US Small Parcel Tax: UK Firms Face Logistical Nightmare

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Small Parcel Tax: UK Firms Face Logistical Nightmare

The new US small parcel tax is creating a logistical nightmare for UK businesses, forcing them to grapple with increased costs and complex compliance procedures. This unexpected hurdle is impacting everything from small online retailers to large multinational corporations, threatening profitability and potentially hindering transatlantic trade. The implications are far-reaching, and understanding the intricacies of this tax is crucial for any UK firm exporting goods to the US.

Understanding the Impact of the New Tax

The US small parcel tax, primarily affecting shipments valued under a certain threshold (often varying by state), introduces significant challenges for UK businesses. These challenges extend beyond simply absorbing the additional cost. Here's a breakdown of the key issues:

-

Increased Costs: The most immediate impact is the increased cost per shipment. These added expenses directly impact profit margins, particularly for businesses operating on tight budgets. This price hike can make exporting to the US less attractive, forcing some businesses to reconsider their international strategies.

-

Complex Compliance: Navigating the complexities of US customs and tax regulations is a significant hurdle. Different states have different regulations, leading to a confusing patchwork of requirements. Businesses need to understand the specific thresholds, filing requirements, and potential penalties for non-compliance. Failure to comply can result in significant fines and delays, severely impacting business operations.

-

Administrative Burden: The administrative burden of managing this new tax is substantial. Businesses must dedicate resources to tracking shipments, calculating taxes, and filing the necessary paperwork. This can be particularly challenging for smaller businesses lacking dedicated logistics teams.

-

Potential for Delays: Incorrectly filed paperwork or a lack of understanding of the tax regulations can lead to significant delays in shipments. This can negatively affect customer satisfaction and damage a company's reputation. Delayed deliveries can also lead to lost sales and potential stock issues.

Strategic Responses for UK Businesses

Facing this logistical challenge, UK businesses need to adapt and implement effective strategies:

-

Invest in Logistics Expertise: Partnering with a logistics provider experienced in US customs and tax regulations is crucial. These specialists can navigate the complexities of the tax, ensuring compliance and minimizing delays.

-

Utilize Customs Brokerage Services: A customs broker can handle the import process, including the payment of duties and taxes. This frees up valuable time and resources within the business.

-

Review Pricing Strategies: A thorough review of pricing strategies is essential to account for the increased costs. Businesses may need to adjust their pricing models to maintain profitability whilst remaining competitive in the US market.

-

Stay Updated on Regulatory Changes: US tax and customs regulations are constantly evolving. Staying informed about changes is vital to avoid non-compliance issues. Subscribe to relevant newsletters and regularly check government websites for updates.

Looking Ahead: The Future of UK-US Trade

The US small parcel tax represents a significant challenge for UK businesses seeking to export to the US. However, with proactive planning, investment in expertise, and a commitment to compliance, businesses can mitigate the risks and continue to thrive in this important market. Failure to adapt, however, could severely impact the future of transatlantic trade for many UK companies. The situation underscores the need for clear communication and collaboration between governments to streamline cross-border trade and reduce unnecessary burdens on businesses. Further research into mitigating strategies and lobbying for clearer, more unified regulations is crucial for the long-term health of UK-US trade relations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Small Parcel Tax: UK Firms Face Logistical Nightmare. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controversial Ballooncraft Plan Scrapped At Heathrow Immigration

Aug 30, 2025

Controversial Ballooncraft Plan Scrapped At Heathrow Immigration

Aug 30, 2025 -

Nationwide Itch Epidemic Experts Investigate Widespread Skin Condition

Aug 30, 2025

Nationwide Itch Epidemic Experts Investigate Widespread Skin Condition

Aug 30, 2025 -

Oregon High School Football Week 0 Live Scores Schedule And Links

Aug 30, 2025

Oregon High School Football Week 0 Live Scores Schedule And Links

Aug 30, 2025 -

Is The Maga Agenda About To Succeed

Aug 30, 2025

Is The Maga Agenda About To Succeed

Aug 30, 2025 -

Will Prince Harry And King Charles Meet During Upcoming Uk Visit

Aug 30, 2025

Will Prince Harry And King Charles Meet During Upcoming Uk Visit

Aug 30, 2025

Latest Posts

-

Powerball Lottery 1 3 Billion Up For Grabs Following Latest Drawing

Sep 03, 2025

Powerball Lottery 1 3 Billion Up For Grabs Following Latest Drawing

Sep 03, 2025 -

Powerball Jackpot Hits Record 1 3 Billion After No Winner

Sep 03, 2025

Powerball Jackpot Hits Record 1 3 Billion After No Winner

Sep 03, 2025 -

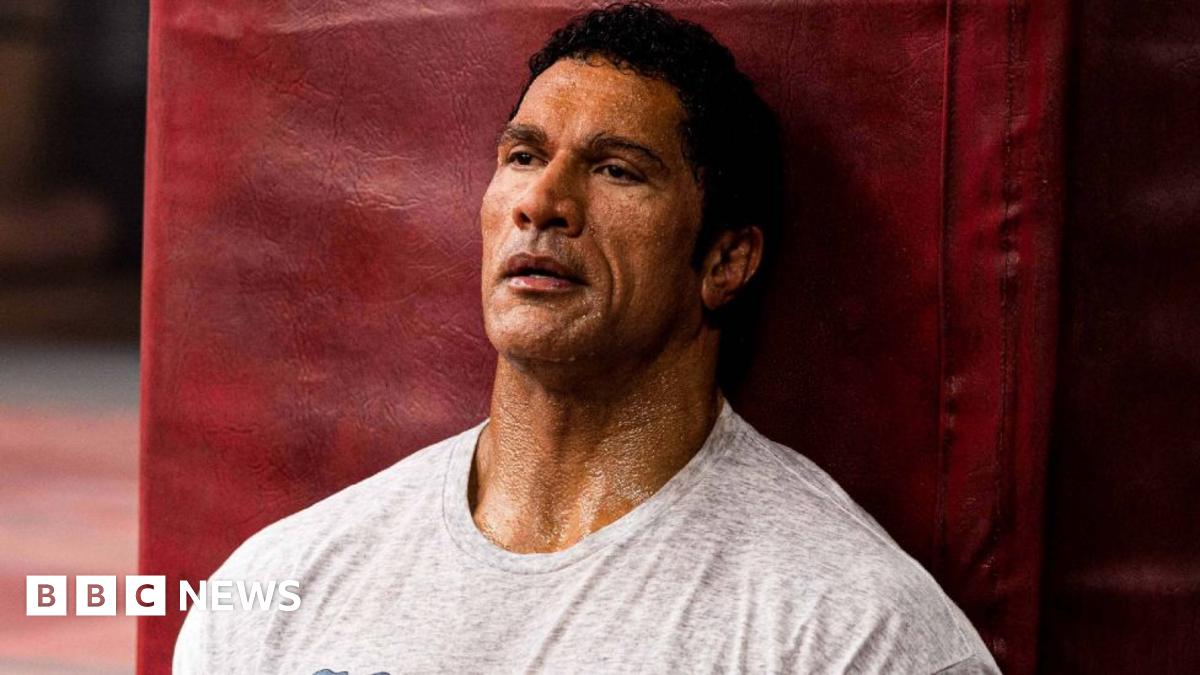

Could Dwayne Johnson Win An Oscar For Portraying Ufc Fighter Mark Kerr

Sep 03, 2025

Could Dwayne Johnson Win An Oscar For Portraying Ufc Fighter Mark Kerr

Sep 03, 2025 -

Grim Forecast Scotlands Drug Death Crisis To Continue As Europes Worst

Sep 03, 2025

Grim Forecast Scotlands Drug Death Crisis To Continue As Europes Worst

Sep 03, 2025 -

Mazda Export Collapse How Us Tariffs Negated Usmca Advantages

Sep 03, 2025

Mazda Export Collapse How Us Tariffs Negated Usmca Advantages

Sep 03, 2025