US-China Trade Deal: A Catalyst For META Stock Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US-China Trade Deal: A Catalyst for META Stock Growth?

The ongoing saga of US-China trade relations has sent ripples through global markets, leaving investors constantly seeking clarity and predicting the impact on various sectors. One company frequently caught in the crosshairs of this geopolitical chess match is Meta Platforms (META), formerly Facebook. But could a potential breakthrough in US-China trade negotiations actually act as a catalyst for META stock growth? Let's delve into the complexities.

The Connection: A Globalized Giant

Meta, with its vast user base spanning the globe, is intrinsically linked to international trade and technological exchange. China, despite regulatory hurdles, represents a significant – albeit currently untapped – potential market. Any easing of trade tensions between the US and China could positively impact META in several ways:

- Increased Access to the Chinese Market: While META's core platforms like Facebook and Instagram are currently blocked in China, a thawing of relations could open doors to potential future expansion, unlocking a massive user base and advertising revenue stream.

- Reduced Operational Costs: A less hostile trade environment could lead to lower tariffs on hardware and software imports, directly reducing META's operational costs and boosting profitability. This could be particularly relevant given META's significant investments in infrastructure and technological development.

- Improved Investor Sentiment: A positive shift in US-China relations generally boosts investor confidence, leading to increased investment in tech stocks, including META. Reduced geopolitical uncertainty contributes to a more stable and predictable investment landscape.

- Enhanced Global Supply Chain Efficiency: Smooth trade relations streamline the global supply chain, making it easier for META to procure components and manage its global operations more efficiently. This translates to improved margins and potentially higher stock valuations.

The Challenges Remain

However, it's crucial to acknowledge the persistent challenges. Even with a trade deal, significant regulatory hurdles remain in China, concerning data privacy, content moderation, and national security. These challenges could significantly limit META's ability to fully capitalize on the Chinese market, even if access were granted.

Furthermore, the current economic climate globally presents its own set of headwinds. Inflationary pressures, rising interest rates, and recessionary fears can all negatively impact investor sentiment and META's stock price, irrespective of US-China trade dynamics.

Analyzing the Potential:

While a US-China trade deal could offer a significant boost to META's long-term prospects, it's not a guaranteed path to immediate stock growth. The impact will depend on several factors, including:

- The scope and depth of the trade deal: A comprehensive agreement will likely have a more positive impact than a limited or piecemeal one.

- The speed of implementation: The quicker the agreement is implemented, the faster META could potentially benefit.

- The ongoing regulatory environment in China: Even with a trade deal, navigating China's regulatory landscape remains a significant challenge.

Conclusion: A Cautious Optimism

A successful US-China trade deal could indeed act as a catalyst for META stock growth, opening doors to new markets and reducing operational costs. However, investors should maintain a degree of caution, acknowledging the complexities of the geopolitical landscape and the persistent challenges in the Chinese market. The potential benefits are significant, but the realization of those benefits depends on several interconnected factors. This situation warrants continued monitoring and careful analysis before making any significant investment decisions. Stay updated on the latest developments in US-China relations and META's strategic moves to make informed investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US-China Trade Deal: A Catalyst For META Stock Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Flying Mallard Causes Traffic Stir In Switzerland

May 15, 2025

Flying Mallard Causes Traffic Stir In Switzerland

May 15, 2025 -

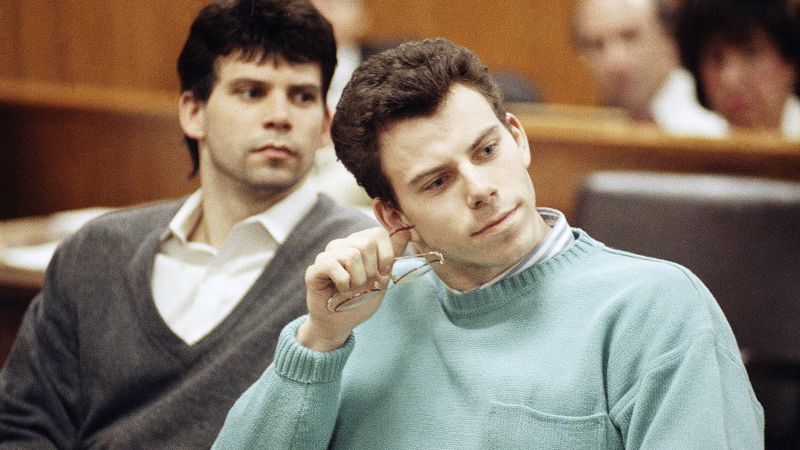

Erik And Lyle Menendez Could Face Resentencing

May 15, 2025

Erik And Lyle Menendez Could Face Resentencing

May 15, 2025 -

The Lasting Impact A Bbc Cameraman Haunted By Injured Gaza Children

May 15, 2025

The Lasting Impact A Bbc Cameraman Haunted By Injured Gaza Children

May 15, 2025 -

Double Play Robbery How Abreu And Rafaela Stole A Home Run From Carpenter

May 15, 2025

Double Play Robbery How Abreu And Rafaela Stole A Home Run From Carpenter

May 15, 2025 -

Andor Honoring The Fighters For Freedom

May 15, 2025

Andor Honoring The Fighters For Freedom

May 15, 2025

Latest Posts

-

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025

Deodorant Recall Alert 67 000 Units Recalled Across Walmart Dollar Tree Amazon

Jul 17, 2025 -

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025

Life After Love Island Usa Amaya And Bryans Relationship Update

Jul 17, 2025 -

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025

September 2025 Ynw Melly Faces Retrial In Double Homicide Case

Jul 17, 2025 -

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025

Love Island Usas Amaya And Bryan Building A Future Beyond The Villa

Jul 17, 2025 -

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025

September Retrial For Ynw Melly On Murder Charges After Jury Fails To Reach Verdict

Jul 17, 2025