Wall Street's Odd Bets: Analyzing Recent Unusual Trading Patterns

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's Odd Bets: Decoding the Recent Surge in Unusual Trading Activity

Wall Street, the epicenter of global finance, is known for its volatility. But recently, unusual trading patterns have captivated market watchers, prompting questions about the underlying forces driving these unexpected market movements. From seemingly inexplicable spikes in obscure stocks to massive options trading activity, analysts are scrambling to decipher the meaning behind these "odd bets." This article delves into the recent surge in unusual trading activity, exploring potential causes and their implications for the broader market.

The Rise of Retail Investors and Meme Stocks: A Continued Influence?

The impact of retail investors, particularly those active on social media platforms, continues to be a significant factor. The rise of "meme stocks" in recent years demonstrated the power of coordinated retail trading, capable of significantly influencing stock prices, often defying traditional valuation metrics. While the fervor around specific meme stocks may have cooled, the underlying influence of retail traders remains a potent force shaping market dynamics. This decentralized, often unpredictable, element adds complexity to analyzing unusual trading patterns. Understanding the sentiment and collective action of these retail investors is crucial for interpreting market fluctuations.

Algorithmic Trading and High-Frequency Strategies: The Invisible Hand?

Another key player in the unusual trading activity landscape is the increasing sophistication of algorithmic trading. High-frequency trading (HFT) firms, utilizing complex algorithms and powerful computing resources, execute millions of trades per second. These algorithms can react to market changes far faster than human traders, potentially creating short-term price fluctuations that appear unusual to casual observers. The opaque nature of these algorithms makes it difficult to pinpoint their exact influence, adding another layer of complexity to the analysis of unusual trading patterns. The interconnectedness of these algorithms and their potential for cascading effects warrants further investigation.

Geopolitical Events and Macroeconomic Factors: A Broader Context

Beyond the realm of individual stock movements, it's essential to consider the broader macroeconomic context. Geopolitical instability, shifts in monetary policy, and unexpected economic data releases can all contribute to unusual trading patterns. For example, escalating geopolitical tensions might lead to a sudden surge in demand for safe-haven assets like gold or government bonds, creating noticeable shifts in trading volume and price. Similarly, an unexpected inflation report could trigger widespread selling or buying activity across various asset classes.

Analyzing Specific Examples: Case Studies in Unusual Trading

While pinpointing specific examples requires careful consideration of market sensitivity and potential for misinterpretation, analyzing past instances of unusual trading activity can offer valuable insights. For example, a sudden spike in options volume for a relatively unknown company might signal insider knowledge or a coordinated effort to manipulate the stock price. Similarly, unusually high trading volume in a specific sector could reflect a broader market shift or emerging trend. These require in-depth analysis, considering factors such as news releases, regulatory filings, and overall market sentiment.

The Future of Unusual Trading Activity: Challenges and Opportunities

The increasing complexity of financial markets, fueled by technological advancements and the evolving role of retail investors, suggests that unusual trading activity will likely remain a feature of the modern financial landscape. This presents both challenges and opportunities. Regulators face the challenge of maintaining market integrity and preventing manipulation while allowing for innovation and competition. Meanwhile, investors and analysts can leverage advanced data analytics and machine learning to better understand these patterns and potentially capitalize on emerging opportunities.

Conclusion:

Analyzing unusual trading patterns on Wall Street requires a multifaceted approach, considering the interplay of retail investors, algorithmic trading, macroeconomic factors, and geopolitical events. While deciphering the precise causes behind these fluctuations remains challenging, understanding the various contributing factors is crucial for navigating the complexities of the modern financial markets. Continued research and analysis are essential for enhancing our understanding of these dynamic market forces.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Odd Bets: Analyzing Recent Unusual Trading Patterns. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

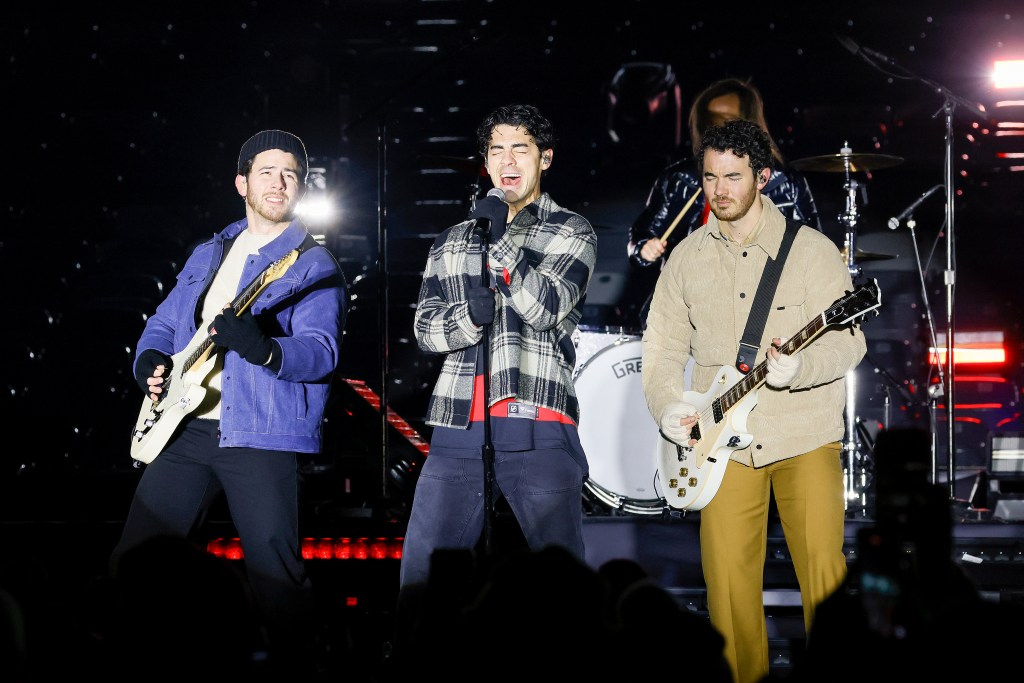

Chicago Fans Disappointed Jonas Brothers Cancel Wrigley Field Concert

Jun 14, 2025

Chicago Fans Disappointed Jonas Brothers Cancel Wrigley Field Concert

Jun 14, 2025 -

Mc Ilroy And Scheffler Fall Behind As Spaun Dominates Us Open 2025 At Oakmont

Jun 14, 2025

Mc Ilroy And Scheffler Fall Behind As Spaun Dominates Us Open 2025 At Oakmont

Jun 14, 2025 -

David Walliams Would I Lie To You Nazi Salute Deemed Unacceptable By Bbc

Jun 14, 2025

David Walliams Would I Lie To You Nazi Salute Deemed Unacceptable By Bbc

Jun 14, 2025 -

Is It Over Caitlin Clark And Conner Mc Cafferys Relationship In Jeopardy Following Public Social Media Post

Jun 14, 2025

Is It Over Caitlin Clark And Conner Mc Cafferys Relationship In Jeopardy Following Public Social Media Post

Jun 14, 2025 -

Can The Pacers Push The Thunder To The Brink Nba Finals Betting Analysis

Jun 14, 2025

Can The Pacers Push The Thunder To The Brink Nba Finals Betting Analysis

Jun 14, 2025

Latest Posts

-

Paige Bueckers Shares Unpopular Food Opinion A Shocking Revelation

Jun 15, 2025

Paige Bueckers Shares Unpopular Food Opinion A Shocking Revelation

Jun 15, 2025 -

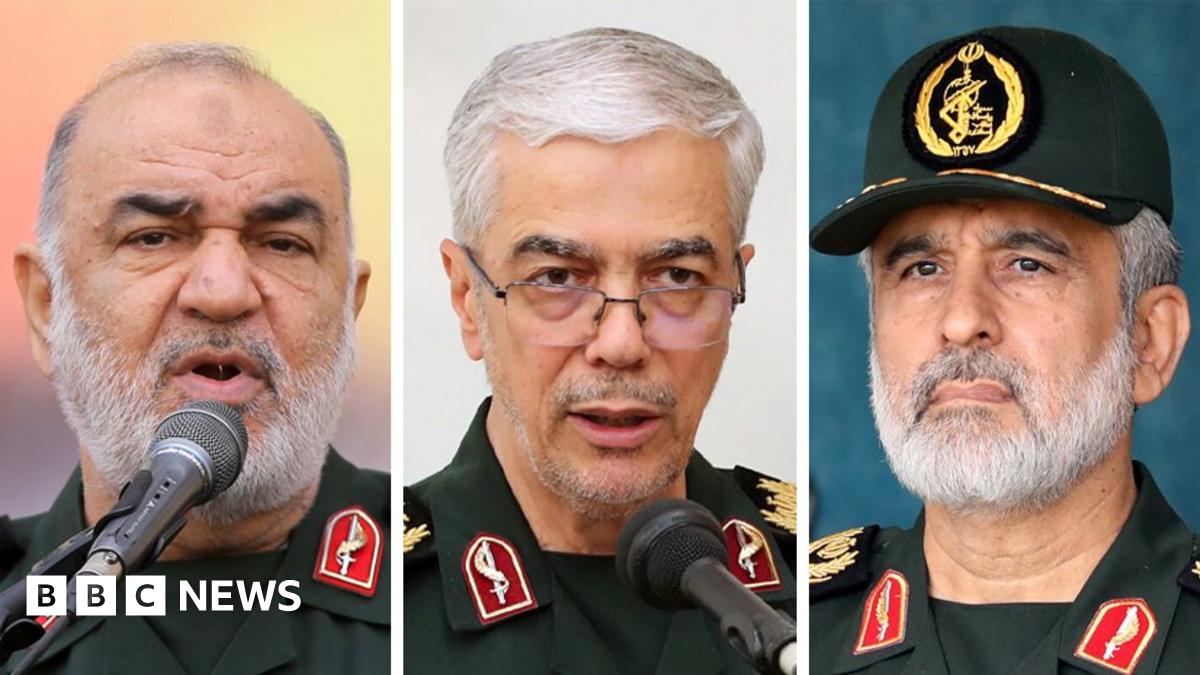

Who Died Confirming The Identities Of Iranian Commanders Killed By Israel

Jun 15, 2025

Who Died Confirming The Identities Of Iranian Commanders Killed By Israel

Jun 15, 2025 -

Shocking Affair Allegations Surface In Rhoc Season 19 Trailer

Jun 15, 2025

Shocking Affair Allegations Surface In Rhoc Season 19 Trailer

Jun 15, 2025 -

En Vivo Barcelona Sc Manta Fc Liga Pro Campeonato Nacional

Jun 15, 2025

En Vivo Barcelona Sc Manta Fc Liga Pro Campeonato Nacional

Jun 15, 2025 -

Is Spencers Winning Streak Over A Look At His Recent Results

Jun 15, 2025

Is Spencers Winning Streak Over A Look At His Recent Results

Jun 15, 2025