VRNA And Your Investments: Deciphering My Stocks Page Data

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

VRNA and Your Investments: Deciphering Your Stocks Page Data

The volatile world of investing can leave even seasoned professionals scratching their heads. Understanding your investment portfolio, especially when dealing with complex data surrounding companies like VRNA (assuming VRNA is a publicly traded company), requires careful analysis. This article will guide you through deciphering the information presented on your stocks page, focusing on how to interpret key data points relevant to your VRNA holdings and making informed investment decisions.

Understanding Your Stocks Page: A Quick Overview

Your online brokerage account's "stocks page" is your central hub for monitoring your investments. It provides a snapshot of your portfolio's performance, including details on individual stocks like VRNA. This page typically displays information such as:

- Current Price: The most recent trading price of VRNA. Fluctuations in this price directly impact your investment value.

- Day Change: The percentage or dollar amount by which VRNA's price has changed since the previous day's closing price. A positive value indicates a gain, while a negative value indicates a loss.

- Quantity: The number of VRNA shares you own.

- Cost Basis: The original price you paid for your VRNA shares, including any commissions or fees.

- Total Value: The current market value of your VRNA holdings, calculated by multiplying the current price by the quantity of shares.

- Gain/Loss: The difference between the total value and your cost basis. This shows your profit or loss on your VRNA investment.

- Gain/Loss Percentage: The percentage change in your VRNA investment's value relative to your cost basis.

Analyzing VRNA-Specific Data

Beyond the general portfolio overview, understanding VRNA-specific data is crucial for making sound investment choices. Look for these key metrics:

- Volume: The number of VRNA shares traded during a given period. High volume can indicate increased investor interest, but it doesn't always correlate with price increases.

- 52-Week High/Low: This shows the highest and lowest prices VRNA reached over the past year. This gives you a perspective on the stock's price range.

- Market Capitalization: The total market value of all outstanding VRNA shares. This metric reflects the overall size and valuation of the company.

- P/E Ratio (Price-to-Earnings Ratio): This compares VRNA's stock price to its earnings per share. A high P/E ratio may suggest the stock is overvalued, while a low P/E ratio may suggest it's undervalued. However, this should be considered alongside other factors.

- Dividend Yield (if applicable): If VRNA pays dividends, this shows the annual dividend payment relative to the stock price.

Beyond the Numbers: Fundamental and Technical Analysis

While your stocks page provides crucial quantitative data, remember that it's only part of the picture. For a comprehensive understanding of VRNA and its potential, consider:

- Fundamental Analysis: This involves analyzing VRNA's financial statements, business model, competitive landscape, and management team to assess its intrinsic value.

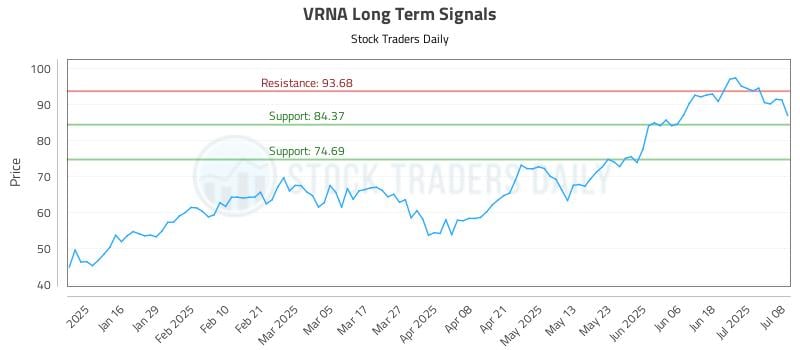

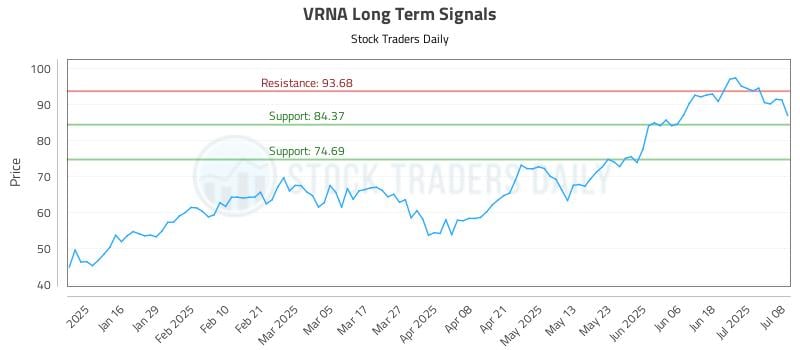

- Technical Analysis: This involves studying VRNA's price charts and trading patterns to identify potential trends and predict future price movements. Tools like moving averages and relative strength index (RSI) can be helpful here.

Making Informed Decisions

By carefully reviewing your stocks page data and conducting thorough fundamental and technical analysis, you can make more informed decisions regarding your VRNA investment. Remember that investing always carries risk, and past performance is not indicative of future results. Consult with a financial advisor if you need personalized guidance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on VRNA And Your Investments: Deciphering My Stocks Page Data. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Investigation Underway Following Police Shooting In Hollingbourne

Jul 10, 2025

Investigation Underway Following Police Shooting In Hollingbourne

Jul 10, 2025 -

Tour De France Rules Explained How Van Der Poel Secured The Yellow Jersey Despite Pogacars Equal Time

Jul 10, 2025

Tour De France Rules Explained How Van Der Poel Secured The Yellow Jersey Despite Pogacars Equal Time

Jul 10, 2025 -

Sexual Violence As A Weapon Israeli Experts On Hamass Genocidal Tactics

Jul 10, 2025

Sexual Violence As A Weapon Israeli Experts On Hamass Genocidal Tactics

Jul 10, 2025 -

Texas Floods Senator Cruz Cuts Short Greece Trip

Jul 10, 2025

Texas Floods Senator Cruz Cuts Short Greece Trip

Jul 10, 2025 -

Live Stream Jannik Sinner Vs Ben Shelton Wimbledon Quarterfinal Match Today

Jul 10, 2025

Live Stream Jannik Sinner Vs Ben Shelton Wimbledon Quarterfinal Match Today

Jul 10, 2025