US Housing Market: Buyer Demand Plunges, Creating Seller's Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Housing Market: Buyer Demand Plunges, Creating a Seller's Market

The US housing market is experiencing a significant shift, with buyer demand plummeting and creating a burgeoning seller's market. This dramatic change, fueled by rising interest rates and persistent inflation, marks a stark contrast to the frenzied buyer's market of the past few years. Experts predict this trend will continue to impact home prices and the overall economic landscape.

Rising Interest Rates Chill Buyer Enthusiasm

The Federal Reserve's aggressive interest rate hikes to combat inflation have had a profound effect on the housing market. Higher mortgage rates translate to significantly higher monthly payments, effectively pricing many potential buyers out of the market. This decrease in affordability is the primary driver behind the slump in buyer demand. For example, a buyer who could afford a $500,000 home with a 3% interest rate might now only qualify for a $350,000 home with a 7% interest rate – a substantial difference.

Inflation's Impact on Purchasing Power

Beyond interest rates, rampant inflation is also eroding purchasing power. The rising cost of everyday goods and services leaves less disposable income for potential homebuyers, further dampening demand. This combination of higher borrowing costs and reduced disposable income creates a perfect storm for a cooling housing market.

A Seller's Market Emerges

The reduced buyer demand has created a noticeable shift in market dynamics. What was once a highly competitive buyer's market, characterized by bidding wars and over-asking prices, is now tilting decisively in favor of sellers. While prices aren't necessarily skyrocketing, sellers are finding they have more leverage to negotiate favorable terms. Inventory remains relatively low in many areas, further solidifying the seller's advantage.

What Does This Mean for Homebuyers and Sellers?

-

For Buyers: The current market presents challenges. Expect less competition but also potentially higher interest rates and a need for more diligent financial planning. Working with a skilled real estate agent is crucial to navigating this complex landscape. Consider exploring options like adjustable-rate mortgages (ARMs) or waiting for interest rates to potentially decrease.

-

For Sellers: This is a favorable time to sell. While prices may not be as inflated as in the recent past, you'll likely face less competition and have more room to negotiate favorable terms. However, it's vital to price your property competitively to attract buyers in this more cautious market.

Looking Ahead: Predicting the Future of the US Housing Market

Predicting the future of the housing market is always challenging, but several factors will likely play a role in the coming months and years. These include:

- Further interest rate hikes by the Federal Reserve.

- The pace of inflation and its impact on consumer spending.

- Government policies aimed at stimulating or cooling the housing market.

- Continued fluctuations in housing inventory levels.

Experts are closely monitoring these factors, and the market's trajectory remains uncertain. However, one thing is clear: the days of ultra-competitive bidding wars are likely behind us, at least for the foreseeable future. The market is shifting, and understanding these changes is critical for both buyers and sellers.

Call to Action: Connect with a local real estate expert to discuss your specific situation and gain personalized advice for navigating the current market conditions. Understanding the current landscape is key to making informed decisions in this evolving market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Housing Market: Buyer Demand Plunges, Creating Seller's Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Barcelona F1 Qualifying Live Updates Results And Radio Commentary For The 2025 Spanish Gp

May 31, 2025

Barcelona F1 Qualifying Live Updates Results And Radio Commentary For The 2025 Spanish Gp

May 31, 2025 -

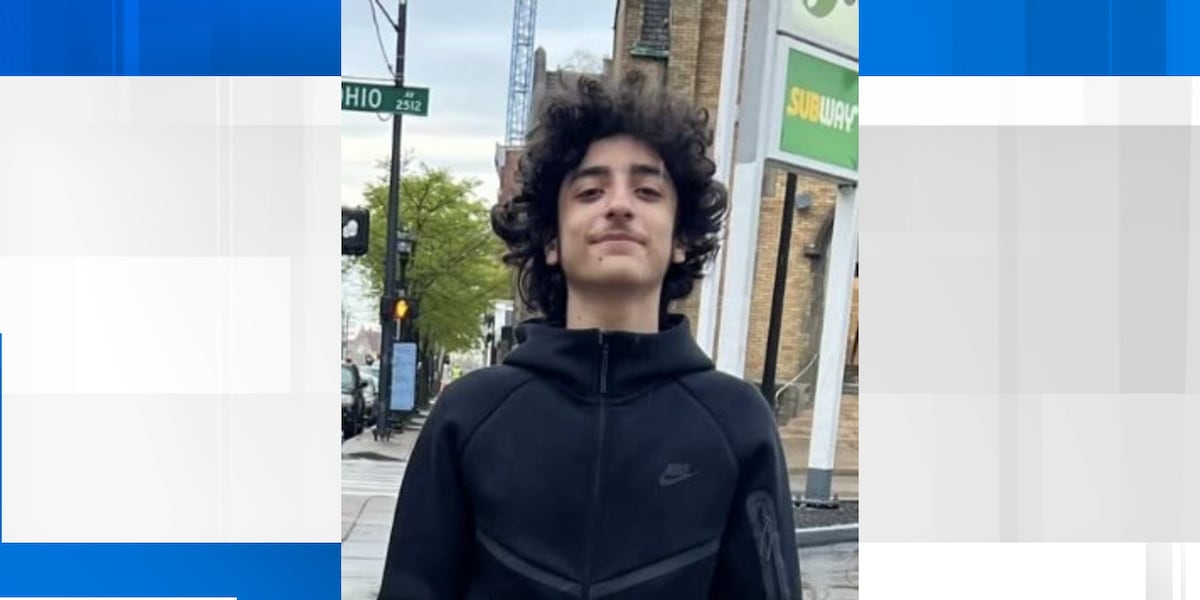

Endangered Missing Person Lexington Police Seek Publics Help In Finding Teen

May 31, 2025

Endangered Missing Person Lexington Police Seek Publics Help In Finding Teen

May 31, 2025 -

E L F Cosmetics Expands Empire With 1 Billion Acquisition Of Rhode Skin

May 31, 2025

E L F Cosmetics Expands Empire With 1 Billion Acquisition Of Rhode Skin

May 31, 2025 -

Bidding Opens Nancy Astors Diamond Tiara At Bonhams Auction House

May 31, 2025

Bidding Opens Nancy Astors Diamond Tiara At Bonhams Auction House

May 31, 2025 -

Relief In Sight Transportation Secretary Addresses Newark Airport Delays

May 31, 2025

Relief In Sight Transportation Secretary Addresses Newark Airport Delays

May 31, 2025

Latest Posts

-

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025

Jannik Sinner Vs Carlos Alcaraz A Us Open 2025 Draw Comparison

Aug 23, 2025 -

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025

Epping Asylum Hotel Government Challenges Court Ruling

Aug 23, 2025 -

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025

Government Launches Appeal Against Epping Asylum Hotel Ruling

Aug 23, 2025 -

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025

Us Open 2025 Preview Comparing Sinner And Alcarazs Draw Challenges

Aug 23, 2025 -

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025

Detroit Lions Vs Houston Texans Preseason Game Your Complete Viewing Guide

Aug 23, 2025