Wall Street's Strange Bets: Analyzing Unconventional Trading Strategies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's Strange Bets: Analyzing Unconventional Trading Strategies

Wall Street, the epicenter of global finance, is known for its high-stakes games and often-unpredictable movements. While traditional investment strategies remain prevalent, a fascinating undercurrent of unconventional trading approaches is gaining attention. These “strange bets,” as some call them, challenge conventional wisdom and offer intriguing insights into the ever-evolving landscape of financial markets. This article delves into some of these unique strategies, examining their potential, their risks, and their implications for the broader market.

Beyond Buy and Hold: Exploring Alternative Trading Strategies

The traditional "buy and hold" strategy, while reliable for long-term growth, isn't the only game in town. A growing number of investors are embracing more unconventional approaches, driven by factors like increased market volatility and the search for higher returns. These strategies often involve higher risk, but the potential rewards can be substantial. Let's examine a few:

-

Momentum Trading: This strategy capitalizes on trends. Investors identify assets exhibiting strong price momentum and bet on their continued upward trajectory. While potentially lucrative, it’s crucial to recognize that momentum can reverse quickly, leading to significant losses. Understanding is crucial for successful momentum trading.

-

Mean Reversion Trading: The opposite of momentum trading, this strategy anticipates that asset prices will eventually revert to their historical average. Investors bet on assets that are currently undervalued or overvalued, expecting them to return to their mean. This requires careful identification of appropriate historical data and an understanding of market cycles.

-

Arbitrage Trading: This strategy exploits price discrepancies between the same or similar assets across different markets. For instance, an investor might buy a stock on one exchange and simultaneously sell it on another, profiting from the price difference. This requires speed, efficiency, and a deep understanding of market mechanics.

-

Sentiment Analysis & Algorithmic Trading: Sophisticated investors are increasingly using advanced technologies like sentiment analysis (gauging market sentiment through news and social media) and algorithmic trading to identify opportunities. These automated systems can execute trades at lightning speed, capitalizing on fleeting market fluctuations. However, reliance on algorithms carries its own set of risks, including potential biases and vulnerabilities to hacking.

The Risks and Rewards of Unconventional Trading

While these strategies offer the potential for significant returns, it’s crucial to acknowledge the inherent risks. High leverage, volatile markets, and the complexities of these strategies can lead to substantial losses. Thorough due diligence, risk management, and a clear understanding of one's own risk tolerance are paramount.

Diversification is Key: Regardless of the strategy employed, diversification remains a cornerstone of sound investment. Spreading investments across different asset classes can mitigate risk and protect against significant losses.

The Future of Unconventional Trading on Wall Street

The adoption of unconventional trading strategies is likely to continue, driven by technological advancements and the search for alpha (above-average returns). As markets evolve, so too will the strategies employed by investors. Staying informed about these developments is crucial for anyone navigating the complexities of Wall Street.

Call to Action: Want to learn more about effective risk management strategies? Check out our (replace with a relevant link) for valuable insights. Remember, investment decisions should always align with your individual financial goals and risk tolerance. Consult a financial advisor before making significant investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Strange Bets: Analyzing Unconventional Trading Strategies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Opens Youngest Competitor A Unique Story

Jun 14, 2025

U S Opens Youngest Competitor A Unique Story

Jun 14, 2025 -

National Portrait Gallery Director Resignation Follows Trumps Call For Removal

Jun 14, 2025

National Portrait Gallery Director Resignation Follows Trumps Call For Removal

Jun 14, 2025 -

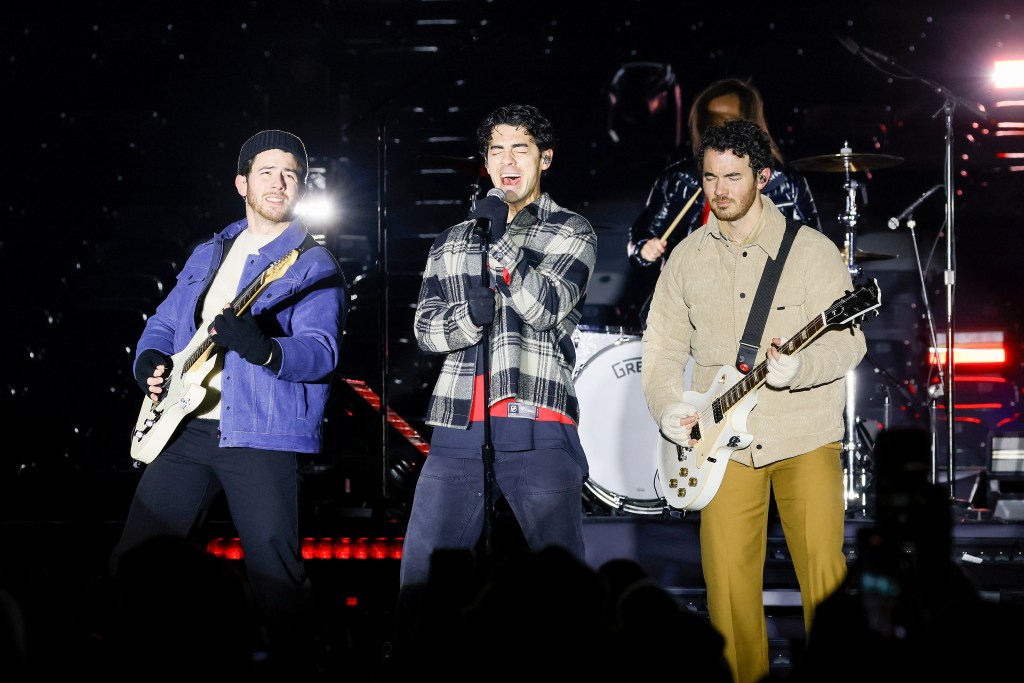

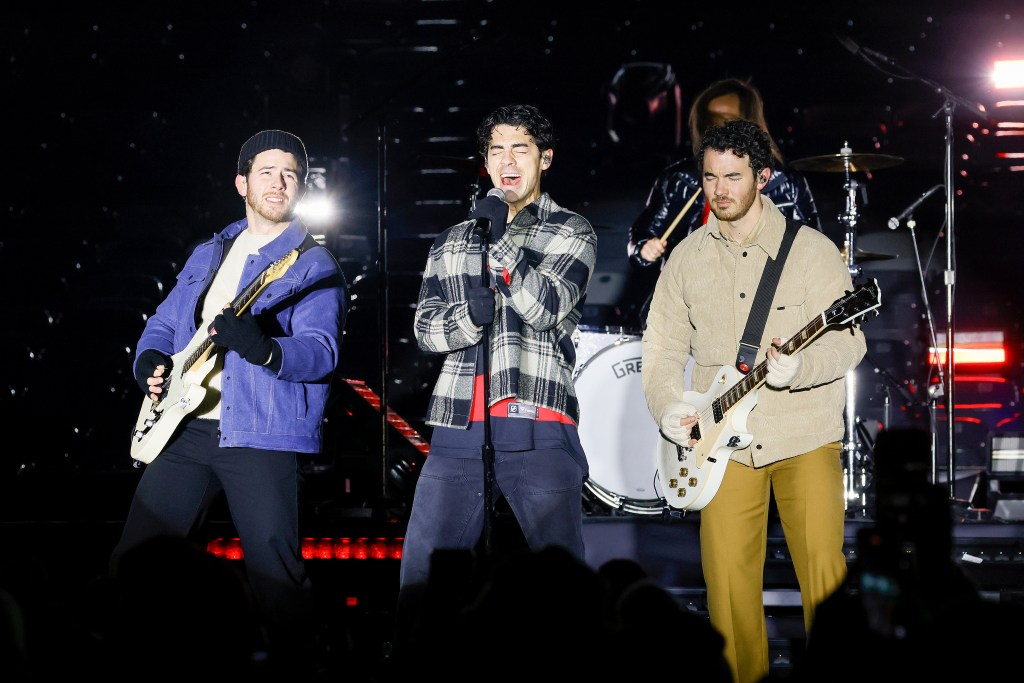

Update Jonas Brothers Cancel Multiple Concerts Including Wrigley Field

Jun 14, 2025

Update Jonas Brothers Cancel Multiple Concerts Including Wrigley Field

Jun 14, 2025 -

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025

Jonas Brothers Concert Cancellation Wrigley Field And Other Dates Affected

Jun 14, 2025 -

Against All Odds Pacers Bench Players Steal The Show Against The Thunder

Jun 14, 2025

Against All Odds Pacers Bench Players Steal The Show Against The Thunder

Jun 14, 2025

Latest Posts

-

Unscripted Gold Ben Stiller And Robert De Niro On An Unexpected Meet The Parents Moment

Jun 15, 2025

Unscripted Gold Ben Stiller And Robert De Niro On An Unexpected Meet The Parents Moment

Jun 15, 2025 -

Against All Odds The Sole Survivors Account Of The Fatal India Plane Crash

Jun 15, 2025

Against All Odds The Sole Survivors Account Of The Fatal India Plane Crash

Jun 15, 2025 -

Switch 2 Performance Specs And Early Impressions

Jun 15, 2025

Switch 2 Performance Specs And Early Impressions

Jun 15, 2025 -

Real Housewives Of Orange County Simpson Exposes Judge And Rossis Toxic Relationship

Jun 15, 2025

Real Housewives Of Orange County Simpson Exposes Judge And Rossis Toxic Relationship

Jun 15, 2025 -

Urgent Amber Warning For Severe Thunderstorms In East And South East England

Jun 15, 2025

Urgent Amber Warning For Severe Thunderstorms In East And South East England

Jun 15, 2025