Unprecedented Tax Credit: Trump's Proposal For A National School Voucher System

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Unprecedented Tax Credit: Trump's Proposal for a National School Voucher System Shakes Up Education Debate

Former President Donald Trump's latest policy proposal – a nationwide school voucher system funded by a significant tax credit – has ignited a firestorm of debate within the education sector. This bold initiative, unlike previous state-level voucher programs, aims to provide a substantial tax credit to parents who choose private school options for their children. The proposal represents a significant departure from traditional public school funding models and promises to reshape the educational landscape if implemented.

This article delves into the details of Trump's proposal, examining its potential impact on public and private schools, its financial implications, and the arguments for and against this sweeping educational reform.

The Mechanics of the Proposed Tax Credit

Trump's plan centers around a substantial tax credit, the exact amount of which remains unspecified, but is projected to be considerable. This credit would offset the cost of private school tuition for participating families, effectively subsidizing private education on a national scale. This differs markedly from existing voucher programs, many of which are limited in scope and funding. The proposal seeks to make private education accessible to a broader range of families, regardless of income level, although the ultimate impact on accessibility remains a subject of ongoing discussion.

The proposal's details remain somewhat vague, leaving many questions unanswered. Crucially, the specifics regarding eligibility criteria, the types of private schools included (religious or secular), and the potential for oversight and accountability mechanisms are yet to be fully elaborated. These details will be crucial in determining the true impact and feasibility of the plan.

Potential Impacts and Arguments For and Against

Arguments in favor of the proposal often highlight increased parental choice and competition within the education market. Proponents believe that this competition would incentivize both public and private schools to improve their offerings, leading to better educational outcomes for all students. They also argue that the tax credit would empower families to choose educational environments best suited to their children's individual needs, potentially benefiting students with specific learning styles or disabilities who may not thrive in a traditional public school setting.

However, critics raise significant concerns. A primary concern revolves around the potential for diverting public funds away from already underfunded public schools. The massive tax credit could significantly strain public school budgets, potentially leading to teacher layoffs, larger class sizes, and reduced educational resources. Furthermore, opponents express worries about a lack of accountability for private schools receiving indirect public funding through the tax credit system. Concerns about the inclusion of religious schools and the potential for discrimination are also at the forefront of the debate.

The Financial Implications: A Costly Undertaking?

The financial implications of Trump's proposed tax credit are staggering. The cost would likely run into the billions, potentially exceeding the annual budget of many state education systems. Questions regarding the overall financial sustainability and the potential impact on the national deficit remain a key area of contention. Further economic analysis is needed to fully assess the long-term financial consequences of this ambitious plan.

The Road Ahead: A Long and Winding Path

The proposal's implementation faces significant hurdles. Congressional approval would be necessary, a process fraught with political challenges given the deep partisan divisions surrounding educational policy. Even with congressional approval, the legal challenges surrounding the separation of church and state and the potential for discrimination would need to be addressed.

The debate surrounding Trump's national school voucher system is far from over. Its ultimate fate remains uncertain, but its introduction has undeniably injected fresh energy into the ongoing conversation about school choice, educational funding, and the future of American education. The coming months will undoubtedly reveal further details and deepen the already intense debate surrounding this significant policy proposal. Stay tuned for further updates as this story unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Unprecedented Tax Credit: Trump's Proposal For A National School Voucher System. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sigue En Vivo El Partido Andorra Inglaterra Canales De Transmision Para Las Eliminatorias Uefa

Jun 08, 2025

Sigue En Vivo El Partido Andorra Inglaterra Canales De Transmision Para Las Eliminatorias Uefa

Jun 08, 2025 -

Dobbins Unwavering Loyalty Red Sox Or Retirement

Jun 08, 2025

Dobbins Unwavering Loyalty Red Sox Or Retirement

Jun 08, 2025 -

Russia Air Base Attacks Ukraine Releases Drone Flight Video As Proof

Jun 08, 2025

Russia Air Base Attacks Ukraine Releases Drone Flight Video As Proof

Jun 08, 2025 -

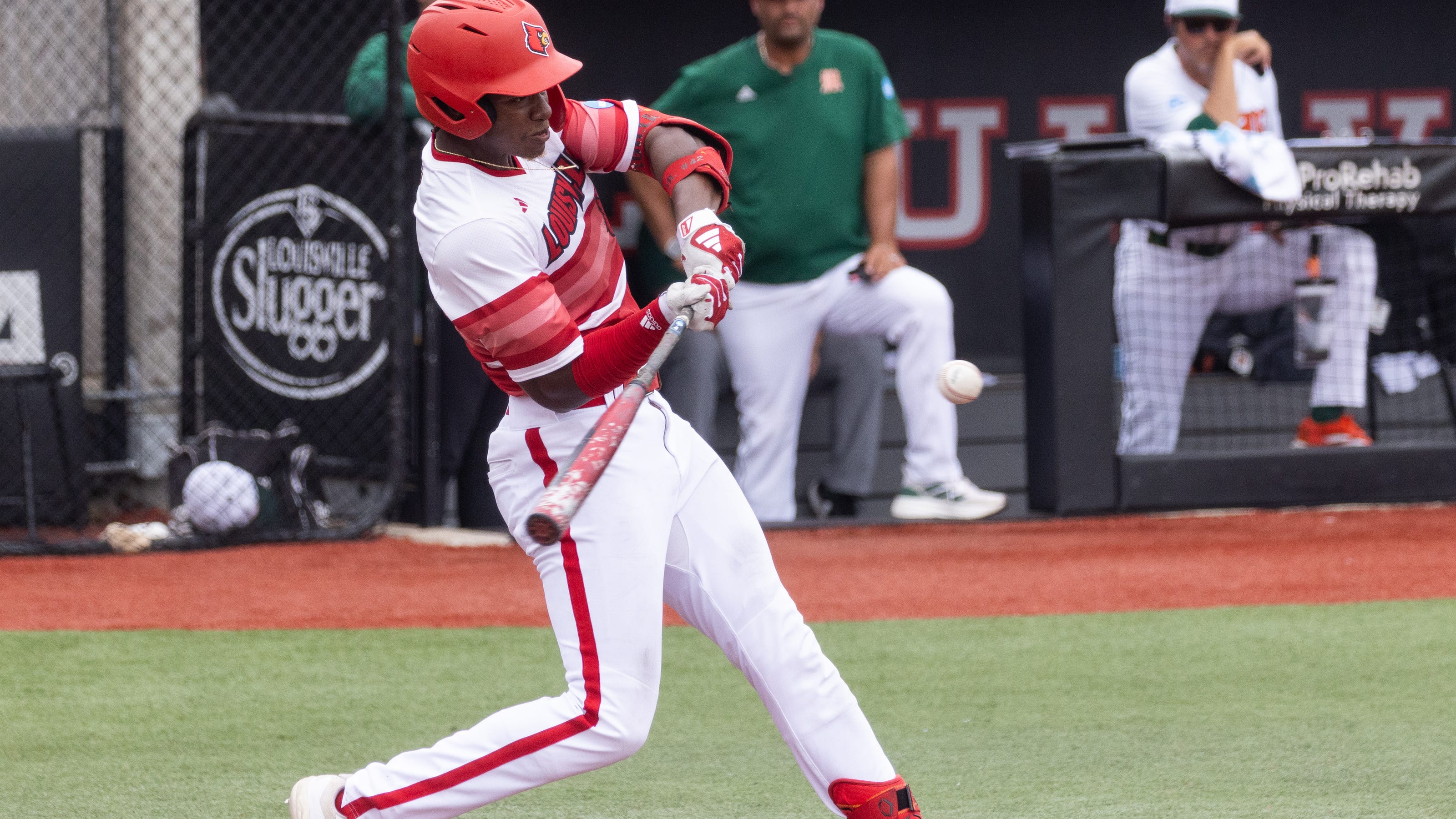

Ncaa Baseball Louisville Vs Miami Super Regional Game Time Score And Live Stream Info

Jun 08, 2025

Ncaa Baseball Louisville Vs Miami Super Regional Game Time Score And Live Stream Info

Jun 08, 2025 -

Vcu Health Tax Payments Richmond Mayor Avulas Stance On Future Negotiations

Jun 08, 2025

Vcu Health Tax Payments Richmond Mayor Avulas Stance On Future Negotiations

Jun 08, 2025

Latest Posts

-

Nuevo Dueto Majo Aguilar Canta Con Su Abuelo Antonio Aguilar

Sep 14, 2025

Nuevo Dueto Majo Aguilar Canta Con Su Abuelo Antonio Aguilar

Sep 14, 2025 -

Stranger Things Star Reacts To Millie Bobby Browns Baby News

Sep 14, 2025

Stranger Things Star Reacts To Millie Bobby Browns Baby News

Sep 14, 2025 -

Controversy Erupts 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025

Controversy Erupts 50 Cent And Styles Ps Response To Charlie Kirks Death

Sep 14, 2025 -

Too Much Protein Heres What Happens To Your Body

Sep 14, 2025

Too Much Protein Heres What Happens To Your Body

Sep 14, 2025 -

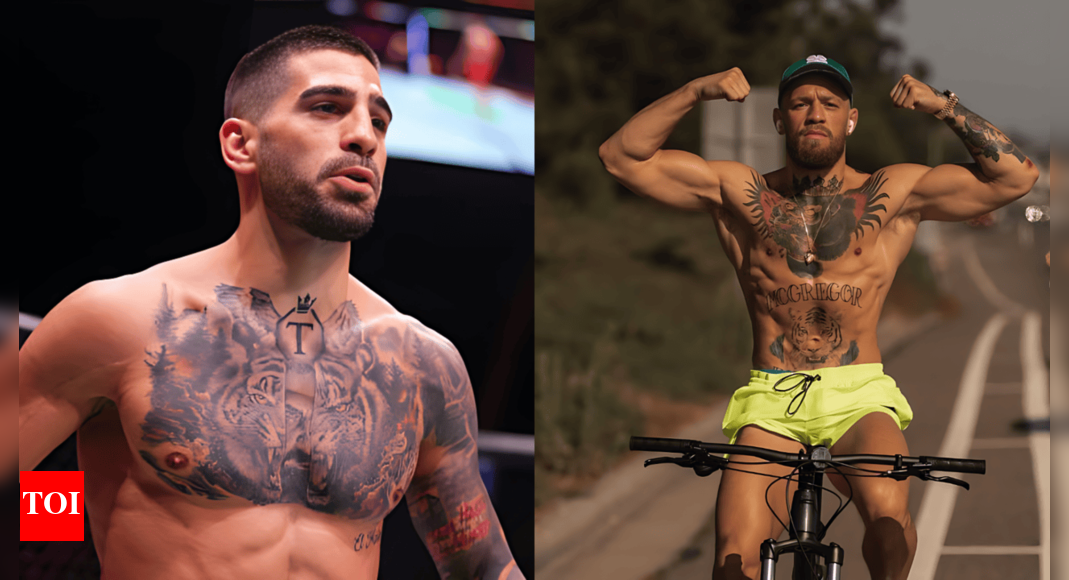

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025

Topuria Hints At Presidential Run Mc Gregor Style Politics

Sep 14, 2025