US Treasury Yields Fall As Fed Hints At One 2025 Rate Decrease

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Fall as Fed Hints at Potential 2025 Rate Decrease

A shift in Federal Reserve expectations sends ripples through the bond market.

The US Treasury bond market experienced a significant downturn on Wednesday, with yields across the curve falling sharply. This decline followed comments from Federal Reserve officials hinting at a potential interest rate cut as early as 2025. This unexpected shift in the Fed's projected trajectory has sparked considerable debate amongst market analysts and investors.

The 10-year Treasury yield, a key benchmark for borrowing costs, dropped below 4%, marking a notable decrease from recent highs. Similarly, the 2-year yield also experienced a considerable fall. This movement indicates a shift in investor sentiment, with a growing belief that the current aggressive monetary tightening cycle may be nearing its end.

What Drove the Treasury Yield Decline?

The primary catalyst for the decline in Treasury yields was the subtle, yet significant, change in communication from the Federal Reserve. While the Fed continues to emphasize its commitment to combating inflation, recent statements suggest a growing recognition of the potential economic slowdown. Several Fed officials have hinted at the possibility of interest rate cuts in 2025, contingent on inflation cooling sufficiently and economic growth remaining robust.

This nuanced shift in messaging differs from previous pronouncements which focused primarily on maintaining higher rates for an extended period. This subtle change is, however, creating a wave of reassessment in financial markets. The market’s reaction highlights the sensitivity of Treasury yields to even the slightest alteration in the Fed's projected policy path.

Implications for Investors and the Economy

The fall in Treasury yields has significant implications for various sectors of the economy:

- Mortgage rates: Lower Treasury yields often translate to lower mortgage rates, potentially stimulating the housing market. However, the impact will depend on other factors affecting the housing market, such as inflation and overall economic conditions.

- Corporate borrowing costs: Reduced Treasury yields can lower borrowing costs for corporations, potentially encouraging investment and economic growth. This, in turn, could influence corporate profitability and stock market performance.

- Dollar value: Changes in US interest rates can affect the value of the US dollar relative to other currencies. Lower yields could potentially weaken the dollar.

Uncertainty Remains

Despite the market's reaction, considerable uncertainty remains. The Fed's future actions will largely depend on upcoming economic data, particularly inflation figures. Any unexpected surge in inflation could lead to a reversal in the current trend, potentially driving Treasury yields higher again.

Furthermore, geopolitical events and global economic conditions continue to play a significant role in influencing investor sentiment and market movements. Therefore, while the recent decline in Treasury yields is notable, it's crucial to maintain a cautious perspective and acknowledge the potential for future volatility.

Conclusion: Navigating a Shifting Landscape

The fall in US Treasury yields highlights the ever-evolving nature of the financial markets and the critical role played by central bank communication. While the possibility of rate cuts in 2025 offers a glimmer of hope for investors, careful consideration of the remaining uncertainties is paramount. This situation underscores the need for diligent monitoring of economic indicators and Federal Reserve pronouncements for informed investment decisions. Staying informed on market trends through reputable financial news sources is crucial for navigating this dynamic landscape. [Link to a relevant financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall As Fed Hints At One 2025 Rate Decrease. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

La Guardia Airport Incident Federal Investigations Underway After Close Call

May 21, 2025

La Guardia Airport Incident Federal Investigations Underway After Close Call

May 21, 2025 -

A J Perez On Brett Favre Threats Untold And The Fall Of Favre

May 21, 2025

A J Perez On Brett Favre Threats Untold And The Fall Of Favre

May 21, 2025 -

Big Change Announced For New Peaky Blinders Series Creators Confirmation

May 21, 2025

Big Change Announced For New Peaky Blinders Series Creators Confirmation

May 21, 2025 -

Family Tragedy Near Railroad Tracks Two Dead Childrens Fate Uncertain

May 21, 2025

Family Tragedy Near Railroad Tracks Two Dead Childrens Fate Uncertain

May 21, 2025 -

Prehistoric Puzzle What Caused The Pachyrhinosaurus Die Off In Canada

May 21, 2025

Prehistoric Puzzle What Caused The Pachyrhinosaurus Die Off In Canada

May 21, 2025

Latest Posts

-

Cross Species Baby Abductions By Monkeys Baffle Scientists In Panama

May 21, 2025

Cross Species Baby Abductions By Monkeys Baffle Scientists In Panama

May 21, 2025 -

Legal Reform On Paedophile Parental Rights Sparks Family Backlash

May 21, 2025

Legal Reform On Paedophile Parental Rights Sparks Family Backlash

May 21, 2025 -

After Years Of Captivity A Hostages Family Recounts Their Joyful Reunion

May 21, 2025

After Years Of Captivity A Hostages Family Recounts Their Joyful Reunion

May 21, 2025 -

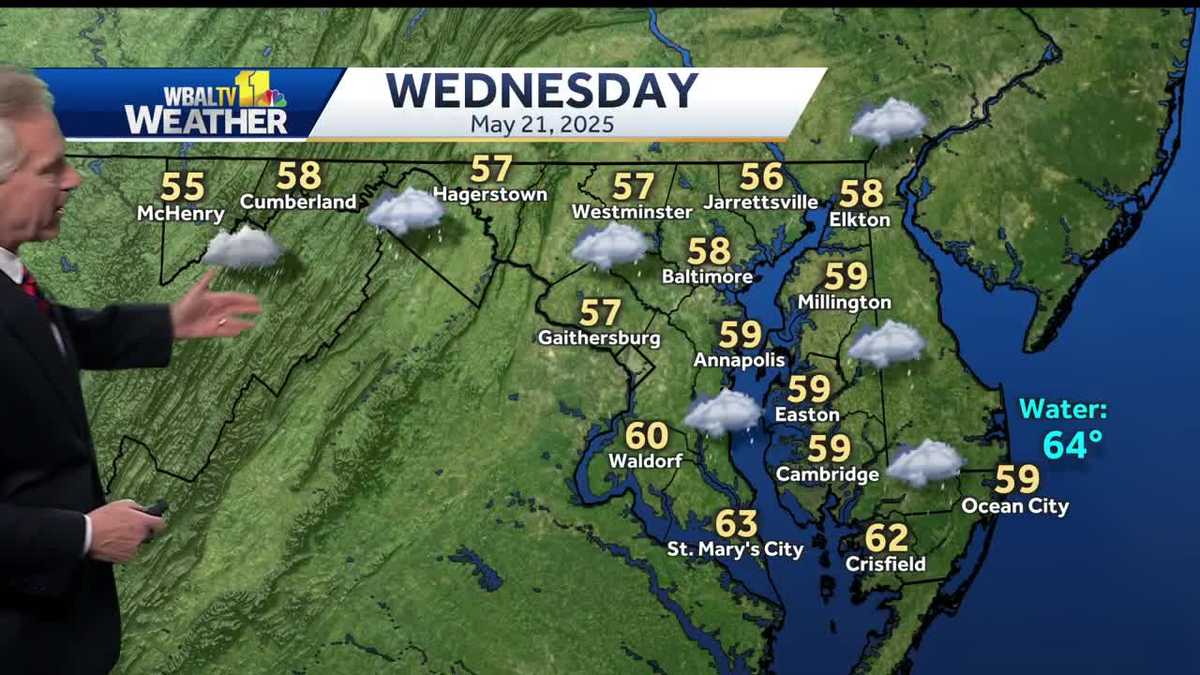

Rain And Chilly Temperatures Sweep The Region Wednesday

May 21, 2025

Rain And Chilly Temperatures Sweep The Region Wednesday

May 21, 2025 -

Vietnam Wars Napalm Girl World Press Photo Reopens Debate Over Image Attribution

May 21, 2025

Vietnam Wars Napalm Girl World Press Photo Reopens Debate Over Image Attribution

May 21, 2025