US Treasury Yields Decline Following Fed's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Fed Hints at 2025 Rate Cuts

US Treasury yields experienced a noticeable decline following the Federal Reserve's recent indication that interest rate cuts could be on the horizon as early as 2025. This shift in market sentiment reflects a growing expectation that the aggressive interest rate hiking cycle, implemented to combat inflation, may be nearing its end. The news sent ripples through the financial markets, prompting investors to reassess their strategies and prompting questions about the future trajectory of the US economy.

This article delves into the implications of the Fed's outlook, analyzing the factors influencing the decline in Treasury yields and exploring the potential consequences for investors and the broader economy.

Fed's Projected Rate Cuts Fuel Yield Decline

The Federal Reserve's revised economic projections, released alongside the minutes from its latest meeting, hinted at a potential rate cut in 2025. While the Fed remains committed to curbing inflation, the projection suggests a belief that inflation will cool sufficiently to warrant a shift in monetary policy. This forecast directly impacted investor expectations, leading to a sell-off in higher-yielding assets and a subsequent decrease in Treasury yields. The decreased demand for higher-yielding bonds, in anticipation of lower rates, naturally pushed yields down.

This move contrasts sharply with earlier predictions of higher rates for a longer period. The change in outlook signals a potential pivot in the Fed's strategy, a factor that is significantly affecting the bond market.

Understanding the Impact on Treasury Yields

Treasury yields move inversely to bond prices. When bond prices rise (due to increased demand), yields fall. Conversely, when bond prices fall (due to decreased demand), yields rise. The Fed's projection of future rate cuts increased demand for longer-term Treasury bonds, driving their prices up and consequently pushing down their yields. This dynamic is a key element in understanding the recent market movements.

What Does This Mean for Investors?

The decline in Treasury yields presents both opportunities and challenges for investors. For those seeking income, lower yields mean reduced returns on fixed-income investments. However, the lower yields also mean that bonds purchased now will offer a relatively higher return should interest rates rise again in the future. This presents a strategic opportunity for long-term investors with a higher risk tolerance. It's crucial for investors to carefully consider their individual financial goals and risk tolerance before making any investment decisions.

Looking Ahead: Uncertainties Remain

While the Fed's projection offers a glimpse into the potential future of monetary policy, several uncertainties remain. Inflation's trajectory, economic growth, and geopolitical factors could all impact the Fed's ultimate course of action. Consequently, investors should remain vigilant and monitor economic indicators closely. Experts advise diversification and a long-term investment strategy as a means to navigate the volatility of the market.

Conclusion: Navigating the Shifting Landscape

The decline in US Treasury yields following the Fed's 2025 rate cut outlook underscores the interconnectedness of monetary policy, investor sentiment, and market dynamics. While the projected rate cuts offer some relief, investors must remain aware of the inherent uncertainties and adapt their strategies accordingly. Careful analysis of economic indicators and a well-diversified portfolio are crucial for navigating the ever-shifting landscape of the financial markets. Consult with a financial advisor for personalized guidance based on your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Decline Following Fed's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Major Post Office Data Breach Leads To Compensation Payments

May 21, 2025

Major Post Office Data Breach Leads To Compensation Payments

May 21, 2025 -

Contradictions Exposed A Us Factory And The Trump Trade Policy Debate

May 21, 2025

Contradictions Exposed A Us Factory And The Trump Trade Policy Debate

May 21, 2025 -

Sesame Streets Future On Netflix Examining The Aftermath Of Lost Funding

May 21, 2025

Sesame Streets Future On Netflix Examining The Aftermath Of Lost Funding

May 21, 2025 -

Putin Demonstrates Trumps Waning Global Power

May 21, 2025

Putin Demonstrates Trumps Waning Global Power

May 21, 2025 -

Police Investigate Church Break In Two Boys Suspected

May 21, 2025

Police Investigate Church Break In Two Boys Suspected

May 21, 2025

Latest Posts

-

Church Defilement Santa Rosa Teens Charged With Public Indecency

May 21, 2025

Church Defilement Santa Rosa Teens Charged With Public Indecency

May 21, 2025 -

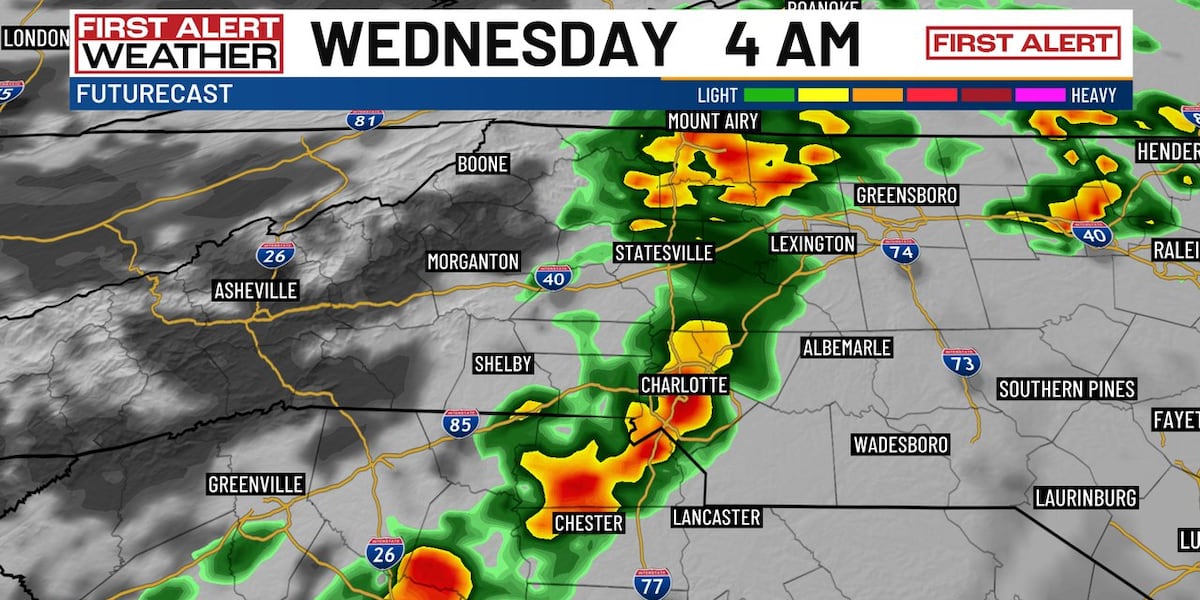

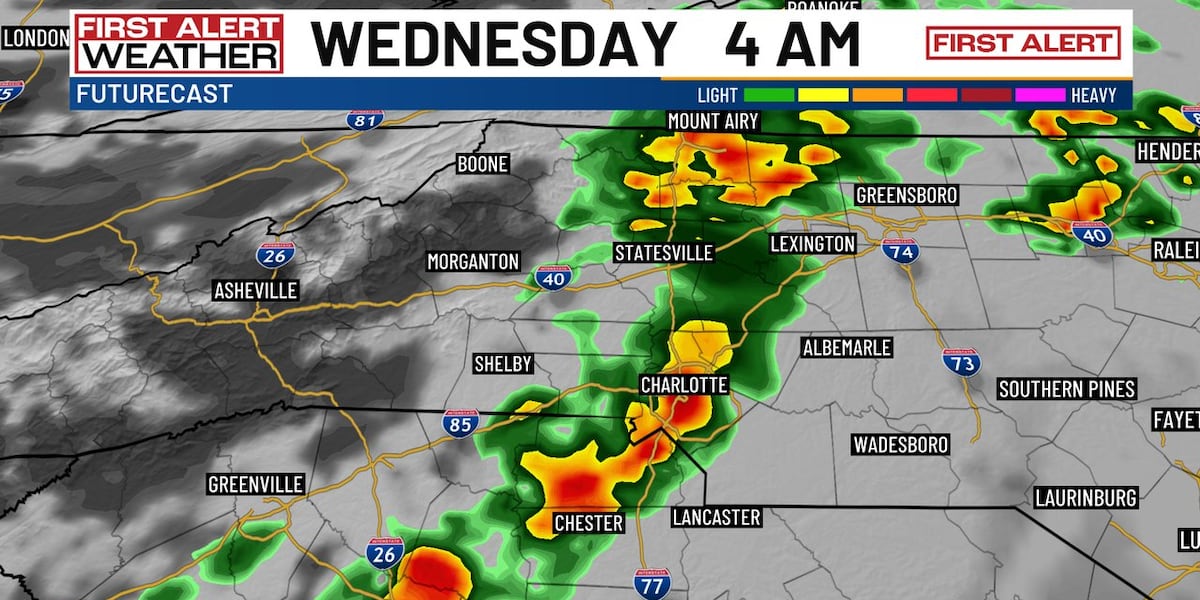

Charlotte Weather Incoming Overnight Storms Bring A Chilly Change

May 21, 2025

Charlotte Weather Incoming Overnight Storms Bring A Chilly Change

May 21, 2025 -

League Of Legends Hall Of Fame 2025 Concerns Over Potential Skin Price

May 21, 2025

League Of Legends Hall Of Fame 2025 Concerns Over Potential Skin Price

May 21, 2025 -

Severe Weather Alert Overnight Storms Hitting Charlotte Temperatures To Drop

May 21, 2025

Severe Weather Alert Overnight Storms Hitting Charlotte Temperatures To Drop

May 21, 2025 -

Post Brexit Britain Challenges And Opportunities For The Uk Economy

May 21, 2025

Post Brexit Britain Challenges And Opportunities For The Uk Economy

May 21, 2025