US Economy Cools: Dismal 37,000 Private Sector Job Additions In May

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economy Cools: Dismal 37,000 Private Sector Job Additions in May Signal Potential Slowdown

The US economy showed signs of significant cooling in May, with a surprisingly weak 37,000 private sector job additions reported by payroll processor ADP. This figure falls drastically short of economists' expectations, which averaged around 180,000 new jobs, raising concerns about a potential economic slowdown and impacting investor sentiment. The weak jobs report casts a shadow over the upcoming official employment numbers from the Bureau of Labor Statistics (BLS), due out on Friday.

This unexpectedly dismal report suggests a potential shift in the economic landscape, moving away from the robust job growth seen earlier in the year. The implications are far-reaching, potentially influencing everything from interest rate hikes by the Federal Reserve to consumer confidence and overall economic growth forecasts.

What Drove the Weak Job Growth?

Pinpointing the exact causes for this significant drop in private sector job creation remains a subject of ongoing analysis. However, several factors likely contributed to the disappointing numbers:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are increasingly impacting borrowing costs for businesses. This makes expansion, hiring, and investment more expensive, potentially leading to reduced hiring activity.

- Lingering Inflationary Pressures: Although inflation has shown signs of easing, it remains stubbornly high. This continues to squeeze consumer spending and business profits, impacting job creation. [Link to recent inflation report from BLS]

- Uncertainty in the Global Economy: Geopolitical instability and global economic uncertainties also play a role. Businesses may be hesitant to commit to significant hiring in the face of such volatility.

- Sector-Specific Slowdowns: The slowdown may not be uniform across all sectors. Some industries might be experiencing more significant contraction than others. Further analysis of the ADP report will reveal sector-specific impacts.

Impact on the Federal Reserve's Policy Decisions

The weak jobs report adds complexity to the Federal Reserve's upcoming decision on interest rates. While stubbornly high inflation still warrants concern, the slowdown in job growth might lead the Fed to take a more cautious approach to future rate hikes. This uncertainty creates volatility in the financial markets. [Link to a reputable source discussing Fed policy]

What's Next?

The ADP report serves as a crucial precursor to the official BLS employment report. While the ADP data isn't always perfectly aligned with the BLS figures, it often provides a strong indication of the overall employment trend. The upcoming BLS report will provide a more comprehensive picture, clarifying the extent of the slowdown and offering crucial insights into the health of the US economy. Investors and economists alike will be closely watching for any further signals of economic cooling.

Looking Ahead: A Potential for Recession?

While it's too early to definitively declare a recession, this unexpectedly weak job growth report underscores growing concerns among economists. The coming weeks will be crucial in determining whether this represents a temporary blip or the beginning of a more sustained economic slowdown. Further data, including consumer spending and manufacturing output figures, will be key in assessing the overall economic trajectory. Stay tuned for updates as the situation unfolds.

Call to Action: Stay informed about the latest economic developments by following reputable financial news sources and subscribing to our newsletter for timely updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economy Cools: Dismal 37,000 Private Sector Job Additions In May. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

College Town Backyard Party Busted Police Disrupt All American Rejects Performance

Jun 05, 2025

College Town Backyard Party Busted Police Disrupt All American Rejects Performance

Jun 05, 2025 -

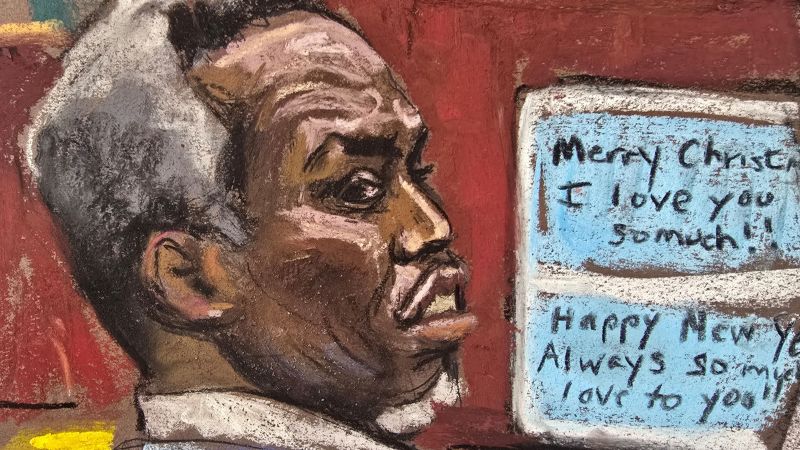

The Sean Diddy Combs Trial Timeline And Key Players

Jun 05, 2025

The Sean Diddy Combs Trial Timeline And Key Players

Jun 05, 2025 -

Sinner Reveals Weakness Against Alcaraz Ahead Of Potential Roland Garros Showdown

Jun 05, 2025

Sinner Reveals Weakness Against Alcaraz Ahead Of Potential Roland Garros Showdown

Jun 05, 2025 -

Roland Garros Days Play Recap Bublik Djokovic Triumph

Jun 05, 2025

Roland Garros Days Play Recap Bublik Djokovic Triumph

Jun 05, 2025 -

Elon Musks Government Resignation Jon Stewarts Ironic Response

Jun 05, 2025

Elon Musks Government Resignation Jon Stewarts Ironic Response

Jun 05, 2025

Latest Posts

-

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025

Ryo Otas Grand Slam Extends Orixs Hope In Late Inning Comeback

Aug 17, 2025 -

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025

Stalker 2 Roadmap Engine Upgrade Ps 5 And Potential Ps 5 Pro Release Date

Aug 17, 2025 -

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025

Topshops Second Act Challenges And Opportunities In The Fashion Industry

Aug 17, 2025 -

Northwests Low Livability Score Sparks Debate

Aug 17, 2025

Northwests Low Livability Score Sparks Debate

Aug 17, 2025 -

Stalker 2 Update Unreal Engine 5 Upgrade And Next Gen Console Release Details

Aug 17, 2025

Stalker 2 Update Unreal Engine 5 Upgrade And Next Gen Console Release Details

Aug 17, 2025