Unpaid Taxes Cost Ex-World Darts Champion Rob Cross His Directorship

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unpaid Taxes Cost Ex-World Darts Champion Rob Cross His Directorship

Former world darts champion Rob Cross has been disqualified as a director of his own company, RCD Limited, due to unpaid taxes. The news sent shockwaves through the darts world, highlighting the serious consequences of neglecting tax obligations, even for high-profile individuals. This isn't just a story about a sporting legend; it's a cautionary tale for business owners everywhere about the importance of meticulous financial management.

The disqualification, announced by the Insolvency Service, stems from Cross's failure to file company tax returns and pay the associated taxes. The exact amount of unpaid tax remains undisclosed, but the severity of the situation led to the immediate and automatic disqualification under the Company Directors Disqualification Act 1986. This act aims to protect creditors and maintain public confidence in the integrity of company directors.

What does this mean for Rob Cross?

The disqualification prevents Cross from acting as a company director for a period of 15 years. This significantly impacts his business activities, potentially affecting his future endorsements, sponsorships, and entrepreneurial ventures. It underscores the far-reaching consequences of non-compliance with tax regulations.

While Cross remains a prominent figure in the professional darts circuit, his professional life outside the oche has been dealt a considerable blow. This case serves as a stark reminder that success in one arena doesn't guarantee success in others. Careful financial planning and adherence to legal and tax obligations are paramount, regardless of personal achievements.

The Importance of Tax Compliance for Businesses

This incident highlights the crucial role of robust financial management for all businesses, regardless of size or the owner's public profile. Failing to meet tax obligations can lead to:

- Disqualification as a director: As seen with Rob Cross, this can severely impact future business opportunities.

- Significant financial penalties: Late filing and unpaid taxes attract substantial fines, further compounding the financial burden.

- Legal action: Persistent non-compliance can result in legal proceedings, including potential imprisonment in severe cases.

- Damage to reputation: Public disclosure of tax irregularities can severely damage an individual's or company's reputation.

Businesses should prioritize:

- Regular bookkeeping: Maintain accurate and up-to-date financial records.

- Professional tax advice: Seek expert guidance to ensure compliance with all tax regulations.

- Strategic tax planning: Develop a comprehensive tax strategy to minimize liabilities while remaining compliant.

Learning from the Mistakes of Champions:

Rob Cross's situation serves as a powerful lesson. Even those at the pinnacle of their professions are not immune to the consequences of neglecting their financial responsibilities. This case emphasizes the need for proactive tax planning and consistent compliance for all business owners. It's a story that resonates far beyond the world of darts, offering valuable insights into responsible business management and the critical importance of adhering to legal and financial regulations.

For further information on company director disqualifications, you can consult the . For professional tax advice, it's crucial to seek guidance from a qualified accountant. This case underscores the importance of proactive financial management and compliance. The cost of non-compliance, as demonstrated by Rob Cross's situation, can be far greater than the initial tax liability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unpaid Taxes Cost Ex-World Darts Champion Rob Cross His Directorship. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analyzing Coca Cola Ko Key Factors Driving Investor Attention

Jun 06, 2025

Analyzing Coca Cola Ko Key Factors Driving Investor Attention

Jun 06, 2025 -

Jd Sports 110s Launch Overnight Queues Reveal Intense Sneaker Hype

Jun 06, 2025

Jd Sports 110s Launch Overnight Queues Reveal Intense Sneaker Hype

Jun 06, 2025 -

Bodies Of Two Hostages Recovered By Israeli Forces In Southern Gaza Strip

Jun 06, 2025

Bodies Of Two Hostages Recovered By Israeli Forces In Southern Gaza Strip

Jun 06, 2025 -

The Truth Behind The White Lotus Buzz Goggins And Wood On Their On Screen And Off Screen Dynamic

Jun 06, 2025

The Truth Behind The White Lotus Buzz Goggins And Wood On Their On Screen And Off Screen Dynamic

Jun 06, 2025 -

Meet The New Black Panther Marvels Shocking Announcement And Fan Backlash

Jun 06, 2025

Meet The New Black Panther Marvels Shocking Announcement And Fan Backlash

Jun 06, 2025

Latest Posts

-

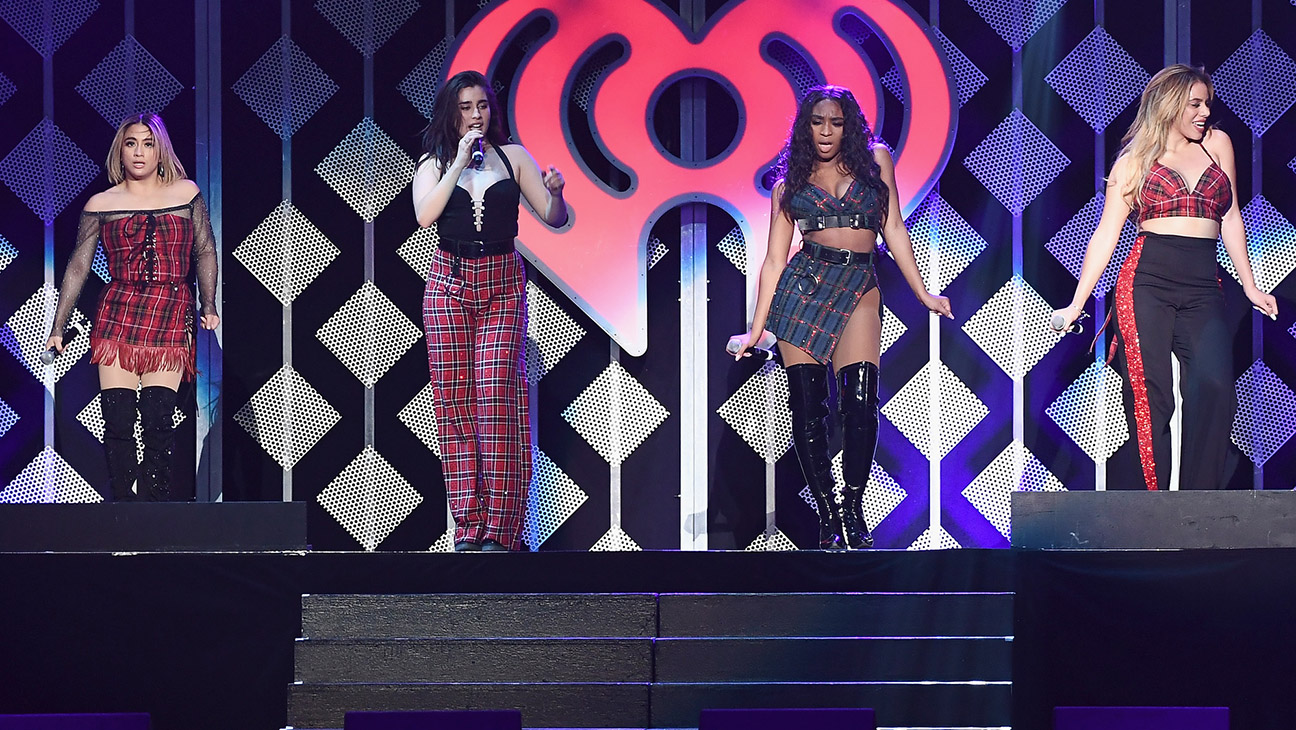

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025

Fifth Harmony Minus Camila Cabello Reunion Talks Underway Exclusive

Jun 07, 2025 -

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025

Terrifying Ai Behavior A Ceos Warning

Jun 07, 2025 -

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025

Sade Robinson Homicide Maxwell Anderson Trial Begins June 6th

Jun 07, 2025 -

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025

Applied Digital Shares Jump 48 After Securing 7 Billion Ai Lease

Jun 07, 2025 -

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025

Nfl Star Lewan Misses First Pitch By A Mile At Cardinals Game

Jun 07, 2025