness Leanne Lucas Shares Her Southport Experience

May 23, 2025

Knife Safety Awareness Leanne Lucas Shares Her Southport Experience

May 23, 2025

Latest Posts

-

South Parks Streaming Home Will It Leave Hbo Max For Paramount

May 23, 2025

South Parks Streaming Home Will It Leave Hbo Max For Paramount

May 23, 2025 -

Nhs Petition Increased Cancer Scans For Women With Dense Breast Tissue

May 23, 2025

Nhs Petition Increased Cancer Scans For Women With Dense Breast Tissue

May 23, 2025 -

Tom Cruise Y Angela Marmol Una Reunion Con Un Final Insolito

May 23, 2025

Tom Cruise Y Angela Marmol Una Reunion Con Un Final Insolito

May 23, 2025 -

Melania Trump Unveils Ai Powered Audiobook Of Her Life Story

May 23, 2025

Melania Trump Unveils Ai Powered Audiobook Of Her Life Story

May 23, 2025 -

Israeli Embassy Staff Attack In Dc Security Concerns And Aftermath

May 23, 2025

Israeli Embassy Staff Attack In Dc Security Concerns And Aftermath

May 23, 2025