US Job Growth Stalls: Private Sector Adds Only 37,000 Jobs In May

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Job Growth Stalls: Private Sector Adds Only 37,000 Jobs in May – A Sign of Slowing Economy?

The US economy showed signs of significant slowdown in May, with private sector job growth dramatically stalling. The latest jobs report from the Bureau of Labor Statistics (BLS) revealed a paltry addition of only 37,000 jobs, a stark contrast to the robust growth expected by economists. This unexpectedly weak number has sent ripples through financial markets and ignited concerns about a potential recession. The figure falls far short of the 190,000 jobs economists had predicted, marking the weakest monthly gain since December 2020.

This significant slowdown raises critical questions about the health of the US economy and the effectiveness of the Federal Reserve's ongoing efforts to combat inflation. The underwhelming job creation data adds fuel to the debate surrounding a potential economic recession later this year.

What Drove the Dismal Job Growth Numbers?

Several factors likely contributed to the disappointing May jobs report. These include:

-

High Interest Rates: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are beginning to impact the economy. Higher borrowing costs make it more expensive for businesses to invest and expand, leading to reduced hiring. This cooling effect on business investment is a key element in understanding the current job market stagnation.

-

Uncertainty in the Banking Sector: The recent banking sector turmoil, following the collapse of Silicon Valley Bank and Signature Bank, may have created uncertainty among businesses, prompting them to delay hiring decisions. This uncertainty has rippled through the financial system, impacting credit availability and potentially dampening overall economic activity.

-

Inflationary Pressures: While inflation has begun to cool, it remains stubbornly high. This persistent inflation continues to squeeze consumer spending and business profits, further hindering job growth. The ongoing struggle to control inflation remains a significant challenge for policymakers.

What Does This Mean for the Future?

The weak May jobs report doesn't automatically signal an imminent recession, but it certainly casts a shadow over the economic outlook. Many economists are now revising their growth forecasts downward, increasing the likelihood of a recession in the coming months. The Federal Reserve will likely continue to closely monitor economic indicators, including employment data, before making any decisions on future interest rate adjustments.

The coming months will be crucial in determining whether this is a temporary blip or a more sustained slowdown. Continued weak job growth, coupled with other negative economic indicators, could increase the chances of a recession significantly.

Further Reading:

- (Replace with actual link)

- (Replace with actual link)

Looking Ahead: What to Watch For

Investors and economists will be closely scrutinizing upcoming economic data releases, particularly the next jobs report and consumer spending figures. Any further weakness in these key indicators could solidify concerns about a recessionary environment. The Federal Reserve's policy decisions will also remain under intense scrutiny, with the central bank walking a tightrope between controlling inflation and avoiding a hard economic landing. This situation highlights the complexities faced by policymakers as they navigate a challenging economic landscape. Stay informed and continue to monitor the economic news for further developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Job Growth Stalls: Private Sector Adds Only 37,000 Jobs In May. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Landmark Supreme Court Ruling Alters Landscape Of Reverse Discrimination Lawsuits

Jun 05, 2025

Landmark Supreme Court Ruling Alters Landscape Of Reverse Discrimination Lawsuits

Jun 05, 2025 -

The Smithsonians Newest Acquisition A Celebrated Football Jerseys Journey

Jun 05, 2025

The Smithsonians Newest Acquisition A Celebrated Football Jerseys Journey

Jun 05, 2025 -

50 000 Theft Pontardawe Mother Sentenced To Repay Stolen Funds

Jun 05, 2025

50 000 Theft Pontardawe Mother Sentenced To Repay Stolen Funds

Jun 05, 2025 -

Carl Nassib Nfls First Openly Gay Player

Jun 05, 2025

Carl Nassib Nfls First Openly Gay Player

Jun 05, 2025 -

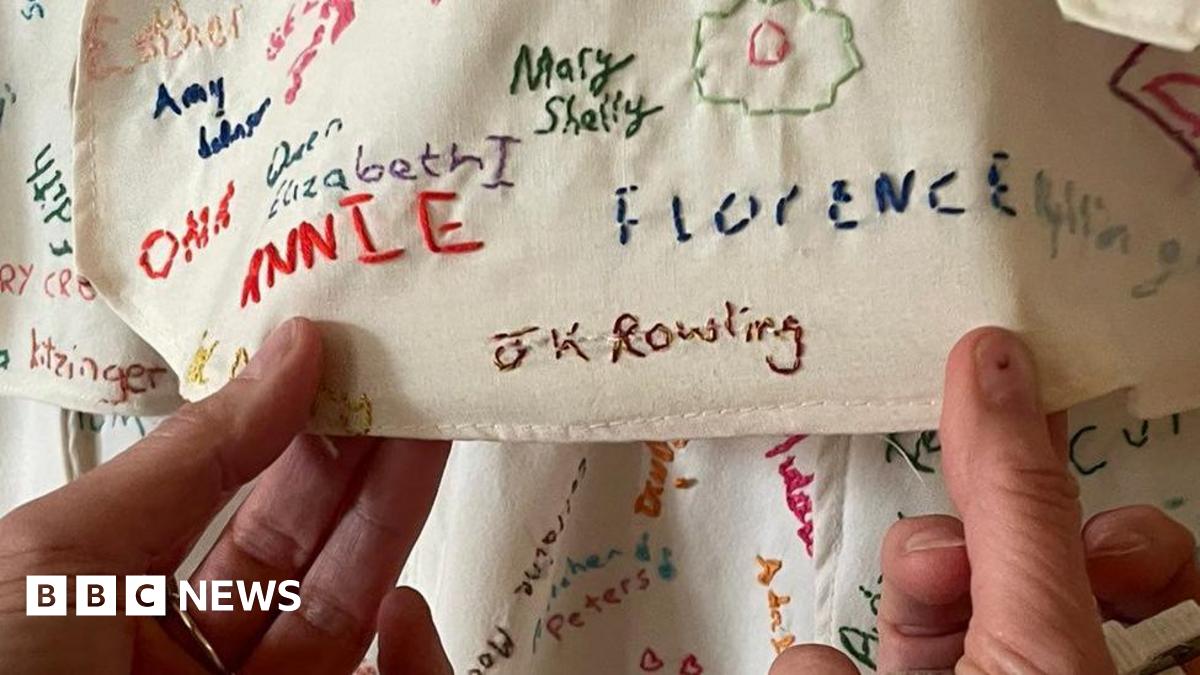

Derbyshire National Trust Site Hides Tampered Artwork J K Rowling Connection

Jun 05, 2025

Derbyshire National Trust Site Hides Tampered Artwork J K Rowling Connection

Jun 05, 2025

Latest Posts

-

Aldo De Nigris Jr Y Sus Polemicas En La Casa De Los Famosos 3 Un Analisis Completo

Aug 17, 2025

Aldo De Nigris Jr Y Sus Polemicas En La Casa De Los Famosos 3 Un Analisis Completo

Aug 17, 2025 -

The Beast In Me Review A Dark And Intense Drama With Danes And Rhys

Aug 17, 2025

The Beast In Me Review A Dark And Intense Drama With Danes And Rhys

Aug 17, 2025 -

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025

Cnns Kaitlan Collins Covering The Dc National Guard And The Trump Putin Summit

Aug 17, 2025 -

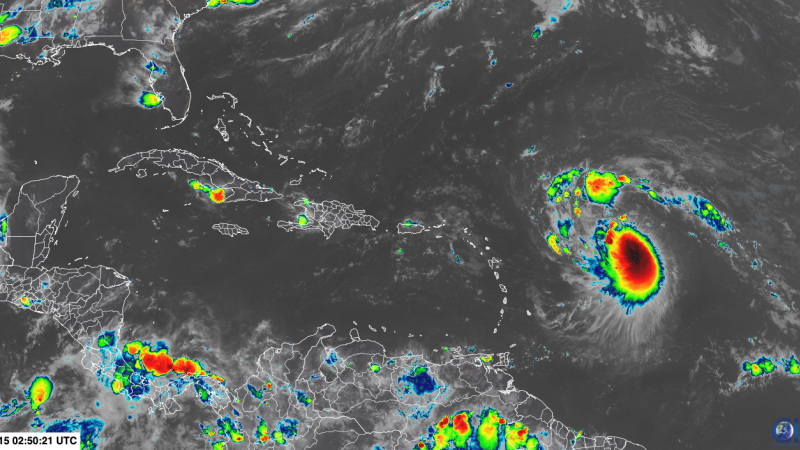

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025

Will Tropical Storm Erin Become The First Hurricane Of The Season

Aug 17, 2025 -

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025

Austin Butler And Matthew Mc Conaughey Lead Caught Stealing Red Carpet

Aug 17, 2025