Wall Street's Unusual Bets: Analyzing Recent Market Anomalies

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wall Street's Unusual Bets: Analyzing Recent Market Anomalies

Wall Street, the heartbeat of global finance, is known for its volatility. But lately, the market's pulse has been exhibiting some unusual rhythms, prompting analysts to dissect recent anomalies and speculate on their implications. From surprising surges in seemingly stagnant sectors to unexpected dips in previously robust markets, the current landscape presents a fascinating case study in unpredictable investment behavior. This article delves into some of the most intriguing recent market anomalies, exploring potential causes and offering insights for navigating this complex terrain.

H2: The Tech Sector's Unexpected Resilience

Despite widespread predictions of a prolonged tech downturn, certain segments of the tech sector have shown surprising resilience. While some tech giants have experienced significant setbacks, smaller companies focused on artificial intelligence (AI), cybersecurity, and cloud computing have defied expectations, exhibiting robust growth. This anomaly suggests a potential shift in investor sentiment, with a renewed focus on long-term growth prospects despite macroeconomic headwinds. Experts attribute this partly to the continued integration of AI into various sectors, creating a sustained demand for related technologies. This presents both opportunities and challenges for investors, requiring careful evaluation of individual company performance and sector-specific trends.

H2: The Rise of "Meme Stocks" – A Second Act?

The resurgence of interest in "meme stocks," those fueled by social media hype rather than traditional fundamental analysis, is another notable anomaly. While the initial frenzy subsided, recent price fluctuations in some meme stocks indicate a renewed speculative interest. This begs the question: is this a sustainable trend or a fleeting phenomenon? Experts remain divided, with some warning of potential risks associated with this volatile sector, while others point to the evolving dynamics of retail investment and the influence of social media on market sentiment. Understanding the psychology behind meme stock investments is crucial for navigating this unpredictable corner of the market. [Link to article on meme stock investing risks]

H3: The Impact of Geopolitical Events

Geopolitical instability continues to play a significant role in shaping market dynamics. Recent international events have created uncertainty, leading to unpredictable swings in various asset classes. This underscores the importance of diversifying investment portfolios and incorporating geopolitical risk assessments into investment strategies. Staying informed about global events and their potential market implications is critical for making informed investment decisions. [Link to reputable source on geopolitical risk analysis]

H2: The Bond Market's Unexpected Behavior

The bond market, traditionally considered a safe haven, has also exhibited unusual behavior recently. Yield curves have flattened, and certain bond yields have fluctuated more than anticipated. These anomalies suggest a complex interplay of factors, including inflation concerns, central bank policies, and shifting investor expectations. Analyzing these trends requires a nuanced understanding of macroeconomic indicators and their impact on fixed-income securities.

H2: Navigating the Anomalous Market

The current market environment presents both challenges and opportunities. Successful navigation requires a multifaceted approach, incorporating:

- Diversification: Spreading investments across different asset classes to mitigate risk.

- Fundamental Analysis: Focusing on a company's intrinsic value rather than solely relying on short-term price fluctuations.

- Risk Management: Implementing strategies to protect investments against unexpected market events.

- Staying Informed: Keeping abreast of current market trends and geopolitical developments.

Conclusion:

Wall Street's recent unusual bets highlight the unpredictable nature of the market. Understanding these anomalies, their potential causes, and their implications is crucial for making informed investment decisions. By adopting a well-informed, diversified, and risk-managed approach, investors can navigate the complexities of this dynamic landscape and potentially capitalize on emerging opportunities. Remember to always conduct thorough research and, if necessary, seek professional financial advice before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Wall Street's Unusual Bets: Analyzing Recent Market Anomalies. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Live From The O2 London Jonas Brothers Drop New Live Album Featuring Unreleased Track

Jun 14, 2025

Live From The O2 London Jonas Brothers Drop New Live Album Featuring Unreleased Track

Jun 14, 2025 -

Wildfire South Of Payson Leads To Sr 87 Road Closure Evacuation Orders

Jun 14, 2025

Wildfire South Of Payson Leads To Sr 87 Road Closure Evacuation Orders

Jun 14, 2025 -

Air India Accident Investigation Implications For Boeings Future

Jun 14, 2025

Air India Accident Investigation Implications For Boeings Future

Jun 14, 2025 -

Toronto Maple Leafs The Uncertain Future Of Matthews And Marners Partnership

Jun 14, 2025

Toronto Maple Leafs The Uncertain Future Of Matthews And Marners Partnership

Jun 14, 2025 -

Illinis Rollercoaster Start A Look At Their First Round At The U S Open

Jun 14, 2025

Illinis Rollercoaster Start A Look At Their First Round At The U S Open

Jun 14, 2025

Latest Posts

-

Israels Iran Attack Official Video Reveals Operational Details

Jun 15, 2025

Israels Iran Attack Official Video Reveals Operational Details

Jun 15, 2025 -

Congressional Inquiry Launched Into Hhss Justification For Vaccine Modifications

Jun 15, 2025

Congressional Inquiry Launched Into Hhss Justification For Vaccine Modifications

Jun 15, 2025 -

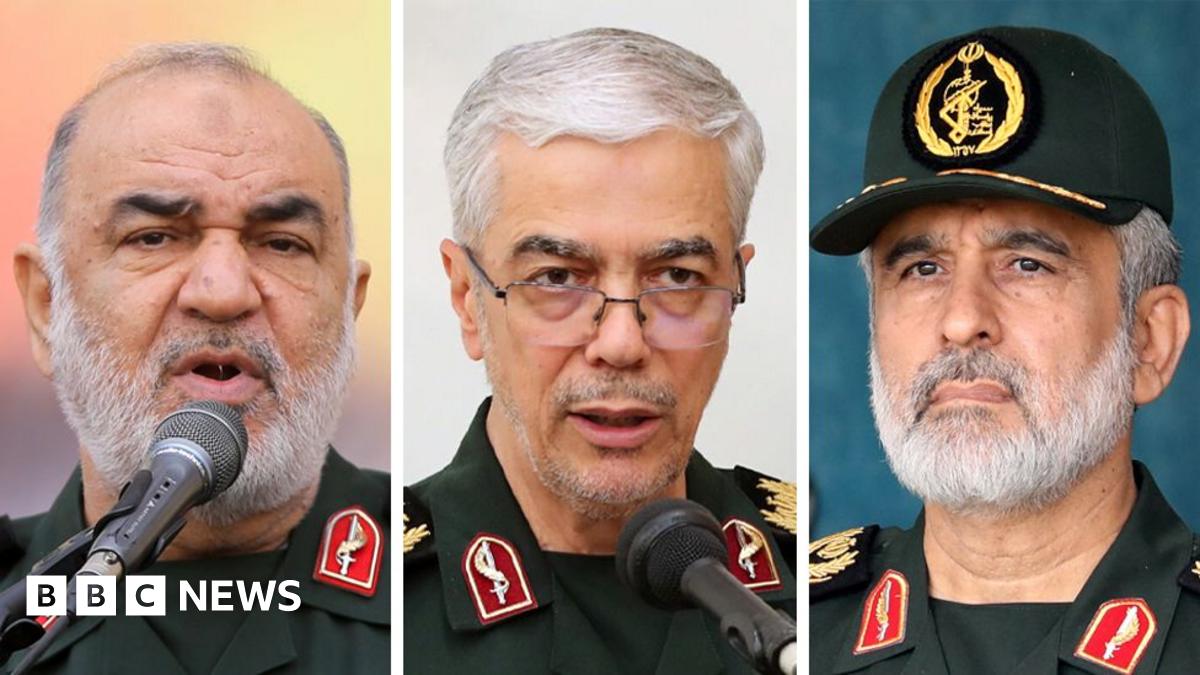

Who Died Identifying Iranian Commanders Killed In Israels Strike

Jun 15, 2025

Who Died Identifying Iranian Commanders Killed In Israels Strike

Jun 15, 2025 -

Flashpoint Worlds Collide June 2025 Codes List

Jun 15, 2025

Flashpoint Worlds Collide June 2025 Codes List

Jun 15, 2025 -

Israeli Airstrikes On Iran Detailed Maps And Photographic Evidence

Jun 15, 2025

Israeli Airstrikes On Iran Detailed Maps And Photographic Evidence

Jun 15, 2025